Nuclear fusion has moved from punchline to pitch deck, with tech giants, oil majors and governments all racing to claim a stake in what they frame as limitless clean power. The hype is loud, but the real question is quieter and more technical: how much of this momentum translates into electricity on the grid, and how much is still experimental physics dressed up for investors.

I see a widening gap between spectacular laboratory milestones and the gritty engineering needed for commercial plants, yet the distance is shrinking in ways that would have sounded fanciful a decade ago. The story now is less about whether fusion is possible and more about how fast it can be made practical, affordable and safe at scale.

From ignition milestones to global “artificial suns”

The modern wave of fusion optimism really began when researchers at Lawrence Livermore National Laboratory in California reported that they had met what they called Lawson conditions for net energy gain in a controlled experiment. That result, achieved at Lawrence Livermore National Laboratory in California, showed that under carefully tuned conditions, fusion reactions could release more energy than the lasers driving them, a symbolic crossing of a line that fusion scientists had chased for decades. It did not produce usable power, but it reset expectations about how quickly fusion research could move when backed by serious funding and modern computing.

Since then, attention has shifted to magnetic confinement machines that aim to run for much longer than a single laser pulse. In China, scientists working on the East reactor, often described as an Artificial Sun, have announced a major advance in sustaining high performance plasma in a tokamak configuration. Separate reporting describes how China’s so called artificial sun shattered a key confinement limit, a sign that the underlying physics is maturing. These achievements are still far from a power plant, but they show that multiple fusion approaches are now hitting performance thresholds that once existed only in theory.

Money, tech giants and the AI connection

Capital is following those scientific signals at a pace that would have been hard to imagine when fusion was dismissed as a perpetual “thirty years away” project. Analysts tracking the sector describe Increased Private Investment and say Total private investment is expected to ramp as tech giants and hyperscalers increase their stakes in fusion developers. One assessment notes that Commonwealth, Helion and TAE have become the Commonwealth of the fusion world, attracting capital and attention in a way that echoes early cryptocurrency booms, but with far more hardware behind the pitch.

Artificial intelligence is a big part of why that money is arriving now. Executives in the AI sector, including voices quoted from Oak Ridge National Laboratory’s Carter, argue that the industry’s appetite for electricity is so large that conventional renewables and fission will struggle to keep up. Carter, who led a Department project on advanced energy systems, has said that ambitious thinking around fusion has credibly pulled its expected arrival closer, in part because AI companies are willing to sign long term offtake agreements that de risk billion dollar demonstration plants. That logic is visible in partnerships where hyperscale data center operators look to lock in future fusion power, betting that even a small slice of their load covered by fusion would be a strategic advantage.

Governments pivot from science projects to deployment roadmaps

Public policy is starting to catch up with the private rush. In WASHINGTON, the U.S. Department of Energy released a Fusion Science and Roadmap that sets a national strategy to accelerate commercial fusion energy. The DOE Roadmap explicitly targets connecting fusion power to the grid by the mid 2030s, a strikingly near term goal for a technology that, as one skeptical analysis put it, still faces a “Real Fusion Energy Breakthrough Is Still Decades Away US” before it can be treated as a mature clean technology. That tension between ambition and caution is now baked into official planning.

China is moving in parallel but with its own industrial tempo. Reporting from HEFEI describes how Xinhua has detailed a national push to accelerate the transition of China’s fusion program from fundamental research to engineering, with a target of a power generation demonstration by 2030 using deuterium tritium plasma. That same report, labeled Updated and datelined HEFEI, China, underscores how fusion has become a strategic technology in the country’s broader energy and industrial policy. When two of the world’s largest economies both talk about fusion on grid timelines measured in a single decade or two, it signals that fusion is no longer treated as a purely academic pursuit.

