Nvidia’s explosive run has made it the defining stock of the artificial intelligence era, so when Jensen Huang insists that “we’re nowhere near a bubble,” markets listen. The chief executive is arguing that what looks like speculative excess is actually the early phase of a massive buildout of computing infrastructure, with real revenues and profits already flowing through the system. I see his case as a high‑stakes bet that today’s AI spending is closer to the early internet than to dot‑com froth.

Huang’s “largest buildout in history” argument

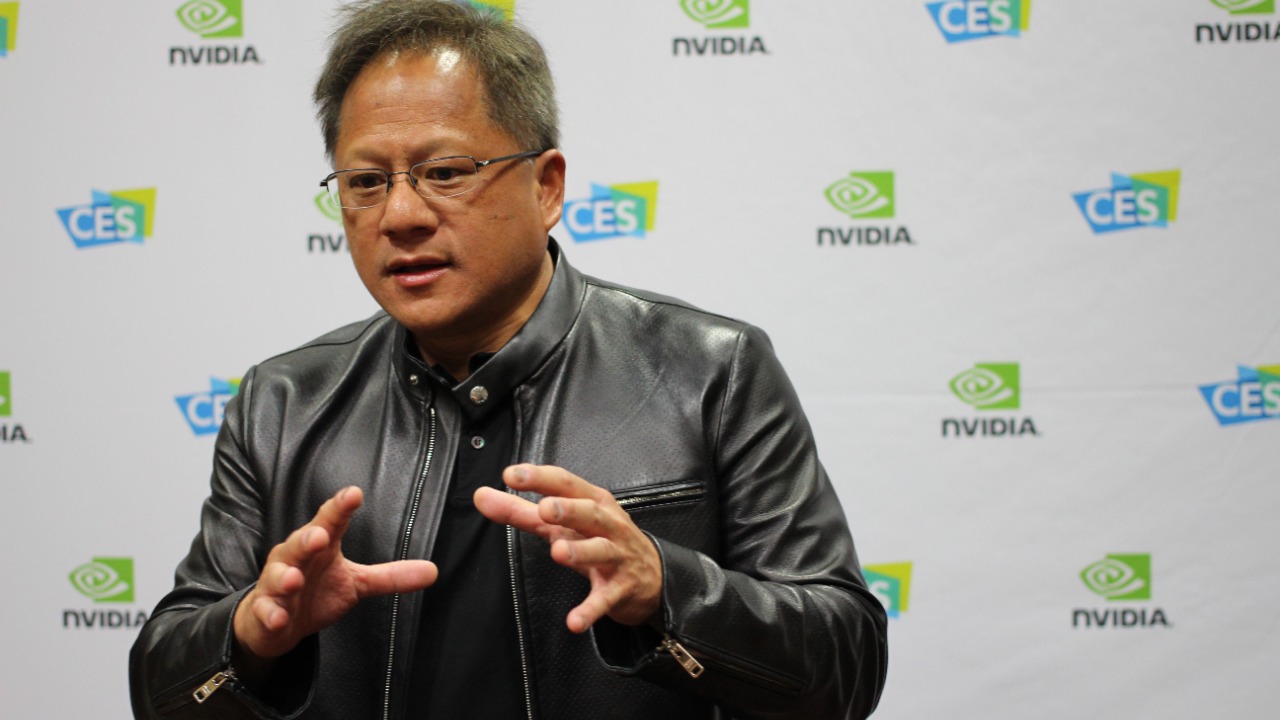

Jensen Huang is not simply brushing off skeptics, he is reframing the entire AI cycle as an industrial project that will take years to complete. At the World Economic Forum in Davos, the Nvidia CEO Jensen described current spending as part of “the largest infrastructure buildout in human history,” arguing that data centers, networks, and power systems are still far from ready for the workloads companies want to run. In his telling, the surge in AI chips is not a speculative side bet but the backbone of a new computing platform that will reshape everything from manufacturing to healthcare.

Huang has doubled down on that view in separate interviews, where he has been quoted pushing back against bubble talk and insisting that AI demand is still in its early innings. In one conversation, he framed AI as a general purpose technology that will change the wage landscape for manual labor and white‑collar work alike, again positioning Nvidia’s hardware as the enabling layer for that shift, a point echoed in another report that also highlighted how Nvidia CEO Jensen is “pushing” back against fears that AI spending is unsustainable. I read this as a deliberate attempt to move the debate away from quarter‑to‑quarter chip orders and toward a multi‑year transformation of the global compute stack.

