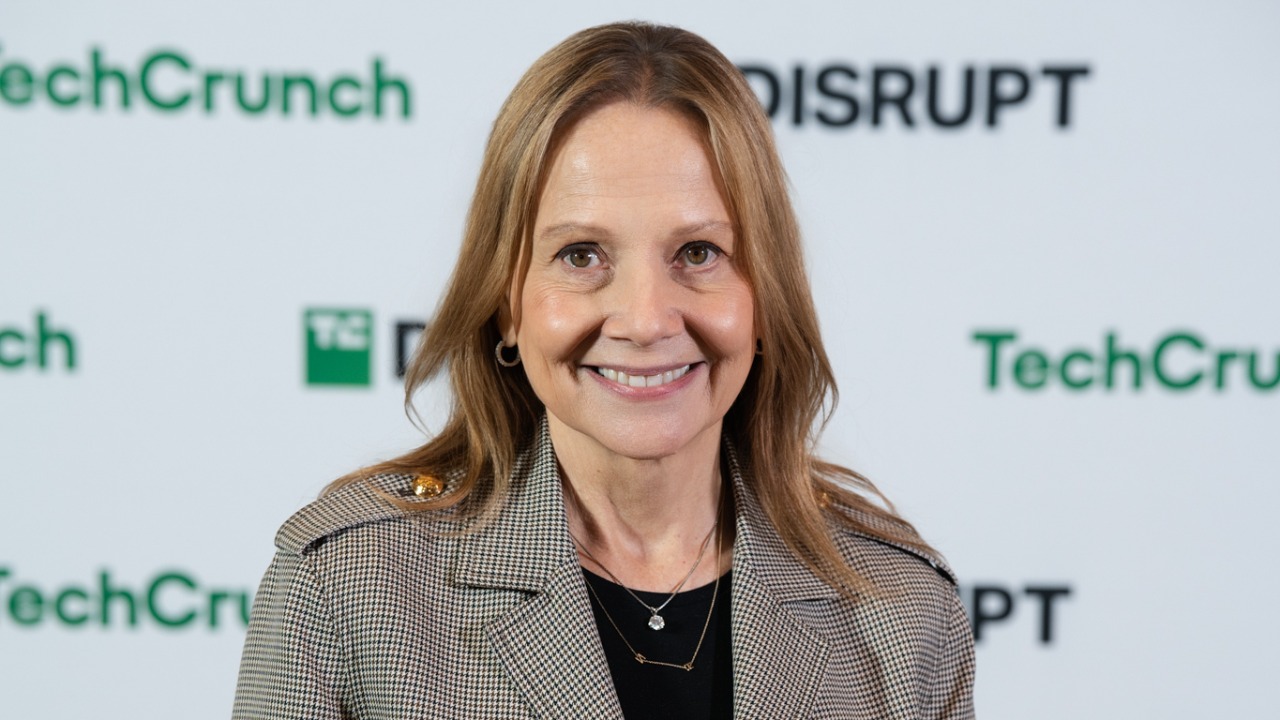

General Motors chief executive Mary Barra is escalating her criticism of Ottawa’s decision to open the door to low cost Chinese electric vehicles, warning that Canada’s softer stance on tariffs risks undercutting North American manufacturing. Her pushback turns a technical trade deal into a high stakes fight over jobs, national security and the future of the continent’s EV supply chain.

At the center is Canada’s move to sharply reduce duties on imported Chinese EVs and to allow a defined volume of vehicles into the market, a break from the hard line favored in Washington. As President Donald Trump threatens sweeping retaliation, Barra is casting Canada’s approach as a dangerous precedent that could ripple across the entire auto industry.

What Canada actually agreed to with China

Canada’s new arrangement with Beijing is not a vague political gesture, it is a concrete tariff cut that dramatically changes the math for Chinese automakers. Earlier this year, Canada’s January 2026 trade deal with China reduced EV duties from 100% to 6.1%, slashing the cost penalty that had effectively kept most Chinese brands out. The same deal allows a specific quota of vehicles to enter the Canadian market at those lower rates, giving Chinese EV makers a clear path to scale up sales just north of the United States.

That quota is not symbolic. Canada has agreed to let in 49,000 Chinese EVs at reduced tariffs, a figure large enough to matter in a market where electric adoption is still emerging. Trade specialists note that this is part of a broader thaw between China and Canada, after Carney, identified as Mark Carney, met Xi Jinping to secure tariff relief on multiple fronts, including canola, with China and Canada announcing a package of measures. For Ottawa, the EV concession is one piece of a larger reset with Beijing, but for Detroit, it is the piece that matters most.

