The Bank of England has issued a stark warning about an impending AI disaster, highlighting risks in the rapidly growing artificial intelligence sector that could lead to widespread economic fallout. Officials at the central bank, drawing parallels to historical market bubbles, emphasize that AI firms are particularly vulnerable to a sharp drop in valuations amid overhyped expectations. This alert comes as the AI boom shows signs of mirroring the dot-com bust, potentially triggering a sharp market correction if investor enthusiasm wanes [Futurism].

The Bank of England’s AI Risk Assessment

The Bank of England’s analysis of the current AI market dynamics reveals a concerning trend of overvaluation driven by speculative investments in unproven technologies. This phenomenon is reminiscent of past financial bubbles, where investor enthusiasm outpaced the actual value and capabilities of the technologies involved. The central bank’s assessment underscores the precarious position of AI firms, which often rely heavily on high capital expenditures without corresponding revenue streams. This imbalance makes them particularly susceptible to sharp drops in valuations if market conditions shift unfavorably [Futurism].

Specific vulnerabilities identified by the Bank of England include the reliance of AI firms on substantial capital investments that do not immediately translate into revenue. This reliance creates a risk of significant valuation drops, especially if the anticipated technological breakthroughs do not materialize as quickly as expected. The central bank’s warning highlights the need for cautious investment strategies and robust financial planning within the AI sector to mitigate these risks [Dunfermline Press].

Regulatory oversight plays a crucial role in mitigating these risks, and the Bank of England has outlined plans to monitor financial stability within the AI sector closely. This includes potential interventions to ensure that the rapid growth of AI technologies does not lead to systemic financial instability. The central bank’s proactive stance aims to safeguard the broader economy from the potential fallout of an AI market correction [Yahoo News].

