Ultra-pure nuclear fuel is quietly becoming one of the most strategic technologies in the energy transition, with the United States racing to build its own supply for a new generation of compact reactors. While fusion developers pursue exotic target pellets and laser systems, the immediate industrial action is in advanced fission fuels that can run hotter, safer, and more efficiently than the uranium used in today’s large plants. At the center of that push is a US startup that has just secured major backing to manufacture high-specification fuel for next‑generation reactors.

Standard Nuclear is positioning itself as a cornerstone of this emerging supply chain, focusing on ultra-pure forms of uranium fuel that advanced fission designs require to meet both safety and performance goals. Its work is unfolding alongside a broader US effort to replace Russian supplies of specialized uranium and to support small modular reactors and other advanced concepts that depend on fuels such as TRISO particles and High Assay Low Enriched Uranium.

Standard Nuclear’s $140 million bet on ultra-pure TRISO

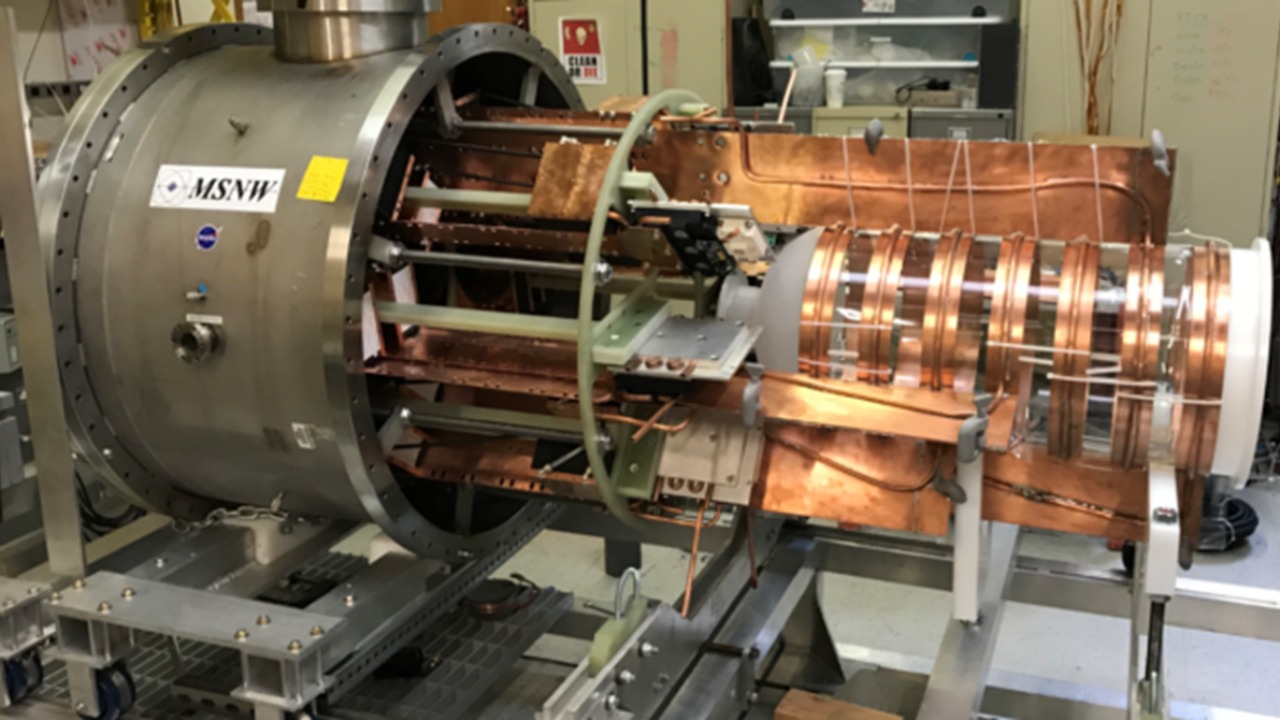

The clearest signal that advanced fuel is moving from concept to industry came when Standard Nuclear closed a $140 m Series A funding round to scale production of TRISO fuel. On Monday, the company confirmed that the $140 million raise will go into expanding a domestic manufacturing base for these tiny, ceramic-coated fuel particles, which are engineered to contain fission products even at very high temperatures. The Department of Energy has described TRISO fuel as “the most robust nuclear fuel on Earth,” a claim that reflects its multilayered structure and the way each particle effectively acts as its own containment system.

