Tesla is asking investors to believe that its humanoid robot, Optimus, will be performing at roughly human level in everyday factory work by 2026, and that this shift will matter more than the car business. The pitch is that a company already worth more than a trillion dollars could still be early in its real growth story if robots that never sleep become a mainstream labor force. I want to examine whether that vision justifies buying the stock now, or whether the risks around execution, competition and valuation still dominate.

Optimus as the centerpiece of Tesla’s next act

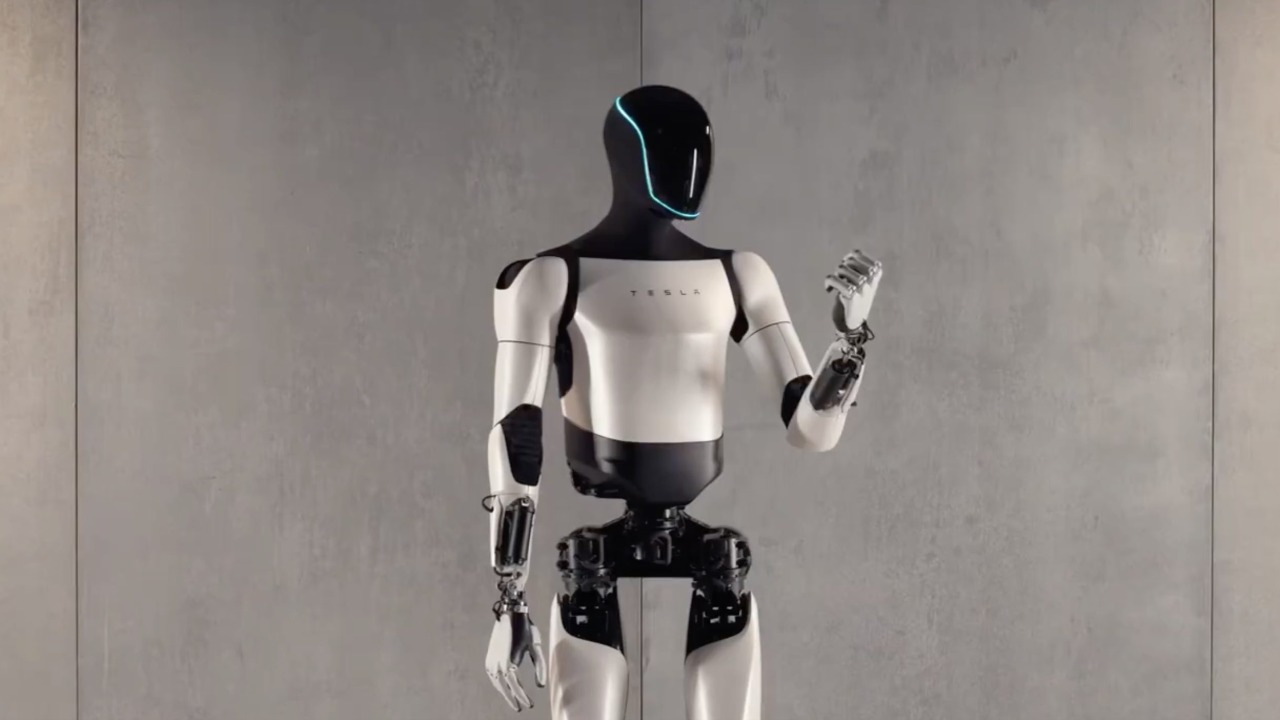

The core claim is bold: Tesla says Optimus will reach human-level proficiency in practical tasks as soon as 2026, turning the robot from a flashy prototype into a real worker on the factory floor. The company has been steadily showcasing Optimus and its growing capabilities, with coverage noting that See the Optimus and other humanoids are already being trained for repetitive industrial work. Another analysis argues that Why Tesla Stock if Optimus Reaches Human, Level Proficiency This Year, highlighting how central this robot has become to the equity story.

Behind the demos is a massive capital bet. Reporting on Tesla’s latest strategy describes a $20 billion AI, with Tesla and Optimus at the center of a pivot from pure automaker to robotics titan. The company is targeting production capacity of one million Optimus units annually by the end of the decade, and plans to stand up manufacturing in Texas and California by mid 2026 according to that same report. That scale is not a side project, it is a declaration that robots, not sedans, are supposed to drive the next wave of growth.

From factory helper to global labor force

To understand the upside story, I look at how Tesla imagines Optimus changing industrial work. Elon Musk has spoken about humanoid robots that work 12 hours a day, never rest and use artificial intelligence to handle tasks that are dull, dangerous or simply undesirable for people. One detailed account of Elon Musk describes a plan to redesign factories, and perhaps the planet, around such humanoid robots. The same reporting notes that Tesla has quietly crossed a threshold in internal deployment, even if the ramp remains “agonizingly slow” before any mass rollout.