Barra’s “slippery slope” warning

Mary Barra is not mincing words about what she thinks this means for her company and its workers. Speaking to employees in an internal all hands meeting, she said she “cannot explain why the decision was made in Canada” and argued that opening the door to cheap Chinese EVs “becomes a very slippery slope” for the North American auto sector, according to remarks relayed in coverage of Canada’s move. She has framed the issue as one of both economic fairness and national security, pointing to heavy state support for Chinese manufacturers that she argues distorts competition.

Her language has been consistent across venues. In public comments highlighted by industry watchers, Barra has slammed Chinese EV makers’ subsidies and described the Canadian deal as a risk to “protecting” the domestic industry, a stance echoed in analysis of the Detroit automaker. On social media, her warning has been distilled into a “Slippery Slope” message, with one widely shared post noting that the GM CEO is “Sounding the Alarm” on the Canada deal and stressing that Mary Barra is not sending a friendly signal about the arrangement, as captured in an Instagram summary. For Barra, the fear is that once Chinese EVs gain a foothold in Canada, pressure will mount to open the U.S. market more widely as well.

Trump’s tariff threat and the political squeeze on Ottawa

Barra’s critique lands in the middle of a broader geopolitical clash that is already putting Canada under intense pressure. President Donald Trump has threatened Canada with 100%, across the board tariffs in response to Ottawa’s decision to allow in 49 Chinese EV makers’ products, a move that would hit far more than the auto sector. The warning underscores how a targeted EV tariff concession has escalated into a potential trade confrontation that could engulf agriculture, energy and other exports that rely heavily on U.S. access.

Canadian officials are trying to frame the deal as a manageable, rules based opening rather than a wholesale capitulation to Beijing. Jan Carney, identified in one account simply as Carney, has been described as the architect of the new arrangement with China and has reportedly defended the move directly to President Donald Trump, arguing that Canada can balance its commitments to its largest trading partner with a more pragmatic relationship with China. That leaves Ottawa squeezed between a White House willing to wield tariffs as leverage and an auto industry that sees the EV carve out as a direct threat.

Why GM sees Canada’s move as a threat to North American jobs

From GM’s perspective, the core issue is not just price competition, it is the structure of the North American market that has been built around integrated supply chains and shared protections. Barra has warned that if Canada becomes a low tariff entry point for Chinese EVs, it could undermine efforts in Washington to keep heavily subsidized Chinese vehicles out of the region, a concern echoed in reports that the GM boss views Canada’s lower China EV tariffs as a “slippery slope”. The fear is that Chinese brands could use Canada as a staging ground, building brand recognition and dealer networks that eventually push south.

Industry analysts note that Chinese automakers benefit from extensive state support at home, from cheap financing to direct subsidies, which allows them to sell EVs at prices that are difficult for North American producers to match. Barra has argued that letting those vehicles into Canada at sharply reduced tariffs, after rates fell from 100% to 6.1%, effectively rewards that model and puts unionized plants in Ontario and the U.S. Midwest at risk. In that context, GM’s alarm is less about a single quota of 49,000 vehicles and more about the precedent that Canada is willing to diverge from its neighbors on trade remedies for China.

The long game: EV supply chains, diplomacy and what comes next

Canada’s leaders are betting that a carefully managed opening to Chinese EVs can coexist with a strong domestic auto base and a stable relationship with Washington. The broader tariff relief package negotiated by Carney and Xi Jinping, which included sectors like canola alongside electric vehicles, shows Ottawa trying to reset ties with Beijing after years of strain, as reflected in the joint announcement by China and Canada. In that view, the EV quota is a controlled experiment that could bring cheaper cars to Canadian consumers while preserving room to respond if Chinese imports surge.

GM and its peers, however, are reading the same deal as an early test of whether North America can maintain a united front on industrial policy in the face of China’s rise. With President Donald Trump threatening 100% tariffs and Mary Barra publicly “Sounding the Alarm” about a “Slippery Slope,” the political space for compromise is narrowing fast, as captured in the social media framing of the Canada deal. The next phase will hinge on whether Ottawa adjusts the terms under pressure, whether Washington follows through on its tariff threats, and whether Chinese EV makers decide the Canadian market is worth the geopolitical heat that now comes with every car they ship.

More from Morning Overview