The first flight of the Boeing 777X, a highly anticipated event in the aviation industry, has been delayed until 2027. This setback is expected to drive billions in charges, according to recent reports.

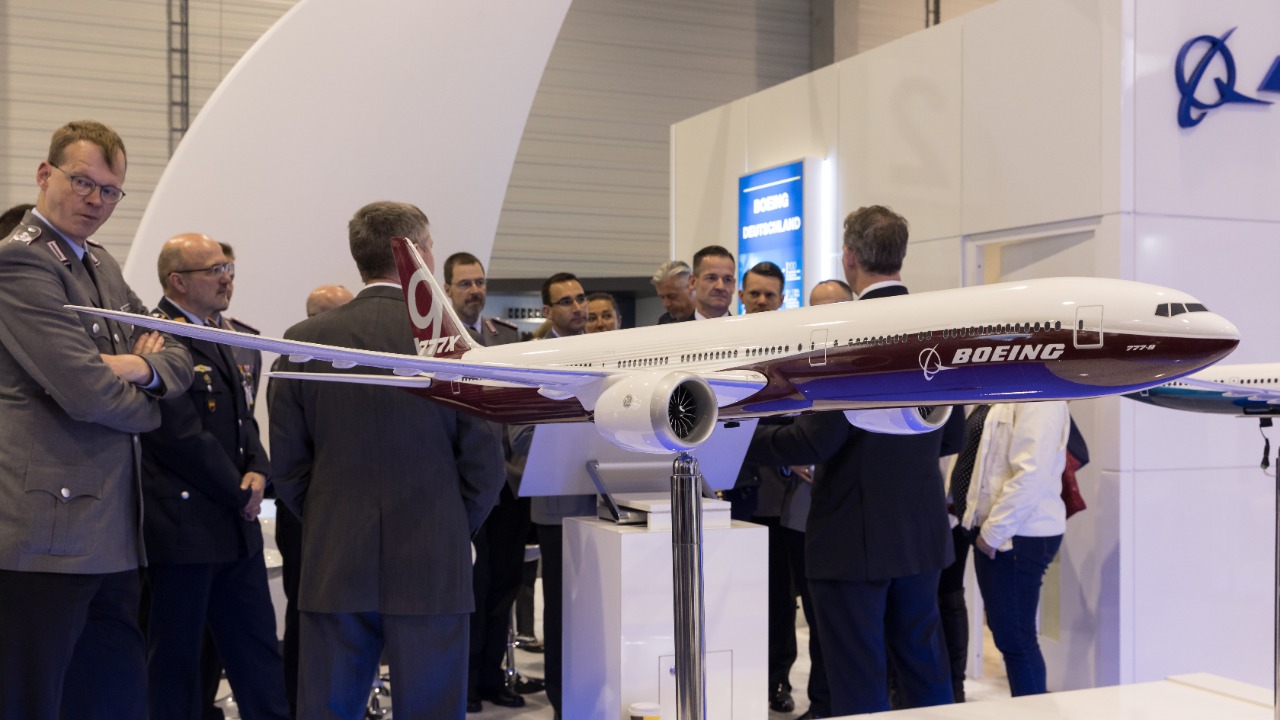

Boeing 777X Delay

The delay of the Boeing 777X’s first flight is a significant development in the aviation industry. The aircraft, which was initially expected to take to the skies much earlier, will now not make its maiden flight until 2027, according to a report by the Business Standard.

Several factors have contributed to this delay. While the specifics are not fully disclosed, it is clear that the postponement is a complex issue involving technical challenges, regulatory hurdles, and perhaps even broader industry trends. More details about these contributing factors can be found in a report by the Japan Times.

As per the Business Standard, the delay in the Boeing 777X’s first flight is not an isolated incident. It is part of a series of setbacks that the aviation industry has faced in recent years. This includes the grounding of the Boeing 737 MAX following two fatal crashes, and the ongoing global pandemic, which has significantly reduced demand for air travel. These events have created a challenging environment for aircraft manufacturers like Boeing.

According to the Japan Times, the delay also raises questions about the future of the 777X program. The aircraft was designed to be a game-changer in the industry, with features such as larger windows, a wider cabin, and more fuel efficiency. However, the delay could potentially impact the aircraft’s marketability and the return on investment for Boeing.

Financial Impact

The financial implications of the Boeing 777X delay are substantial. The postponement is projected to drive billions in charges, a significant financial blow for the company. This information is based on a video report by Bloomberg.

These charges could take various forms, including penalties for late delivery, increased production costs, and potential compensation to airlines for disrupted schedules. The exact nature and amount of these charges are yet to be determined, but the financial impact on Boeing is expected to be significant, as reported by the Japan Times.

As reported by Bloomberg, the financial impact of the delay extends beyond the immediate charges. It could also affect Boeing’s future profitability. The 777X was expected to be a major source of revenue for the company, with several airlines having placed substantial orders. The delay could lead to cancellations or renegotiations of these orders, further impacting Boeing’s financial position.

The Japan Times also highlights that the delay could have a ripple effect on the broader supply chain. Many suppliers, including engine manufacturers and parts providers, have invested heavily in the 777X program. The delay could result in financial losses for these companies and potentially lead to job cuts in the industry.

Industry Implications

The delay of the Boeing 777X’s first flight has broader implications for the aviation industry. The industry has been eagerly awaiting the launch of this new aircraft, and the delay could disrupt plans and expectations. The Business Standard provides more details on these potential implications.

Moreover, this delay could affect Boeing’s position in the market. The company is already facing stiff competition from other aircraft manufacturers, and the delay of the 777X could provide an opportunity for competitors to gain ground. This aspect of the situation is explored in more depth in the Bloomberg video report.

The Business Standard points out that the delay could also have geopolitical implications. The 777X is a key part of Boeing’s strategy to compete with Airbus, its European rival. The delay could potentially give Airbus an advantage in key markets, particularly in Asia, where demand for long-haul aircraft is expected to grow in the coming years.

As per the Bloomberg video report, the delay could also impact the dynamics of the aircraft leasing industry. Many leasing companies have placed orders for the 777X, and the delay could disrupt their plans. This could lead to a shift in the balance of power in the industry, with lessors potentially looking to other manufacturers to meet their needs.