Meta’s long, expensive detour into virtual worlds is finally giving way to something more grounded: making money from products people actually use. After years of hype, investor frustration, and staggering losses, the company is cutting back on its most speculative metaverse bets and rediscovering the value of boring, profitable reality.

I see the retreat not as a tragedy for innovation but as a necessary correction from a $70 billion fixation that distorted priorities inside one of the world’s most powerful tech firms. The metaverse push was a costly distraction, and its unwinding is already reshaping how Meta allocates capital, talks to Wall Street, and competes in artificial intelligence.

The $70 billion wake-up call

The scale of Meta’s metaverse misadventure is not abstract. The company has now acknowledged that its virtual reality and augmented reality push has produced a cumulative $70 billion loss, a figure that would be eye watering even for a company that still prints cash from social advertising. That number represents years of pouring resources into headsets, avatars, and digital real estate while the core business faced regulatory pressure, competition from TikTok, and a generational shift in how people communicate online.

In response to that $70 billion hole, Meta is now cutting its metaverse budget by roughly 30 percent, a move that signals a decisive shift away from the all-in posture that defined the early “Meta” rebrand. The company is not abandoning virtual and mixed reality entirely, but it is treating them less like the inevitable future of computing and more like one bet among many. That change reflects a hard lesson: even for a company of Meta’s size, there is a limit to how long investors will tolerate a strategy that burns tens of billions without a clear path to sustainable returns.

Wall Street’s verdict: the metaverse is “more or less cooked”

Investors have been telegraphing their verdict on the metaverse for some time, and the latest shift only confirms it. As Meta has pulled back on its most aggressive spending, Wall Street has responded with relief, treating the cuts as a long overdue recognition that the grand vision of immersive virtual worlds has not matched user behavior or revenue reality. In a pointed Analysis, Allison Morrow captured the mood by noting that the metaverse is “more or less cooked,” a phrase that neatly summarizes how far sentiment has swung from breathless enthusiasm to weary skepticism.

That skepticism is not just about one product line or one headset generation. It reflects a broader recognition that Meta’s attempt to will a new computing paradigm into existence ran into the stubborn fact that most people still prefer phones, laptops, and simple apps over strapping a device to their face. When an Analysis can credibly describe the metaverse as “more or less cooked” and investors cheer spending cuts, it is clear that the market has moved on from treating virtual worlds as the inevitable successor to the mobile internet.

