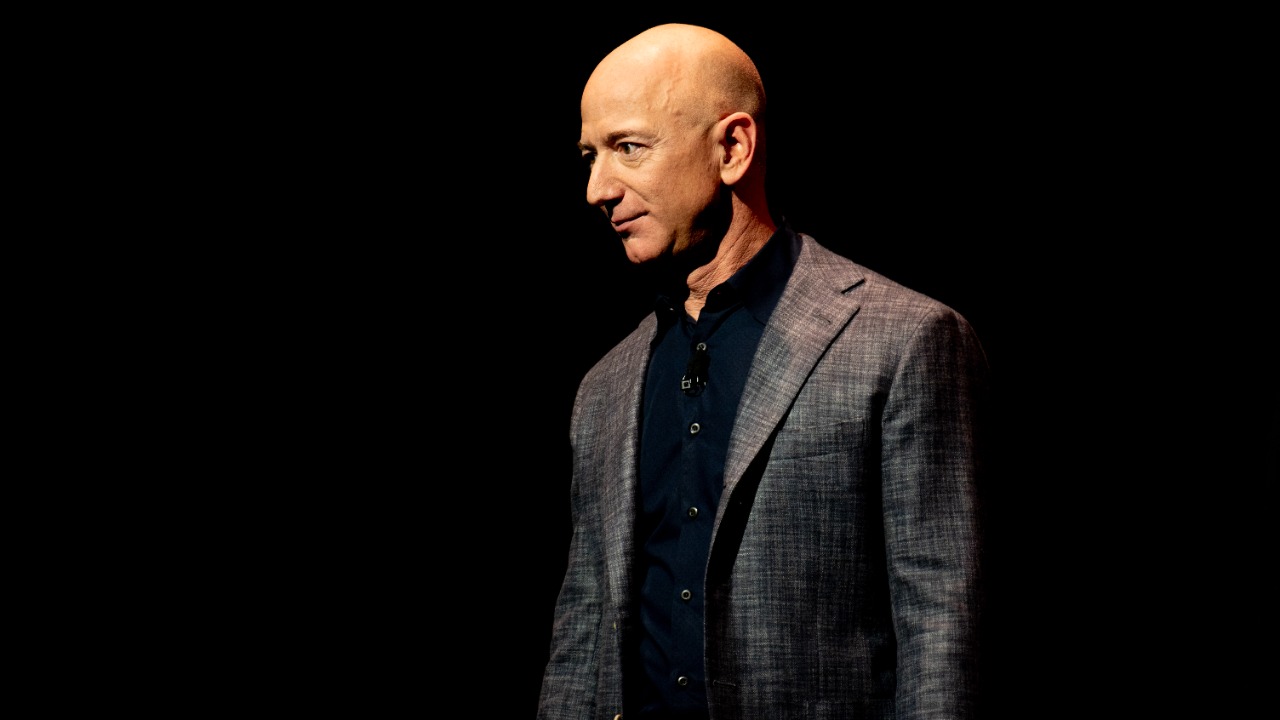

Jeff Bezos is no longer content to watch the satellite internet boom from the sidelines. His space company Blue Origin has laid out an aggressive plan for a new orbital network that would blanket the planet with high capacity connectivity and directly challenge the dominance of SpaceX in low Earth orbit. The blueprint, centered on a megaconstellation called TeraWave, signals that Bezos intends to make space-based data infrastructure as central to his legacy as online retail.

Rather than chasing consumer broadband in remote cabins and camper vans, the project is pitched as a backbone for the cloud era, aimed at enterprises, data centers, and governments that are already customers of Amazon’s terrestrial networks. If it works, the constellation could turn Blue Origin into a critical middleman for global data flows, reshaping how information moves between continents, clouds, and even future lunar outposts.

