Billionaire hedge fund manager Ken Griffin has quietly rotated out of one of the market’s hottest artificial intelligence memory plays and into a speculative quantum computing name that has already surged 1,900% since early 2023. The shift, executed through his firm Citadel Advisors, replaces a mature semiconductor winner with a far riskier bet on D-Wave Quantum, a company still fighting for commercial relevance in a nascent industry. I see this as a revealing snapshot of how one of Wall Street’s most closely watched investors is positioning for the next wave of computing power beyond today’s AI boom.

Griffin’s move does not mean the AI trade is over, but it does underscore how quickly capital can pivot when valuations stretch and new technologies start to look less theoretical and more investable. By selling nearly 2 million shares of Sandisk and initiating a position in D-Wave Quantum, Citadel Advisors is signaling that quantum hardware and software are moving from the lab into the portfolio, even if the path to profits remains uncertain.

Why Ken Griffin is rotating out of Sandisk

Ken Griffin runs Citadel Advisors, which is described as the most profitable hedge fund in history, and his portfolio changes tend to be studied as a barometer of institutional risk appetite. In the third quarter, Citadel Advisors sold nearly 2 million shares of Sandisk, trimming a position in a company that had become one of the hottest AI-linked semiconductor names after a severe supply shortage in memory chips drove pricing power and margins higher. That scale of selling suggests Griffin is locking in gains from a mature uptrend rather than abandoning the broader AI theme altogether, especially given how aggressively Sandisk had rerated as investors crowded into anything tied to data center demand.

Sandisk, which trades under the ticker SNDK, has benefited from the same structural forces lifting peers that supply high-performance storage for training and running large language models, but its stock had already priced in a long runway of growth. The shares, identified as Sandisk (SNDK +0.43%), were part of a cohort of semiconductor companies that rallied as hyperscale cloud providers scrambled to secure enough memory capacity to feed AI workloads. When a manager of Griffin’s stature chooses to sell millions of shares into that strength, as reflected in Citadel Advisors filings, it reads less like a vote of no confidence in AI and more like a disciplined decision to recycle capital from a crowded winner into a less consensus opportunity.

Sandisk’s AI boom and what Griffin is walking away from

To understand the significance of Griffin’s exit, it helps to look at what made Sandisk such a standout in the first place. The company sits at the heart of the memory chip ecosystem, and Sandisk (SNDK +0.43%) is described as one of several semiconductor companies that has benefited from a severe supply shortage in memory chips during the AI buildout. As cloud operators like Amazon Web Services and Microsoft Azure raced to deploy Nvidia accelerators and custom silicon, they also needed vast amounts of high-bandwidth storage, which tightened supply and allowed Sandisk to command better pricing and utilization. That dynamic turned Sandisk into one of the hottest AI stocks, with investors treating it as a relatively straightforward way to play the infrastructure side of generative AI.

Yet even a strong fundamental story can become stretched when expectations compound on top of already elevated valuations. By the time Citadel Advisors sold nearly 2 million shares, Sandisk had already enjoyed a powerful run, and the stock’s incremental upside depended on the supply shortage persisting and AI demand continuing to surprise to the upside. In that context, Griffin’s decision to pare back exposure to Sandisk, as highlighted in coverage of Sandisk, looks like a classic hedge fund move: step aside from a name where the risk-reward has normalized and redeploy into an area where the market is still debating whether the technology will work at scale.