There are concrete milestones on the production side. A social media post shared by India-focused coverage explains that in 2025, Jan 2025, Tesla aims to begin deploying Optimus in its own factories to handle work that is dangerous, or undesirable for humans. Separate industrial coverage notes that in the Market for Metals, Tesla is on track to unveil its third generation humanoid robot, with plans to deploy these units in factories to alleviate labour shortages. If that rollout works, Optimus shifts from a cost center to a product that can be sold into a global industrial base.

The financial backdrop: profits under pressure, valuation sky high

Any decision about the stock has to start with the numbers. Tesla’s net income for the twelve months ending December 31, 2025 was $3.794B, a 46.5% decline year over year, according to Tesla net income data. A second view of the same figures from Tesla confirms the 46.5% drop and the $3.794 figure, underscoring how sharply profitability has fallen even as the company spends heavily on AI and robotics. That erosion is part of why some analysts describe Tesla earnings as being in a long slide, even while the stock narrative shifts toward autonomy and robots.

The market, however, is still assigning a premium. One recent analysis notes that, even after volatility, Tesla carries a market value of about $1.4 trillion, and describes how Clearly, Tesla is a risky stock at that size. Another commentator, writing under the banner of While Tesla has ambitious plans, argues that Underneath the surface the valuation already bakes in a lot of success, and that the stock’s valuation demands flawless execution. For investors, that means Optimus is not a free call option, it is a core assumption embedded in today’s price.

Wall Street’s Optimus trade: euphoria and skepticism

On the bullish side, some analysts are explicit that Optimus is the lever that could send the stock sharply higher. One breakdown of the opportunity notes that Tesla shares have risen 134% over the last year, and frames the case as 134% already, with Key Points arguing that Optimus production could start by 2026 and that Tesla has data and manufacturing advantages that other robot makers lack. A separate video discussion framed as Research asks why Tesla, and not Nvidia, remains the preferred AI play, pointing again to the potential of robotaxis and humanoid robots to justify a doubling of the stock in 2026.

Others are more cautious. One detailed breakdown of Tesla’s capital spending notes that the company plans to invest about $20 billion on new plants and AI projects, including Optimus, and that Tesla stock is falling and really needs the Optimus robot to justify that spending. That same piece cites a poll of investors on X that tried to gauge how much faith shareholders actually have in the AI roadmap. Another analysis of Feb capital plans notes that euphoria around FSD, robotaxis and Optimus has already driven a sharp recovery in Tesla’s equity value, with overall enterprise value up 134.7% year over year, which again suggests that a lot of optimism is already priced in.

Execution risk, timelines and what I would watch

Even if I accept that humanoid robots will eventually be a huge market, the near term hinges on execution. Industrial reporting on the Tesla roadmap explains that to achieve the goal of one million units a year, During Wednesday earnings calls Musk has outlined significant production adjustments and a third generation robot designed for mass production. Another deep dive into Tesla and Optimus calls that timeline aggressive, with factories in Texas and California expected to be ready by mid 2026. A separate industrial note on Metals markets reinforces that Tesla is moving quickly to advance humanoid robot production, but speed increases the risk of missteps.

There is also the broader context of Tesla’s business and stock behavior. One stock outlook notes that Yet investors have abandoned the sour views that knocked off a quarter of Tesla’s value early in 2025, and now see 2026 as a defining year tied to self driving robotaxis and autonomy, according to Yet Tesla coverage. Real time quotes show the stock trading around $ 407.50 After Hours, with a 1.49 move equal to 0.37% at the Last Updated EST Delayed Close, which underlines how sensitive the price is to every new data point. Any investor leaning on Optimus has to accept that the stock will likely swing violently as each milestone is hit or missed.

For anyone considering a position, I would treat Optimus as a high risk, high reward thesis layered on top of a cyclical car business that is currently under earnings pressure. I would watch for concrete evidence that Optimus is doing real work in Tesla factories at scale, not just performing in staged demos, and I would track whether external customers in sectors like Tesla linked metals and manufacturing actually sign purchase agreements. I would also keep an eye on independent financial data from platforms that aggregate market information, such as Google Finance, to see how earnings, cash flow and capital spending evolve as the robot program scales. For now, I see Tesla as a stock for investors who are comfortable betting that a $1.4 trillion company can still reinvent itself, and who can live with the possibility that Optimus, despite all the hype, may take longer than 2026 to truly match humans where it matters most: on the bottom line.

More from Morning Overview