Elon Musk has agreed to settle a $128 million lawsuit brought by former Twitter executives, including Parag Agrawal, Ned Segal, Vijaya Gadde, and Sean Edgett. These executives sought unpaid severance following their 2022 terminations after Musk’s acquisition of the platform. The settlement resolves claims that Musk’s company, now known as X, failed to honor executive compensation agreements worth the specified amount. This development, reported on October 8, 2025, marks the end of prolonged legal battles stemming from the chaotic post-acquisition layoffs.

Background of the Lawsuit

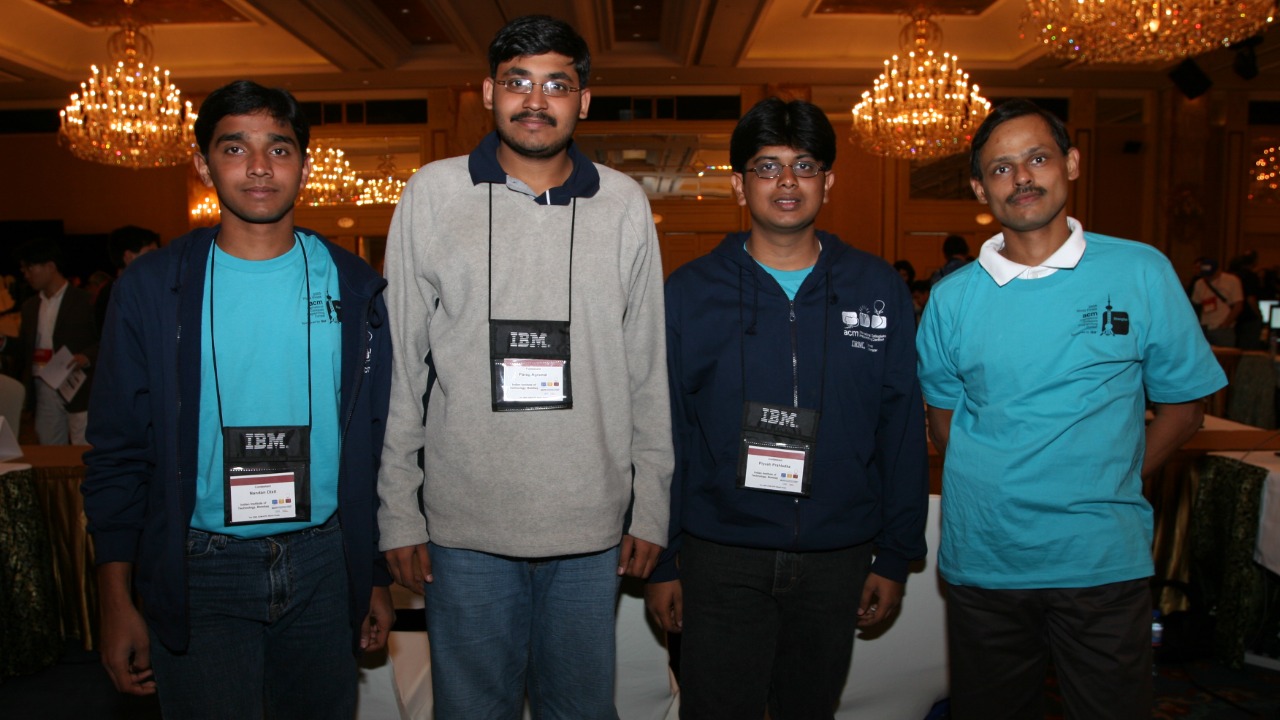

The origins of this legal dispute trace back to Elon Musk’s acquisition of Twitter in 2022 for $44 billion. This high-profile takeover led to the immediate ousting of several top executives without the severance payouts stipulated in their pre-existing contracts. The executives, including Parag Agrawal, Ned Segal, Vijaya Gadde, and Sean Edgett, argued that their removal violated the terms of their employment agreements, which promised substantial severance packages upon termination without cause. The lawsuit highlighted the abrupt nature of their dismissals and the lack of financial compensation, which became a focal point of the legal proceedings [UPI].

Specifically, the severance claims included $32.5 million for Parag Agrawal, $12.5 million each for Ned Segal and Vijaya Gadde, and $7.5 million for Sean Edgett. These amounts encompassed not only severance pay but also stock options and bonuses that were allegedly owed. The total claim of $128 million underscored the significant financial stakes involved in the lawsuit [Law.com]. The legal battle was filed in the U.S. District Court for the Northern District of California, where the executives argued that X Corp. breached their contracts and failed to provide the required notice periods before termination [TechCrunch].

Key Parties Involved

The plaintiffs in this case were high-profile figures within Twitter’s former leadership. Parag Agrawal served as the CEO, Ned Segal as the CFO, Vijaya Gadde as the legal chief, and Sean Edgett as the general counsel. All were terminated on October 27, 2022, coinciding with the day Musk finalized his acquisition of Twitter. Their collective experience and roles within the company added weight to their claims, as they were integral to Twitter’s operations prior to the acquisition [Tech in Asia].

Elon Musk, acting through X Corp., was the defendant in this lawsuit. Despite initially countersuing in some related cases, Musk’s legal team, led by attorneys from Quinn Emanuel Urquhart & Sullivan, ultimately opted for a settlement to avoid a protracted trial. This decision reflects a strategic move to mitigate further legal expenses and potential reputational damage [WebProNews]. The settlement negotiations were complex, involving detailed discussions on the terms and conditions to ensure a resolution that would satisfy all parties involved.

Settlement Details

The settlement agreement involves a $128 million payout, structured to be divided among the four executives based on their individual claims. Importantly, the settlement does not include any admission of liability by X Corp., which allows Musk to maintain a stance of non-culpability while resolving the financial dispute. This aspect of the settlement is crucial for Musk, as it helps protect his and the company’s public image [TechCrunch].

Additional terms of the settlement include confidentiality clauses and the dismissal of all related counterclaims. These terms are expected to be finalized in court by late October 2025, ensuring that the legal proceedings are concluded swiftly and without further public scrutiny. Musk commented on the settlement via an X post, stating, “Settlement reached to move forward,” which emphasizes his desire to focus on platform improvements rather than ongoing litigation [WebProNews].

Broader Implications

This settlement could have significant implications for X Corp.’s ongoing severance disputes with other former employees. The resolution of this high-profile case may set a precedent for hundreds of similar claims, which collectively amount to over $500 million. The outcome of this lawsuit could influence how other former employees approach their claims and negotiations with X Corp., potentially leading to more settlements or changes in the company’s severance policies [Tech in Asia].

For Elon Musk, the settlement also impacts his reputation and business practices. Investors and stakeholders are likely to scrutinize the costs associated with the acquisition and the strategies employed for executive retention. The financial and reputational costs of such legal disputes highlight the challenges Musk faces in managing high-profile acquisitions and the importance of adhering to contractual obligations [Law.com].

Regulatory bodies, such as the SEC, may also take an interest in the settlement, particularly regarding stock option disclosures in the Twitter deal. The resolution of this lawsuit might influence future tech mergers, as companies may need to reassess their executive compensation agreements and severance policies to avoid similar legal challenges. This case serves as a reminder of the complexities involved in large-scale acquisitions and the potential pitfalls of neglecting contractual commitments [TechCrunch].