The quantum leap: D-Wave Quantum’s 1,900% surge

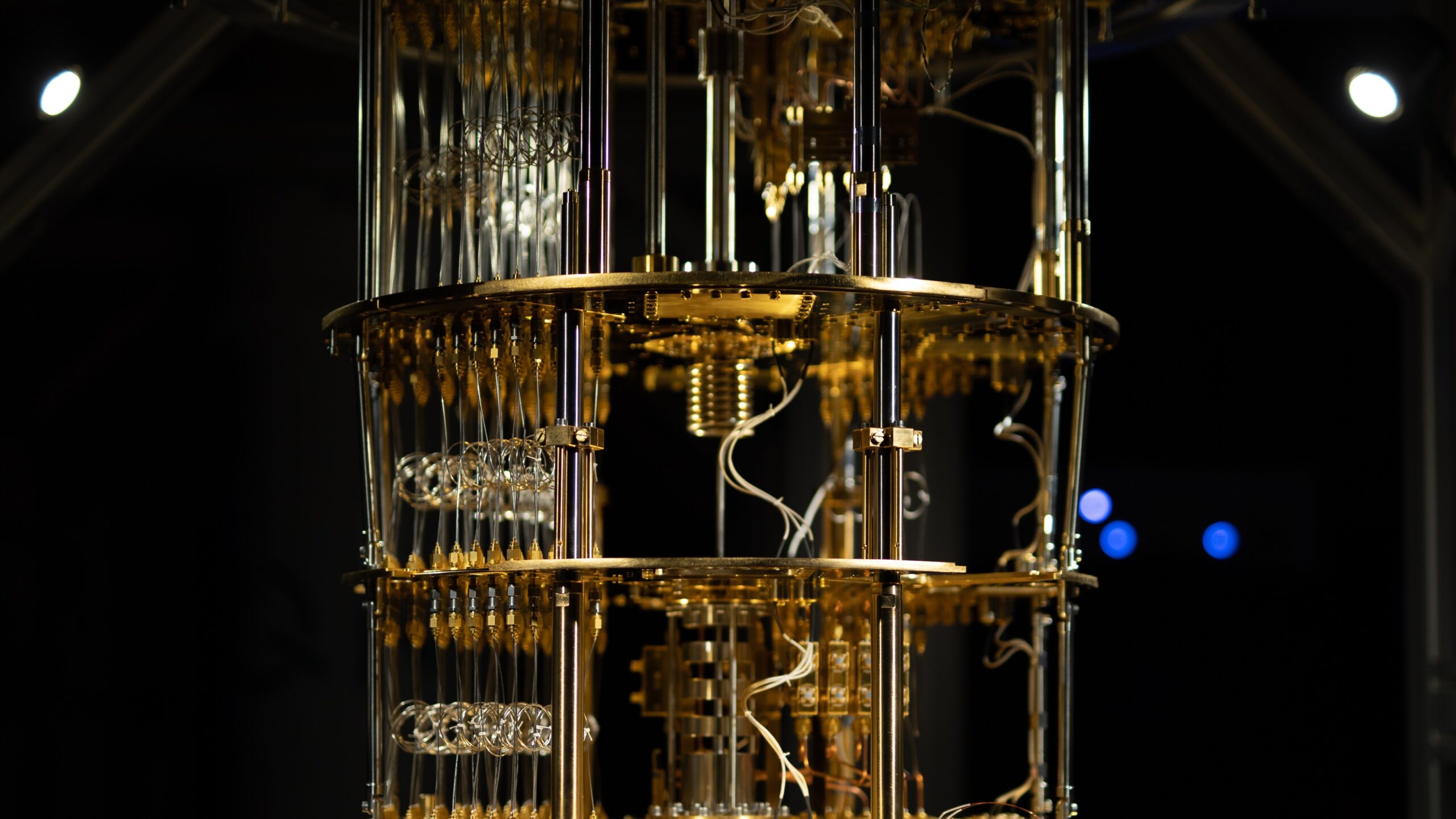

The destination for some of that recycled capital is D-Wave Quantum, a company that has become one of the hottest quantum computing stocks after a stunning rally. Reporting on Griffin’s trades notes that he bought D-Wave Quantum, described as one of the hottest quantum computing companies, and that this quantum stock has advanced 1,900% since January 2023. That kind of move would be eye-catching in any sector, but it is especially striking in a field where commercial adoption is still early and technical roadmaps remain complex. For a manager known for rigorous risk management, stepping into a name with that kind of volatility suggests he sees something more than just speculative froth.

D-Wave Quantum focuses on quantum systems that aim to solve optimization and other complex problems faster than classical computers, positioning itself as a potential accelerant for industries ranging from logistics to financial services. The fact that a stock tied to this company is up 1,900% since early 2023, as highlighted in quantum stock coverage, underscores how quickly sentiment can swing once investors start to believe that quantum hardware and software are inching closer to real-world use cases. I read Griffin’s entry not as a chase of past performance, but as a calculated bet that the addressable market for quantum solutions will expand dramatically if the technology can prove even a modest advantage over classical systems in targeted workloads.

How Griffin has been building a quantum computing basket

Griffin’s purchase of D-Wave Quantum is not an isolated foray into the space, but part of a broader pattern of building exposure to quantum computing. Earlier, he bought small positions in Rigetti Computing and D-Wave Quantum in the third quarter, a move that came as every Wall Street analyst covering those names was still wrestling with how to value businesses that generate limited revenue but promise transformative computing capabilities. By spreading capital across Rigetti Computing and D-Wave Quantum, he is effectively constructing a basket of quantum hardware and software bets, acknowledging that no single architecture or company is guaranteed to win.

This approach mirrors how sophisticated investors often treat emerging technologies: rather than trying to pick the one eventual champion, they allocate to a handful of credible contenders and let the market’s evolution determine which positions grow over time. The fact that Ken Griffin initiated these small positions in Rigetti Computing and D-Wave Quantum, as detailed in analysis of his quantum computing stocks, suggests he is comfortable with the binary nature of the risk, where some holdings may fail outright while others could compound dramatically if quantum adoption accelerates. I see this as a textbook example of using a diversified micro-portfolio to gain exposure to a frontier technology without betting the firm on any single thesis.

What Griffin’s pivot signals for AI and quantum investors

For investors watching both AI and quantum computing, Griffin’s pivot from Sandisk to D-Wave Quantum offers a few practical signals. First, it reinforces that even the strongest AI infrastructure plays can become sources of capital once their upside looks more incremental than explosive, especially after a period of intense multiple expansion. Second, it shows that some of the most sophisticated capital in the market is already looking beyond today’s AI leaders to the next layer of compute, where quantum systems could eventually complement or, in specific niches, outperform classical chips. When a hedge fund manager like Ken Griffin, who oversees Citadel Advisors, chooses to sell shares of Sandisk and buy a quantum stock that has already surged 1,900% since early 2023, as noted in Key Points coverage, it sends a clear message that the opportunity set is shifting.

More from Morning Overview