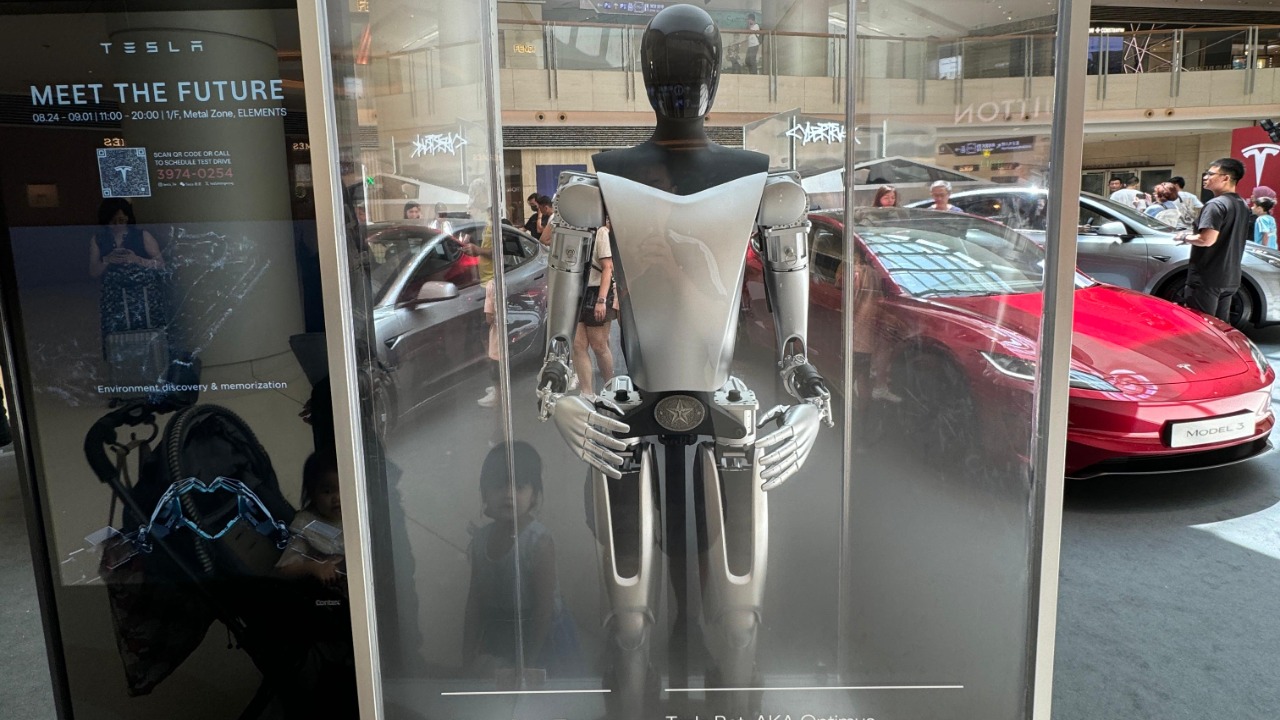

Tesla’s humanoid robot Optimus has crossed a line that once belonged firmly to science fiction, moving from carefully staged demos to agile, simulation-trained movement that looks startlingly human. In new footage, the machine does not just shuffle or wave, it executes a controlled leap that signals how quickly digital training is turning into physical capability. The leap is not a party trick so much as a proof point that Tesla’s bet on virtual practice at massive scale is beginning to pay off in the real world.

That shift matters far beyond one robot. By tying Optimus to the same data-hungry artificial intelligence playbook that transformed language models and self-driving systems, Tesla is positioning its humanoid platform as a general-purpose worker that can learn almost anything. If the company can turn those simulation gains into reliable performance on factory floors and, eventually, in homes, the economics of labor and automation could change with surprising speed.

