Robotic surgery is shifting from futuristic concept to everyday hospital reality, and the companies behind these systems are starting to look like the next generation of blue‑chip healthcare leaders. For investors willing to sit tight through volatility, one focused player in this niche could realistically compound into a seven‑figure position over a long enough horizon. To understand how a single robotic surgery stock might become a $1 million payoff, I need to unpack the growth of the market, the competitive landscape, and the specific traits that separate durable winners from short‑lived hype.

The $1 million question: what kind of stock can get you there?

Turning a modest stake into $1 million is not magic, it is math plus patience. If I start with $10,000 and a company compounds at roughly 15 percent a year, I am waiting close to three decades before that stake crosses seven figures. With $25,000 and a 20 percent annualized return, the journey is closer to twenty years. The point is that a “$1 million payoff” is really shorthand for a business that can sustain high growth, defend its margins, and keep reinvesting in a large opportunity for decades, not just a quick trade on the latest medical gadget.

Robotic surgery fits that profile because it sits at the intersection of aging populations, hospital cost pressure, and a clear clinical shift toward minimally invasive procedures. When I look at lists of $2,000 starter portfolios built around “Top Robotics Stocks” to “Buy and Hold for” at “Least” a “Decade”, I see the same pattern: investors are being nudged toward platforms that can dominate a category for a very long time. A robotic surgery stock that can plausibly become a $1 million position will almost certainly share those traits of long runway, recurring revenue, and entrenched technology.

Why surgical robots are becoming a core healthcare technology

Before I can pick a standout stock, I need to understand the tide lifting the entire sector. Surgical robots are not just fancy tools, they are becoming embedded in standard care pathways because they can improve precision, reduce complications, and shorten hospital stays. That combination matters to surgeons, who want better control and visualization, and to hospital administrators, who are under constant pressure to cut length of stay and readmission rates without sacrificing outcomes.

Market data backs up how quickly this shift is happening. The global surgical robots market was valued at 8.1 billion in 2024 and is expected to reach from 9.2 in the near term as adoption spreads across more specialties and geographies. Broader medical robotics is expanding even faster, with analysis from NEWARK, Del indicating that the global medical robot market could reach a staggering USD 38,701.5 million by 2034, driven by AI, imaging advances, and hospital automation. In that context, a well‑positioned surgical robotics company is not fighting for scraps, it is riding a structural wave.

From niche to necessity: how fast the opportunity is expanding

What makes surgical robotics particularly compelling is how quickly it is moving from a niche used in a handful of flagship hospitals to a necessity across community systems. Earlier adopters focused on high‑profile procedures like prostatectomies, but as surgeons gain experience and systems improve, robots are being used in gynecology, general surgery, orthopedics, and even some thoracic cases. Each new indication adds volume to installed systems and deepens the moat for the companies that already have a footprint.

Industry commentary notes that Theglobal market for surgical robotics has expanded rapidly, “Per” research that highlights minimally invasive surgery as a central growth driver and points to major areas of growth in urology, gynecology, and orthopedics. When I combine that with the broader medical robot forecast out of GLOBE “NEWSWIRE” coverage, the picture is clear: this is not a fad tied to one product cycle, it is a multi‑decade modernization of how surgery is delivered.