Parallels to the Dot-Com Bubble

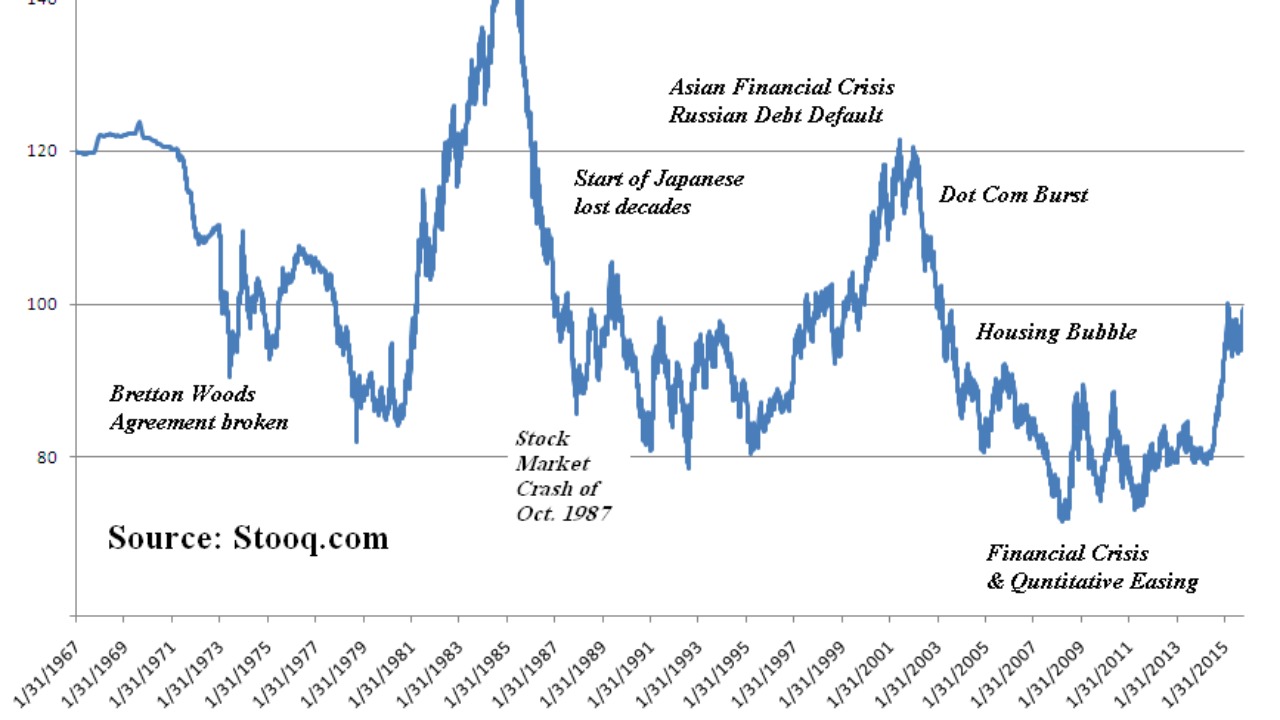

The trajectory of the AI boom bears striking similarities to the late-1990s dot-com era, characterized by rapid stock surges fueled more by hype than by solid business fundamentals. During the dot-com bubble, many companies saw their valuations skyrocket based on speculative investments, only to face dramatic declines when the bubble burst. The Bank of England’s warning suggests that the AI sector could be on a similar path, with inflated valuations potentially leading to a sharp market correction [WebProNews].

Historical examples from the dot-com bust, such as the 2000 Nasdaq crash, serve as cautionary tales for the AI industry. These events illustrate how quickly market enthusiasm can evaporate, leaving companies and investors grappling with significant financial losses. The Bank of England’s projections indicate that a similar scenario in the AI sector could have far-reaching implications, affecting not only individual firms but also global markets [Futurism].

The potential for an AI valuation drop to echo dot-com losses underscores the importance of prudent investment strategies and realistic expectations. Investors and companies alike must be vigilant in assessing the true value and potential of AI technologies to avoid the pitfalls of past market bubbles [WebProNews].

Implications for AI Firms and Investors

Major AI companies face significant exposure to valuation risks, particularly if their profitability fails to materialize as expected. The threat of a sharp correction looms large, with the potential to disrupt business operations and investor confidence. This scenario highlights the need for AI firms to develop sustainable business models that can withstand market fluctuations and deliver consistent returns [Dunfermline Press].

Investor behavior in the AI space often mirrors the over-optimism seen in past tech manias, contributing to bubble-like conditions. This optimism can lead to inflated valuations that are not supported by the underlying business fundamentals, increasing the risk of a market correction. The Bank of England’s warning serves as a reminder for investors to exercise caution and conduct thorough due diligence before committing capital to AI ventures [Yahoo News].

The broader economic ripple effects of an impending AI disaster could be significant, impacting venture capital flows and stock market stability. A sharp correction in AI valuations could lead to a tightening of investment capital, affecting not only AI firms but also the broader tech industry. This potential outcome underscores the interconnectedness of global financial markets and the importance of maintaining a balanced and diversified investment portfolio [Futurism].

Policy Responses and Future Outlook

The Bank of England is considering potential interventions to address the risks associated with AI market dynamics, including stress testing financial institutions for AI-related exposures. These measures aim to ensure that the financial system remains resilient in the face of potential market disruptions. By proactively identifying and addressing vulnerabilities, the central bank seeks to prevent a repeat of past financial crises [WebProNews].

International coordination on AI regulation is increasingly seen as necessary to prevent a dot-com-style crash. Collaborative efforts among global financial regulators could help establish consistent standards and practices for managing AI-related risks. This approach would enhance the stability of international markets and support the sustainable growth of AI technologies [WebProNews].

Looking ahead, the future stability of the AI market will depend on balancing the benefits of innovation with the risks of a sharp valuation drop. By fostering a regulatory environment that encourages responsible investment and innovation, policymakers can help ensure that the AI sector continues to thrive without succumbing to the pitfalls of past market bubbles [Yahoo News].