That robustness is not theoretical. The DOE’s own testing programs have subjected TRISO particles to extreme temperatures and irradiation as part of the Advanced Gas Reactor Program, with performance that underpins their use in high-temperature gas-cooled reactors. Standard Nuclear’s business case rests on taking that lab-proven fuel and turning it into an industrial product at scale, with quality controls tight enough to satisfy regulators and reactor vendors that every batch meets the same ultra-pure standard.

From pilot program to domestic TRISO supply chain

Standard Nuclear’s rise is not happening in isolation. The Department of Energy has tapped the company as the first participant in a federal pilot program to establish a domestic nuclear fuel supply that can displace imports from geopolitical rivals. Under that initiative, Standard Nuclear is expected to demonstrate that US industry can reliably produce advanced fuel forms at commercial scale, a prerequisite for deploying many of the reactors now in design or licensing.

The company is also part of a broader partnership to build a full TRISO ecosystem in the United States. Industry groups describe a “Partnership for TRISO production” that aims to create a resilient, domestic TRISO fuel supply chain, with Pairing Standard Nuclear and other firms to cover everything from uranium feedstock to finished fuel compacts. A related report notes that this partnership plans to commence manufacturing in 2027, pending regulatory approvals, which would align fuel availability with the timelines many advanced reactor developers are targeting for first-of-a-kind units.

TRISO’s role in next-gen fission reactors

TRISO fuel is central to several of the most advanced fission designs now moving toward deployment. X-energy, for example, has developed TRISO‑X, described as Advanced TRISO Particle Fuel for Gen 4 Nuclear Reactors, which packages the particles into fuel forms tailored for high-temperature gas-cooled systems. The most critical element in these designs is the ability of each particle to retain fission products, which allows reactors to operate at higher outlet temperatures and with passive safety characteristics that differ sharply from conventional light-water plants.

Those characteristics are already being translated into specific reactor offerings. The Xe‑100, a high-temperature gas-cooled reactor that uses TRISO-based fuel, is marketed as an 80 m unit sold in a pack of four to construct 320 m of total capacity, according to its The Xe project CEO. That modular approach is designed to let utilities add capacity in 80 megawatt increments rather than committing to a single 100 scale gigawatt-class plant, which in turn makes fuel logistics and financing more manageable for smaller grids and industrial customers.

HALEU: the other ultra-pure fuel the US needs

Alongside TRISO, High Assay Low Enriched Uranium is emerging as the other critical fuel for advanced fission. HALEU is uranium enriched to between 5 and 20 percent U‑235, higher than the fuel used in today’s large reactors but far below weapons-grade material. High Assay Low Enriched Uranium allows reactor cores to be more compact and to run longer between refueling, which is particularly attractive for small modular reactors and microreactors that may be deployed in remote locations.

Today, Applications for HALEU are largely limited to research reactors and medical isotope production, but industry groups stress that, However, HALEU will be needed for many of the advanced power reactors now under development. The World Nuclear Association notes that Applications for HALEU are expected to expand sharply as small modular reactors move from demonstration to commercial fleets. Centrus Energy, which is pioneering enrichment technology for this market, argues that a reliable domestic source of HALEU is essential for US reactor vendors to compete globally and to avoid dependence on foreign suppliers.

Breaking Russia’s grip on advanced fuel

For now, Russia has been the world’s primary commercial supplier of Haleu, with state-owned Tenex dominating the market for this specialized material. That concentration has become a strategic liability for The US, which is trying to decouple critical energy infrastructure from Russian supply chains. A recent analysis of advanced fuel markets notes that Russia and Tenex have effectively set the pace for HALEU availability, which in turn constrains how quickly non-Russian reactor projects can move.

The US response is to seed a domestic industry that can supply both TRISO and HALEU without relying on imports. That strategy includes support for enrichment companies such as Centrus Energy, which is developing centrifuge cascades specifically configured for HALEU production, and for fuel fabricators like Standard Nuclear that can turn enriched uranium into qualified reactor fuel. By combining federal pilot programs with private capital, policymakers are trying to compress what might have been a decade-long buildout into a much shorter window.

More from Morning Overview