The incumbents: Intuitive Surgical and the benchmark for dominance

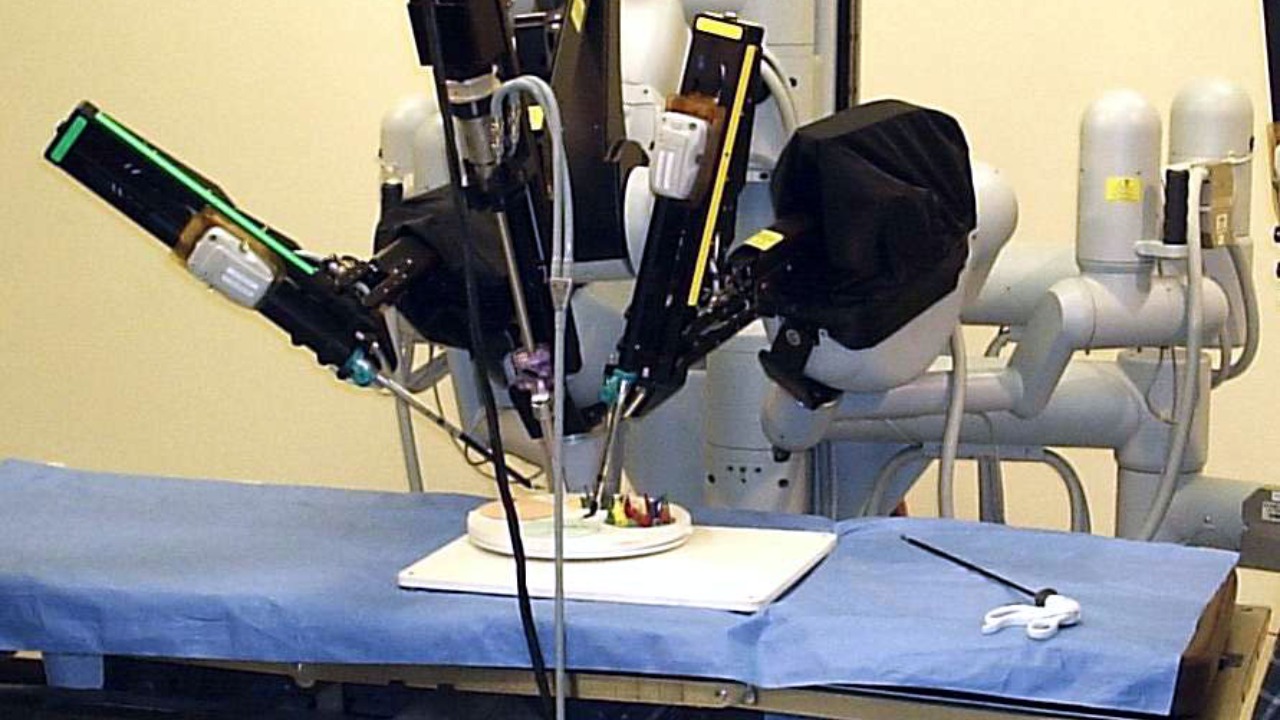

Any discussion of a potential $1 million robotic surgery payoff has to start with the current category leader. Intuitive Surgical built its da Vinci platform into the default choice for many hospitals, and its installed base, training ecosystem, and recurring instrument revenue have given it a formidable moat. For long‑term investors, it has already been a life‑changing compounder, which is why it often appears in lists of healthcare names suited to very long holding periods.

Analysts describing “Key Points These” companies for beginners with a 40‑year time horizon explicitly call out Intuitive Surgical as a leader that has dominated the surgical robotics market for decades and remains highly profitable. That track record sets the bar for what a future $1 million payoff stock must look like: a platform that becomes embedded in training programs, generates high‑margin recurring revenue from disposables and service, and can keep expanding into new procedures without losing its edge. The question for investors today is whether the next Intuitive is already public and still early in its growth curve.

PROCEPT BioRobotics: a focused bet on urologic procedures

One candidate that fits the profile of an early‑stage compounder is PROCEPT BioRobotics, which has built its business around robotic treatment of benign prostatic hyperplasia and related urologic conditions. Rather than trying to be all things to all surgeons, PROCEPT has concentrated on a specific, high‑volume problem that affects aging men worldwide and often leads to invasive surgery or chronic medication. That focus gives it a clear clinical story and a defined sales target inside hospitals, which is exactly what a smaller player needs when competing with giants.

Recent analysis aimed at “Investors” seeking opportunities in the healthcare sector highlights PROCEPT “Cor” as offering a promising 48 percent upside based on its current valuation and growth prospects, with particular emphasis on its long‑term potential. I see that as a sign that the market is still pricing PROCEPT as a niche device maker rather than a future platform company. If its technology becomes the standard of care for a large slice of urologic procedures, the combination of procedure growth, recurring disposables, and international expansion could support the kind of compounding that turns a patient investor’s stake into a seven‑figure holding over time.