From viral leap to simulation-trained worker

The latest Optimus clips show a machine that no longer moves like a cautious prototype but like a robot that trusts its own balance, landing a jump that would have been unthinkable in its early iterations. In the videos, Tesla and Elon Musk frame the leap as the result of intensive virtual practice, with Optimus effectively rehearsing thousands of times in a digital environment before attempting the maneuver in hardware. That is why the company describes the moment as a transition “from simulation to reality,” with Posted and Jan updates emphasizing how far the robot has come in a short time.

What makes this leap different from earlier humanoid stunts is the training pipeline behind it. Tesla is not just hand-coding balance routines, it is feeding Optimus a stream of synthetic experiences that let the robot fail safely in virtual space until it discovers robust strategies for staying upright. That same approach underpins the broader “robot breakthrough” narrative around Tesla and Optimus, where the company highlights how digital rehearsals are starting to translate into physical dexterity that looks less like a lab demo and more like the early stages of a useful worker.

Inside Tesla’s simulation-first playbook

Behind the glossy clips is a technical strategy that treats Optimus as an AI system first and a piece of hardware second. Tesla leans heavily on high-fidelity simulation to generate the enormous volumes of experience that a learning system needs, sidestepping the practical limits of collecting every data point in the real world. Robotics researchers have long warned that “to train a robot the way we train a language model, you need enormous amounts of demonstration data,” a challenge that has become a central data problem for the field.

One detailed look at Optimus’s learning process describes how the robot “went from 0% success to over 40% success on novel tasks in unseen environments,” a jump that the analysis labels with the word Effectively to underscore the magnitude of the gain. That improvement came not from painstakingly programming every behavior but from letting the robot iterate through countless digital “dreams,” then transferring those skills to the physical world where fine-tuning continues.

Austin becomes Optimus’s real-world classroom

Simulation alone is not enough, which is why Tesla is now turning its own factories into training grounds. A detailed Plan describes how Tesla, trading under the ticker TSLA, intends to start data collection and training for Optimus humanoid robots at its Austin, Texas facility. The idea is straightforward: put robots into the same environment where Tesla already builds cars, let them observe and eventually assist human workers, and harvest that stream of interactions as training data.

Financial analysts have started to frame this shift as a strategic pivot. One commentary by Moz Farooque ACCA notes that Tesla, Inc is treating Optimus as its biggest long term bet, with Tesla increasingly willing to reconfigure its operations around humanoid robots. That seriousness is visible not just in training plans but in product roadmaps, where the company has told investors it will reveal a Gen 3 version of the robot in the first quarter of 2026, signaling rapid iteration.

From carmaker to robot company

The Optimus push is already reshaping Tesla’s core business. In a striking move, the company has decided to discontinue its Model S and Model X lines in order to free capacity for humanoid production, a shift detailed in coverage of how Tesla is changing lanes. That reporting notes that Tesla announced it would begin production of Optimus before the end of 2026, with Musk saying the robot will be for sale to the public in 2027.

That timeline aligns with other investor facing updates that describe a production ready Optimus arriving “soon,” including plans to show the Gen 3 robot early this year. Analysts like Mon have pointed out that this is not a side project but a redefinition of what Tesla, Inc wants to be, with the company’s stock symbol TSLA now tied as much to humanoid robots as to electric vehicles.

The price tag that could flood factories and homes

For all the technical drama, the most disruptive detail may be the price. Elon Musk has repeatedly said the robot could cost between $20,000 and $30,000 once it reaches full scale production, a range that However ambitious it sounds, would undercut many industrial machines. Another pricing analysis notes that Tesla’s Optimus is positioned as a price disruptor with a target of $20,000 to $30,000, aiming for large scale production to serve both homes and industries.

That same pricing breakdown, published in Nov, underscores how aggressively Tesla is trying to expand the addressable market. If a humanoid worker can be bought for the price of a mid range car, then logistics warehouses, small manufacturers and even affluent households could justify deploying fleets. That is why some observers describe Optimus as a potential “iPhone moment” for robotics, with Elon Musk and Tha broader ecosystem of humanoid robots all racing to hit similar price points.

More from Morning Overview