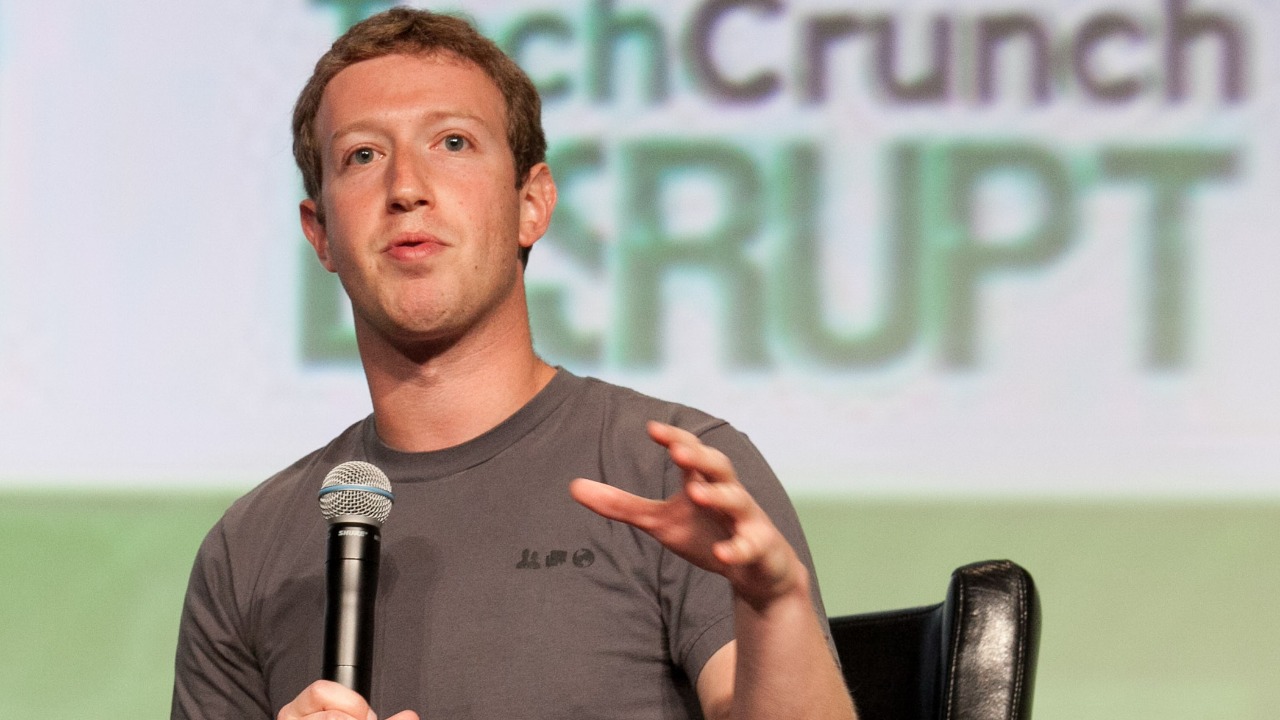

Mark Zuckerberg’s dream meets investor reality

Mark Zuckerberg’s conviction in the metaverse was never in doubt. He renamed the company, reorganized teams, and tied his legacy to a vision of persistent, shared virtual spaces where work, play, and commerce would blend together. Yet the same reporting that tallies the Mark Zuckerberg’s metaverse dream against a $70 billion loss also makes clear that this dream has not delivered the adoption or revenue he promised. Reality Labs hardware remains niche, and flagship experiences have struggled to break out beyond early adopters and enterprise pilots.

Investors, who tolerated years of heavy spending in the name of long term transformation, have grown less patient as the gap between rhetoric and results widened. The decision to slash the metaverse budget by 30 percent is as much a political act inside the company as it is a financial one, a signal that Zuckerberg is willing to temper his ambitions in the face of shareholder pressure. It also underscores a shift in narrative: instead of insisting that everyone else is simply too early to understand his vision, he is now repositioning Meta as a more balanced company that can pursue future platforms without sacrificing near term profitability.

Why the spending cuts are a “no-brainer”

From a purely financial perspective, dialing back metaverse investment looks like the kind of obvious move that should have happened sooner. After years of pouring money into projects that generated limited revenue, Meta is now being praised for what one analysis framed as a Meta Just Made “Brainer Move” that aligns spending with actual demand. The logic is straightforward: if the company can redirect billions from speculative virtual worlds into proven profit engines, margins improve, and the stock becomes more attractive.

That same assessment argues that the shift could be a turning point for earnings, with the company expected to see Why It Could Lead To More Profits as it trims the most capital intensive parts of its metaverse portfolio. I see this as a recognition that Meta’s competitive advantage still lies in its ability to monetize attention at scale through advertising and commerce, not in trying to out innovate specialized hardware makers on devices that most consumers remain ambivalent about. Cutting back is not an admission that all of that research was wasted, but it is an acknowledgment that the return on each additional dollar spent had fallen far below what shareholders expect.

Stock market reaction: relief and renewed enthusiasm

The market’s response to Meta’s pivot has been swift and telling. As the company announced its metaverse spending cuts, its shares rallied, with one investor focused breakdown describing how Meta Platforms Stock Jumps on the news. The reaction reflects a simple truth: investors prefer disciplined growth stories to open ended science projects, especially when those projects have already consumed tens of billions of dollars.

That same analysis framed the company as a Screaming Buy Before 2026, in part because the metaverse pullback frees up resources for more promising areas like artificial intelligence and the Family of Apps that still drive the bulk of revenue. I read that enthusiasm as conditional: investors are rewarding Meta for acting like a mature, profit focused company again, but they will expect continued discipline. The days when a charismatic founder could spend at will on a pet vision without detailed accountability are fading, even in Silicon Valley.