Globus Medical and the rise of robotic spine and orthopedics

Another contender in the robotic surgery race is Globus Medical, which has carved out a strong position in spine and orthopedic procedures. Its strategy blends implants, navigation, and robotic systems, giving surgeons an integrated toolkit for complex spine work and joint reconstruction. That integration matters because it ties the robot to a broader ecosystem of hardware and software, which can deepen customer loyalty and support premium pricing.

Coverage of Globus Medical notes that the company does not offer dividends, with a payout ratio of 0.00%, which may appeal to investors who prefer management to reinvest every dollar of profit back into growth. The same analysis points to a 29 percent potential upside tied to robust revenue expansion, particularly in its robotic and navigation portfolio. For a long‑term investor, that reinvestment mindset is critical: a company that forgoes near‑term cash returns in favor of building out its platform, training programs, and installed base is exactly the kind of business that can quietly compound into a very large position over a couple of decades.

How the competitive field is shaping up across specialties

Robotic surgery is no longer a one‑company show, and that is good news for investors looking for the next breakout. Across specialties, a growing roster of companies is building systems tailored to specific procedures, from soft‑tissue general surgery to orthopedics and neurosurgery. This specialization creates room for multiple winners, each dominating its own niche while still benefiting from the overall shift toward robotic assistance.

A survey of the “Top” 8 surgical robotic players lists each “Company”, its primary “System”, and its “Surgical Focus”, underscoring how diverse the field has become, from multi‑port abdominal platforms to single‑port systems and orthopedic robots focused on knee and hip replacements. That overview, available through Top 8 surgical robotics companies in 2025, shows that the market is big enough to support leaders in urology, spine, general surgery, and orthopedics simultaneously. For a patient investor, that diversity is an advantage: it allows me to target a stock whose technology, clinical data, and business model line up with a specific, durable procedure category rather than betting on a crowded generalist field.

Why long time horizons matter more than perfect timing

Even the best robotic surgery stock will not move in a straight line. Hospital capital budgets are cyclical, reimbursement rules evolve, and new competitors can pressure pricing. That is why the most compelling opportunities in this space are framed around decade‑plus holding periods, not short‑term trades. If I am aiming for a $1 million outcome, the key variable I can control is my time horizon, not the exact entry point.

Guidance aimed at beginners with very long time frames emphasizes that “Key Points These” healthcare leaders are both very profitable and positioned to benefit from structural trends for decades, which is why they are recommended for a 40‑year time horizon alongside leaders in the surgical robotics market. That same logic applies to emerging names like PROCEPT and Globus Medical. If I believe a company can keep compounding procedure volume, expanding its installed base, and defending its margins for twenty or thirty years, then short‑term volatility becomes noise rather than a thesis breaker.

Position sizing, diversification, and the path to seven figures

Finally, the path to a $1 million payoff in robotic surgery is not just about picking the right stock, it is about how I build and manage the position. Starting with a small allocation and adding over time as the thesis proves out can reduce risk while still leaving room for a very large eventual stake. For example, an investor who begins with $2,000 and steadily increases exposure as conviction grows can end up with a meaningful position without overcommitting early on.

Lists of “Have” $2,000 “Top Robotics Stocks” to “Buy and Hold for” at “Least” a “Decade” illustrate how modest initial sums can be deployed into high‑conviction names and then left to work. That approach, highlighted in Have $2,000? style frameworks, dovetails with the growth trajectory of surgical robotics and medical robots more broadly, which are projected by Sept forecasts to reach a massive USD 38,701.5 million by 2034. In that environment, a disciplined, long‑term allocation to a high‑quality robotic surgery stock, particularly one with a focused clinical niche and strong reinvestment culture, has a credible shot at compounding into a seven‑figure holding for investors who are truly patient.

More from MorningOverview