Trillions in capital and a real revenue base

Huang’s confidence rests on a simple claim: the world has not yet invested enough in AI, not that it has invested too much. In one interview, he argued that the sector will require “trillions” more in capital to reach its potential, with Nvidia CEO Says in Investments and warned that under‑building the infrastructure would be the real “Ultimate” risk. That framing flips the usual bubble narrative on its head: instead of fearing overcapacity, he is warning about the economic cost of falling short, from missed productivity gains to stalled innovation in areas like autonomous vehicles and drug discovery.

Crucially, Nvidia can point to hard numbers rather than just lofty promises. For the fiscal year ending in January 2025, the company reported annual revenue of $130.50B, with $130 billion in sales representing 114.20% growth and a trajectory that some estimates put on a path toward $187 and even $187.14 billion on a TTM basis. Another breakdown notes that What NVIDIA reported was total revenue of $130.50B and net income of $72.88B, figures that are difficult to square with the idea of a purely speculative mania. When a business is converting AI enthusiasm into tens of billions in profit, the line between bubble and genuine structural shift becomes more complicated.

Data center dominance and the Rubin roadmap

Under the hood of those numbers is a business that has become synonymous with AI infrastructure. Analysts have repeatedly highlighted how the AI Boom Keeps Driving Data Center Business, with the Data Center segment now widely seen as the company’s most powerful growth engine. That is where the flagship GPUs that train and run large language models are sold, and where cloud providers and enterprises are racing to expand capacity. In that context, the 39% stock gain in 2025 cited in the same analysis looks less like a meme‑stock spike and more like a reflection of a company that has become the default supplier for a new class of computing.

Huang is also trying to show that Nvidia’s dominance is not static but built on a roadmap of new products. One viral clip highlighted how the Nvidia CEO says Rubin chips are nearing release, underscoring that the company is already planning the next generation of AI accelerators even as demand for current models remains intense. That same snippet noted that the company’s valuation took nearly 25 years to reach $1 trillion but only months to surpass $2 trillion in March, a reminder of how quickly markets have repriced Nvidia’s role in the AI stack. I see that acceleration as both a validation of Huang’s thesis and a source of the very bubble fears he is trying to defuse.

Davos, Trump, and the politics of AI optimism

The debate over an AI bubble is no longer confined to earnings calls, it has moved onto the global political stage. At Davos, the Nvidia CEO used his platform to argue that AI has already started a large infrastructure buildout, directly addressing concerns that the sector is overheating. He framed the spending as a rational response to real demand from enterprises that are already deploying AI in production, not just experimenting at the margins. That message was aimed as much at policymakers as at investors, signaling that governments should prepare for a world where AI is embedded in everything from logistics to public services.

Huang’s presence in Davos also intersected with U.S. politics, where President Trump has been vocal about American tech leadership. One account described how The Nvidia (NVDA) co‑founder, wearing his trademark black leather coat, talked about a “boom” in trade jobs and six‑figure technical roles linked to AI infrastructure. That narrative dovetails with Trump’s emphasis on domestic industry and high‑wage employment, turning Nvidia’s capex‑heavy vision into a political selling point. I read this alignment as another reason Huang is so forceful in rejecting bubble language: if AI is framed as a jobs engine and strategic asset, it becomes harder for regulators and central banks to justify policies that might choke off investment.

Moody’s warning and the bubble skeptics

Not everyone is convinced that the AI surge can continue without serious turbulence. A detailed analysis from Moody mapped out “contagion channels” that could transmit damage across the economy if an AI bubble bursts, with analysts led by Vincent Gusdorf outlining how a sharp correction in AI‑linked equities could hit banks, funds, and even labor markets as companies pull back on hiring. They stopped short of declaring that a bubble already exists, but the scenario analysis reads like a warning label for investors who assume that AI multiples can only go up. I see this as the most credible counterweight to Huang’s optimism, because it focuses not on whether AI is transformative but on how financial markets might overshoot even a very real trend.

Retail investors are hearing similar cautionary notes. One widely circulated piece framed the question bluntly, asking whether people should be worried about an AI bubble in 2026 and stressing that Key Points include the fact that AI stocks have thrived but that Nobody can predict short‑term moves. The same analysis argued that, over a decade, AI could still create enormous enterprise value even if there are painful drawdowns along the way. That strikes me as the most balanced view: investors can believe in the long‑term AI story and still recognize that valuations may be ahead of themselves in the near term.

More from Morning Overview