AI and the Family of Apps step back into the spotlight

As the metaverse recedes from center stage, Meta’s core strengths are reasserting themselves. The Family of Apps, including Facebook, Instagram, WhatsApp, and Messenger, remains the company’s primary engine of growth, and the renewed focus on these platforms is already being framed as a key reason investors are optimistic. The same breakdown that calls the stock a Why the Growth Stock Is attractive highlights how a stronger emphasis on the Family of Apps should please investors who care about predictable cash flow.

Artificial intelligence is the other major beneficiary of the strategic reset. Instead of treating AI as a supporting character in a metaverse narrative, Meta is now positioning it as a core technology that can improve ad targeting, content recommendations, and new products across its existing platforms. The same investor focused analysis that praises the spending cuts also points to AI as a reason Meta looks like a compelling growth story heading into 2026. In practical terms, that means more resources for recommendation algorithms, generative tools for creators, and AI driven ad products that can lift revenue without requiring users to buy new hardware.

What the metaverse pullback means for hardware and VR

Meta’s decision to slash its metaverse budget by 30 percent does not mean virtual reality and augmented reality are dead inside the company, but it does change their role. Instead of being treated as the inevitable next platform that justifies unlimited spending, VR and AR are now being evaluated more like any other product line, with expectations for clear milestones and a path to profitability. The Meta Slashes Metaverse Budget decision effectively forces hardware teams to prioritize features and experiences that can drive real adoption instead of chasing every futuristic concept.

For users, that could be a net positive. A leaner hardware roadmap might focus on making headsets lighter, cheaper, and more useful for specific tasks like fitness, gaming, or remote collaboration, rather than trying to replace the smartphone wholesale. For developers, the shift may mean fewer subsidies and grandiose platform promises, but also a more realistic sense of where Meta is actually committed to investing. The $70 billion already spent has built a foundation of technology and expertise, yet the new budget constraints will test whether that foundation can support sustainable products instead of just impressive demos.

How Meta’s pivot reshapes Big Tech’s future bets

Meta’s retreat from its most aggressive metaverse spending will reverberate far beyond Menlo Park. Other tech giants that flirted with similar visions of immersive digital worlds will now have to justify their own investments in light of a high profile example of overreach. When a company that has burned $70 billion on a single strategic bet decides to pull back, it sends a clear signal about the risks of chasing hype cycles without a grounded business case.

I expect this to accelerate a broader shift in Big Tech toward more incremental, AI centered bets that build on existing products rather than trying to invent entirely new universes from scratch. The metaverse will not disappear, but it is likely to be reframed as a niche within gaming, enterprise training, and specialized collaboration tools rather than the next universal platform. Meta’s experience will become a case study in the limits of visionary storytelling when it is not matched by user demand, and in the importance of aligning long term bets with the patience of public market investors.

Why saying goodbye to the distraction is healthy

For all the sunk costs and bruised egos, I see Meta’s metaverse comedown as a healthy development for the company and for the broader tech ecosystem. The fixation on virtual worlds distorted priorities, pulling attention and capital away from more immediate challenges like content moderation, privacy, competition, and the responsible deployment of AI. By scaling back, Meta is implicitly acknowledging that it cannot solve every future problem at once, and that it must focus on the products and technologies that deliver value today.

There is also a cultural benefit to moving past the metaverse obsession. Inside Meta, teams that were overshadowed by the grand narrative of immersive futures can now make a more straightforward case for their work on messaging, short form video, business tools, and AI infrastructure. Outside the company, regulators, advertisers, and users can engage with a Meta that is less fixated on speculative worlds and more accountable for the platforms that already shape public discourse. Saying good riddance to the $70 billion distraction does not mean abandoning ambition, but it does mean grounding that ambition in reality rather than in a headset dependent fantasy.

More from MorningOverview