The next leg of artificial intelligence growth will not be decided in chip fabs alone. It will be shaped in power plants, memory racks and the back offices of companies quietly rewiring how work gets done. As capital keeps chasing headline chipmakers, the more consequential story is shifting to the infrastructure and operators that can actually feed, store and monetize The AI surge.

The real bottleneck: electricity, not GPUs

Investors have spent the past two years fixated on graphics processors, but the limiting factor for the next wave of AI is increasingly the grid. Large data centers already consume 1.5% of all global electricity, a figure that is rising as models grow larger and more pervasive in everyday products. The AI-driven demand for power is climbing at a rate that traditional generation and transmission were never designed to handle, which is why utilities and clean power developers are emerging as the quiet gatekeepers of future AI capacity.

That shift is pulling companies that once sat on the periphery of the tech trade into the center of the conversation. As operators race to secure long term supply, they are turning to nuclear and renewables, from firms positioned as AI is going to utilities marketing themselves as the backbone of digital infrastructure. The result is a new class of AI winners whose fortunes depend less on transistor density and more on their ability to deliver reliable, low carbon megawatts to hyperscale campuses.

Nuclear and clean power step into the AI spotlight

As data center developers confront the scale of their power needs, nuclear energy is being recast from legacy asset to strategic advantage. Operators with existing fleets are signing long term deals with cloud providers, while new projects are pitched explicitly as AI enablers. One example is the way Constellation Energy is working with technology partners, with Constellation Energy described as partnering to breathe new life into America’s nuclear capacity in order to meet digital demand.

Clean power developers are following a similar arc, pitching wind, solar and storage as the only scalable way to square AI’s appetite with climate targets. Companies that once sold themselves as generic utilities now highlight their role in enabling “clean energy, clean AI, clean returns,” a framing that has helped push some clean energy stocks into AI-focused portfolios. In parallel, investors tracking Constellation Energy through CEG and peers are treating grid access and nuclear capacity as scarce assets that could define who can keep scaling models when power constraints bite.