Pilot plants, ITER delays and the brutal engineering reality

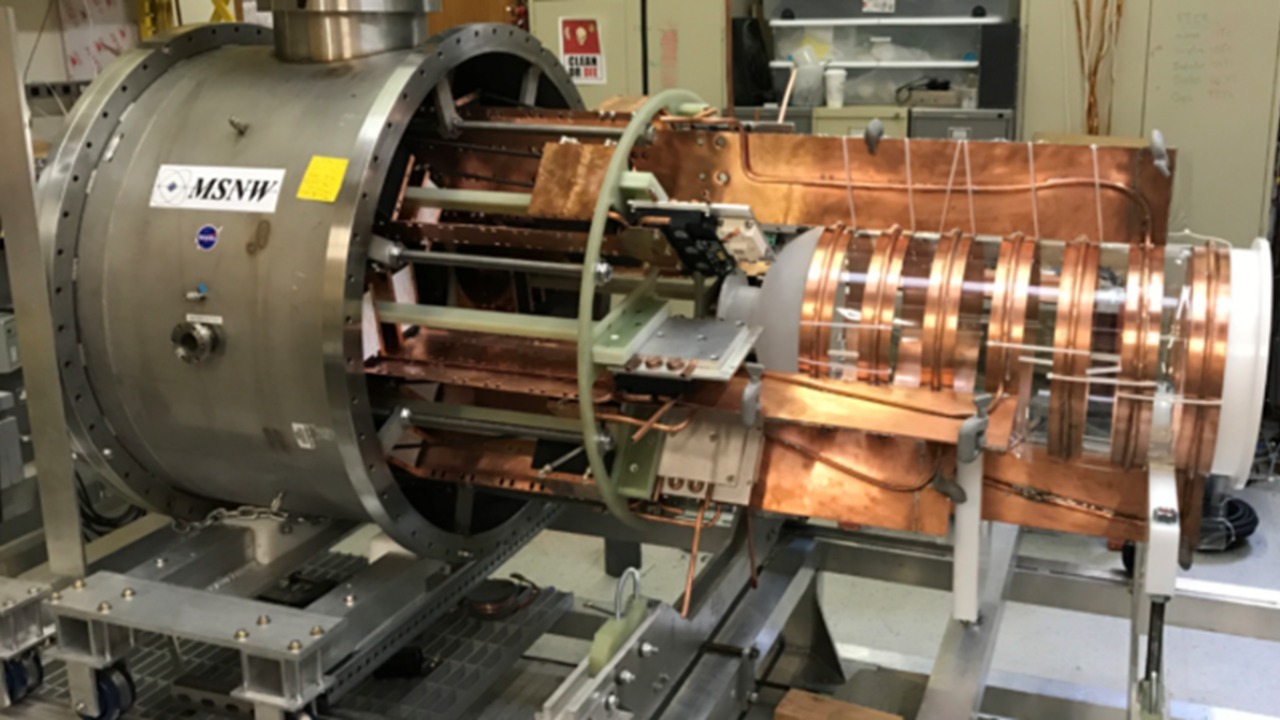

For all the roadmaps and rhetoric, the real test is whether pilot plants can run reliably and cheaply. In Devens, Massachusetts, CFS is building a fusion demonstration machine at its headquarters, with expectations that it will produce significant power and pave the way for commercial units connected to the grid in the early 2030s. A separate profile notes that if SPARC succeeds, CFS’ first commercial fusion plant, ARC, is slated to come online just outside Boston in the early 2030s and is designed to power about 300,000 homes, a scale that would move fusion from demonstration to meaningful regional supply if it works as advertised. Those plans are ambitious, but they are at least tied to specific hardware, locations and customer classes.

The engineering hurdles remain formidable. In an update from Commonwealth Fusion Systems, a senior figure warned that the fast neutron flux in a future tokamak operating at reactor relevant power levels is going to be “absolutely stupendous,” likely a huge challenge for materials and maintenance in any real power plant, a point made bluntly in a video briefing. At the same time, the multinational ITER fusion research facility in France has announced another schedule slip, with a four year delay that has prompted lawmakers to quiz experts about realistic commercial reactor timelines, as detailed in coverage of ITER in France. Those setbacks are a reminder that even with decades of international collaboration, building and operating a large scale fusion device is still one of the major engineering challenges of the century.

Timelines, skepticism and what “real power” actually means

Timelines are where hype and reality collide most sharply. One industry analysis notes that while fusion power might enter the grid in the 2030s, the old joke that it is always thirty years away is giving way to a view that it is now a question of when, not if, as summarized in a discussion that quotes Sharma on the shift from “if” to “when” in fusion expectations. Yet other experts are far more cautious, with one detailed technical review arguing that despite optimism around private projects and national programs, practical fusion power on a large scale is unlikely before at least after 2050 or 2060, a sober view captured in an assessment titled How close is nuclear fusion power. A separate commentary by Maury Markowitz, described as a Former Solar Nerd at AS Solar and Author, goes further, stating that there is currently no prospect of commercial fusion power plants any time this century, a stark warning preserved in a There is currently no prospect comment.

More from Morning Overview