Electric vehicles are entering a pivotal phase in 2026, as battery chemistry, manufacturing and charging infrastructure all shift from lab promises to commercial reality. The next wave of innovation is less about a single breakthrough and more about a stack of incremental gains that together reshape cost, range and safety. From sodium and silicon to structural packs and wireless charging, the technology roadmap is finally converging with what drivers have been told to expect for a decade.

At the same time, the global Market context is changing, with governments tightening emissions rules and major carmakers racing to differentiate their electric line‑ups. In the UK, for example, the electric vehicle Market has already reached a 19.6% share of new sales, a sign that batteries are no longer a niche technology. What comes next for EV batteries in 2026 will determine whether that momentum accelerates into the mainstream or stalls under the weight of cost and infrastructure constraints.

The lithium era evolves, not ends

Despite the hype around exotic chemistries, lithium‑ion remains the backbone of the Electric Vehicle Battery Market and is likely to keep that role through 2026. Industry analysis notes that, Based on battery type, the market is segmented into lithium‑ion, lead acid, nickel‑metal hydride and others, with lithium‑ion expected to continue its dominance in the near future, reflecting its mature supply chains and proven performance in mass‑market cars like the Tesla Model 3 and BYD Atto 3. Even as new chemistries arrive, most automakers are optimizing existing lithium‑ion packs with better cell formats, smarter battery management systems and more efficient cooling.

Cost is the other reason lithium‑ion will not disappear overnight. New research from Goldman Sachs suggests average pack prices could fall to $80 per kWh by 2026, a level that would represent a near halving in price compared with the previous year and make EVs far more competitive with combustion engines on upfront cost. That forecast, which highlights $80 as a critical threshold, underpins aggressive pricing strategies in China and Europe and is already influencing how manufacturers plan their next‑generation platforms. As prices drop, I expect more brands to offer larger battery options as standard, using cheaper cells to deliver longer range without pushing list prices higher.

Sodium, silicon and solid state move from promise to product

The most visible chemistry shift in 2026 is the arrival of sodium‑ion cells in real vehicles. Battery market leader CATL has announced that it will start commercial production at scale of sodium‑ion batteries in 2026, positioning the technology as a lower‑cost alternative for small cars and two‑wheelers. Sodium cells trade some energy density for cheaper raw materials and better cold‑weather performance, which makes them attractive for urban runabouts and grid storage. I expect early adopters to be Chinese city cars and scooters, where range demands are modest and price sensitivity is high.

Those commercial plans are backed by a wave of research and pilot deployments. Scientists have developed a new solid‑state sodium‑ion battery that they say could make EVs cheaper and safer by replacing flammable liquid electrolytes with solid materials, potentially reducing fire risk while using abundant sodium. At the same time, industry commentary underlines that Sodium Ion Batteries Are Here, noting that Contempor manufacturers are already putting sodium‑ion packs into demonstration vehicles and scooters to validate performance in daily use. Together, these developments suggest sodium will not replace lithium‑ion outright but will sit alongside it in a multi‑chemistry landscape tailored to different vehicle segments.

Silicon is the other big materials story. Analysts tracking cell manufacturing expect 2026 to bring the first large‑scale deployment of silicon batteries in EVs, with higher silicon content in anodes boosting energy density and enabling faster charging. One detailed set of predictions describes a silicon battery breakthrough that will reshape energy storage as manufacturers compete on performance, arguing that packs will no longer all look and perform alike once silicon‑rich chemistries scale. In parallel, technical overviews of the sector stress that the future of electric vehicle batteries relies on multiple options rather than a single winner, with silicon, lithium iron phosphate, high‑nickel cells and sodium each occupying distinct niches.

On the horizon, Solid State Batteries are edging closer to showrooms. Expert explainers describe Solid State Batteries as Smaller, Safer, More Powerful than today’s packs, thanks to solid electrolytes that can support higher voltages and reduce thermal runaway risk. Forecasts for the UK EV Market go further, stating that 2026 will see the first production solid‑state battery vehicles, positioning them as a premium alternative to lithium‑ion technology for drivers who value range and safety above all. I see these early solid‑state models as halo products, likely appearing first in high‑end crossovers and sports cars before costs fall enough for mass‑market adoption.