From chips to memory, storage and the data plumbing

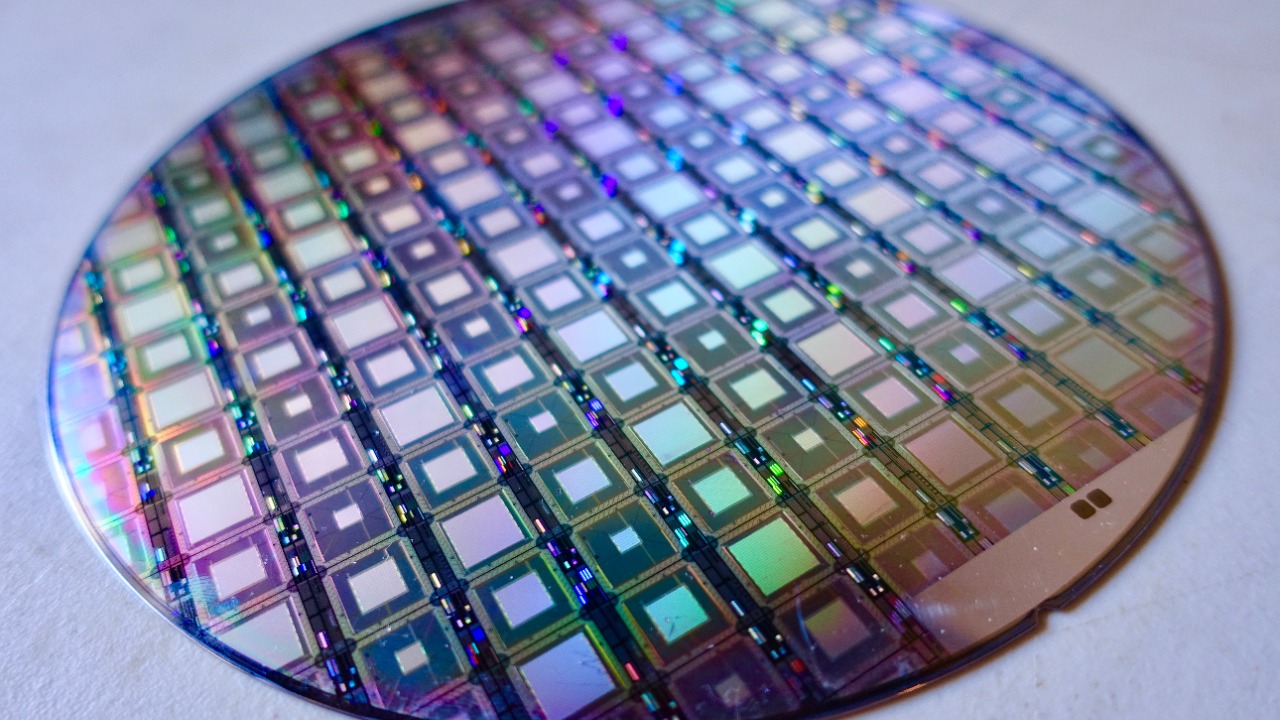

Even inside the data center, the next phase of AI growth is shifting away from the most obvious chip names. As accelerators proliferate, the real choke point is how quickly data can be moved, cached and recalled. Analysts tracking one AI-focused chip stock argue that, as data center build outs scale, the hidden bottleneck is at the data movement layer, with But as data center build outs scale, the hidden bottleneck is at the data movement layer: memory and storage systems.

That view is echoed in broader coverage of 2026’s biggest AI trends, which highlights how hyperscalers have poured hundreds of billions of dollars into capital expenditures over the last three years, much of it into high bandwidth memory and solid state storage. As one analysis puts it, Not only have the hyperscalers poured hundreds of billions of dollars into capital expenditures over the last three years, they are now looking to memory specialists for the company’s next growth arc. That dynamic is creating room for suppliers of DRAM, NAND and networking gear to capture a disproportionate share of incremental AI spending, even as headline chipmakers continue to dominate the narrative.

Wall Street’s AI darlings are no longer just fabs

Chip foundries are still printing record profits, but the market is already hinting that the AI ecosystem is broader than a handful of semiconductor giants. TSMC, for example, has reported that profit jumped 35% to a fresh record, with investors reading the move as confirmation that the AI chip boom is far from finished. Analysts looking at What the Market argue that the stock is pricing in years of robust demand ahead, but they also note that the most interesting upside may lie in adjacent sectors that benefit from the same AI tailwinds.

That is where utilities and infrastructure names come back into focus. Coverage of the AI power trade points out that if you are following the artificial intelligence industry, you will find that most of the talk is still about companies that are directly involved in AI, but the next phase could see energy stocks take center stage. One report on NEE frames clean utilities as one possible solution to the sector’s power problem, while another analysis notes that the next phase of the AI boom may not come from chipmakers at all, highlighting how CEG gained as investors reassessed nuclear capacity as a digital asset.

AI’s hidden winners: logistics, retail and everyday operations

The most surprising beneficiaries of the AI wave may be companies that do not sell technology at all, but instead use it to transform unglamorous processes. In logistics, UPS has become a case study, with reports that UPS now uses agentic AI to automatically handle over 90% of cross border transactions. That operational shift, highlighted in a Quick Read, shows how deeply AI is being embedded into trade documentation and customs workflows that once relied on armies of clerks.

Retail is undergoing a similar transformation. Walmart’s AI assistant has reportedly answered a vast volume of customer queries, with the same Quick Read noting that Walmart’s AI assistant answered a huge share of customer service interactions and helped drive operational efficiency or revenue acceleration. Another breakdown of Hidden AI Winners reinforces that UPS and Walmart are not isolated examples, but part of a broader pattern in which AI shows up directly in financial results rather than in splashy product launches.

More from Morning Overview