The TeraWave vision: 5,400-satellite muscle for the cloud age

The core of the plan is a vast low Earth orbit network that Jeff Bezos wants to use to move data at a scale that rivals fiber. Blue Origin has outlined a constellation of 5,400-satellite units, a scale that would instantly place it among the largest fleets in orbit. Each spacecraft is designed to contribute to an aggregate throughput of around 6 terabits per second, a figure that puts TeraWave in the same conversation as subsea cables rather than traditional telecom satellites.

Blue Origin has been explicit that this is not a generic internet service for households. The company says TeraWave is optimized for enterprise, data center, and government customers, with symmetrical upload and download speeds and built in redundancy between satellites. That framing positions the network as a kind of orbital extension of the cloud, a place where financial firms, intelligence agencies, and content platforms can route their most latency sensitive traffic.

Bezos, rivalry, and the race with Starlink

Jeff Bezos has watched Elon Musk’s Starlink turn into the default synonym for satellite internet, and TeraWave is his clearest answer yet. Starlink began launching in 2019 and, As of January 2026, the constellation consists of over 9,422 satellites in low Earth orbit, a presence that dominates both the night sky and the market. By contrast, Blue Origin is still on the starting blocks, but it is pitching a different customer set and a higher capacity architecture that could carve out a lucrative niche even if it never matches Starlink’s raw satellite count.

The rivalry is not just about numbers, it is about who defines the next layer of internet infrastructure. Reporting on Jeff Bezos’s latest announcement describes a network that would serve up to 100,000 customers, a far smaller user base than Starlink’s consumer footprint but one that is likely to pay a premium for guaranteed performance and security. In that sense, Bezos is not simply copying Musk’s playbook, he is trying to leapfrog it by focusing on the most profitable slice of the connectivity market.

Inside the 6-terabit architecture

At the heart of TeraWave is a promise of sheer bandwidth. Blue Origin has described a 6-terabit super constellation that uses advanced inter satellite links to move data across the network without always touching the ground. That design reduces the number of ground stations needed and allows traffic to be routed dynamically around congestion or outages, a critical feature for customers that cannot afford downtime.

Technical details remain sparse, but the company has said TeraWave will deliver “data speeds of up to 6Tbps” across the system, a figure echoed in coverage of Another Jeff Bezos company’s megaconstellation ambitions. For enterprises, that kind of capacity opens the door to real time replication between data centers on different continents, live 8K video contribution from remote locations, and resilient backup paths when terrestrial cables are cut.

Launch muscle: New Glenn and a sprawling network buildout

Building a 5,400 unit constellation is only possible if Blue Origin can launch quickly and cheaply, and that is where its heavy lift rocket comes in. The Jeff Bezos founded space company has already flown its New Glenn rocket, which is designed for missions to the Moon and beyond and can be reused to lower launch costs. That vehicle gives Bezos a vertically integrated path from factory to orbit, similar to the model SpaceX uses with Falcon 9 and Starship.

Investors have been told that Bezos’s Space Company plans to deploy a sprawling satellite network, a phrase that hints at the cadence of launches required to fill out the TeraWave shell. If New Glenn can achieve a reliable flight rate, Blue Origin will not have to buy rides from competitors, and it can tune each mission to maximize the number of satellites per launch, compressing the timeline from blueprint to operational service.

Markets, customers, and the AMZN connection

For all the engineering bravado, the business case for TeraWave is grounded in a very specific customer profile. Blue Origin has said the network will target enterprises and governments that need higher throughput, symmetrical speeds, and more redundancy than existing satellite services provide, a point underscored in technical briefings on enterprise focused connectivity. That aligns neatly with the needs of financial trading platforms, cloud providers, and defense agencies that already rely on Amazon Web Services for terrestrial infrastructure.

It is no accident that coverage of the announcement has appeared alongside the ticker symbol AMZN. Even though Blue Origin is a separate company, the prospect of a dedicated orbital backbone for Amazon’s cloud and logistics operations is likely to be closely watched by shareholders. If TeraWave can deliver the promised performance for up to 100,000 high value customers, it could become a strategic asset that reinforces Amazon’s dominance in e commerce and cloud computing while opening new revenue streams in secure government and industrial connectivity.

More from Morning Overview