Structural packs and new formats reshape the car itself

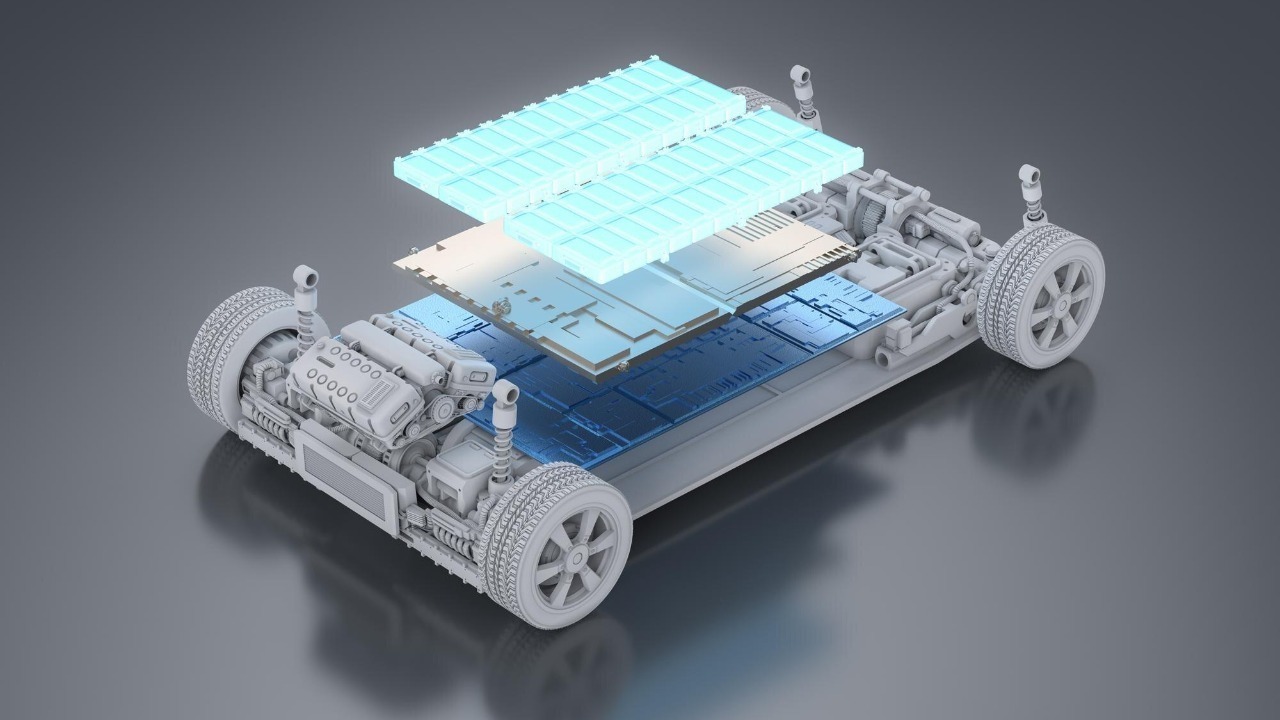

Beyond chemistry, 2026 is the year battery packs start to change the physical structure of vehicles. Engineers are pushing toward Structural EV batteries, where the pack doubles as part of the chassis rather than sitting as a separate, heavy slab under the floor. One development that could appear within the next few years is structural batteries built from carbon‑fibre composites that carry both mechanical loads and electrical charge, potentially cutting weight and freeing up interior space. Commentators point to companies like BYD exploring how future blade battery generations could integrate more tightly into the body structure, hinting at slimmer floors and more flexible cabin layouts.

These structural ideas dovetail with broader trends in pack design. Technical blogs on next‑generation batteries describe how automakers are moving from module‑based packs to cell‑to‑pack and even cell‑to‑chassis architectures, reducing parts count and improving volumetric efficiency. A detailed overview of next‑generation batteries in 2026 and beyond notes that such designs can improve crash performance and simplify manufacturing, especially when combined with new chemistries like sodium and high‑silicon cells. I expect this to show up first in dedicated EV platforms from Chinese and European brands, where engineers have more freedom to rethink the underbody than in converted combustion models.

Charging, infrastructure and the China effect

Battery innovation in 2026 is tightly linked to how drivers charge their cars. Industry forecasts for the EV charging sector argue that Wireless charging finally moves into the real world, with 2026 set to be the first year wireless charging becomes a practical option for some production vehicles. After years of pilot projects, embedded pads in parking bays and taxi ranks are expected to support hands‑free top‑ups, particularly for fleets that value convenience and predictable dwell times. The same outlook suggests that fast‑charging hardware takes a generational step forward, cutting stop times and putting more stress on pack durability, which in turn pushes manufacturers toward chemistries that can tolerate repeated high‑power sessions.

Dynamic charging is also gaining attention. Analysts tracking EV industry trends highlight Dynamic on‑the‑Move charging as one of five critical developments emerging in 2026, referring to roadways that can energize vehicles as they drive using inductive coils or overhead lines. While these systems are still experimental, they influence how engineers think about battery sizing: if vehicles can reliably sip power while moving, packs can shrink, reducing cost and weight. I see this as especially relevant for heavy trucks and buses, where today’s battery sizes are a major constraint on payload and route planning.

China’s role in this transition is impossible to ignore. According to market analyst Wood Mackenzie’s Electric vehicle and battery supply chain report, China’s EV market in 2026 is shifting from a subsidy‑driven price war to a high‑tech focus, with manufacturers under pressure to deliver real efficiency improvements and rapidly commercialise advanced technologies. That pivot is already visible in the way Chinese brands are racing to adopt sodium‑ion packs, structural batteries and high‑voltage architectures to differentiate themselves. At the same time, commentary on the future of electric vehicles in the UK notes that Key Insights from policymakers and industry leaders are converging around the need for robust charging networks and clear incentives, as the UK electric vehicle Market maintains a 19.6% share and prepares for the arrival of solid‑state models.

More from Morning Overview