On October 7, 2025, a detailed examination revealed that the entire global economy now critically depends on the AI industry avoiding major missteps, as unchecked hype and investment have created vulnerabilities akin to a massive bubble. This perspective underscores how AI’s rapid integration into finance, manufacturing, and services has made systemic failure in the sector a potential trigger for recession or worse. Key figures in tech and economics warn that without careful navigation, the fallout could dwarf past tech crashes. [source]

The Explosive Growth of AI Investments

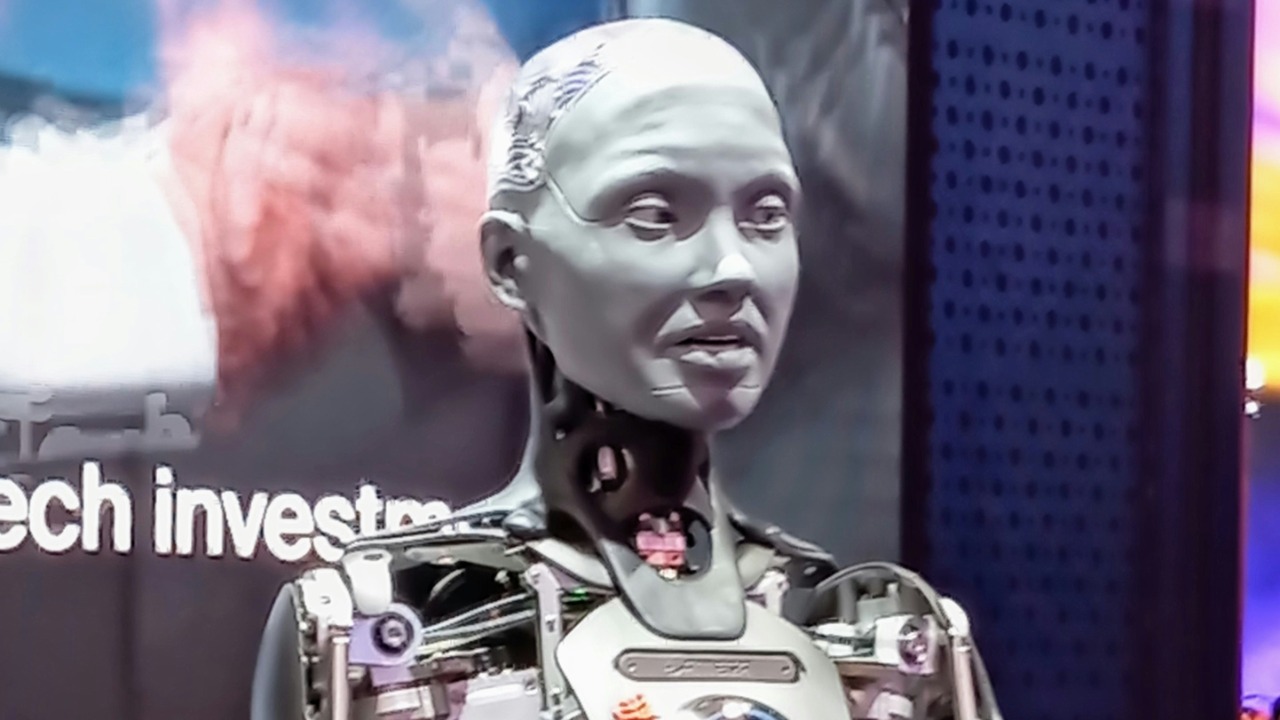

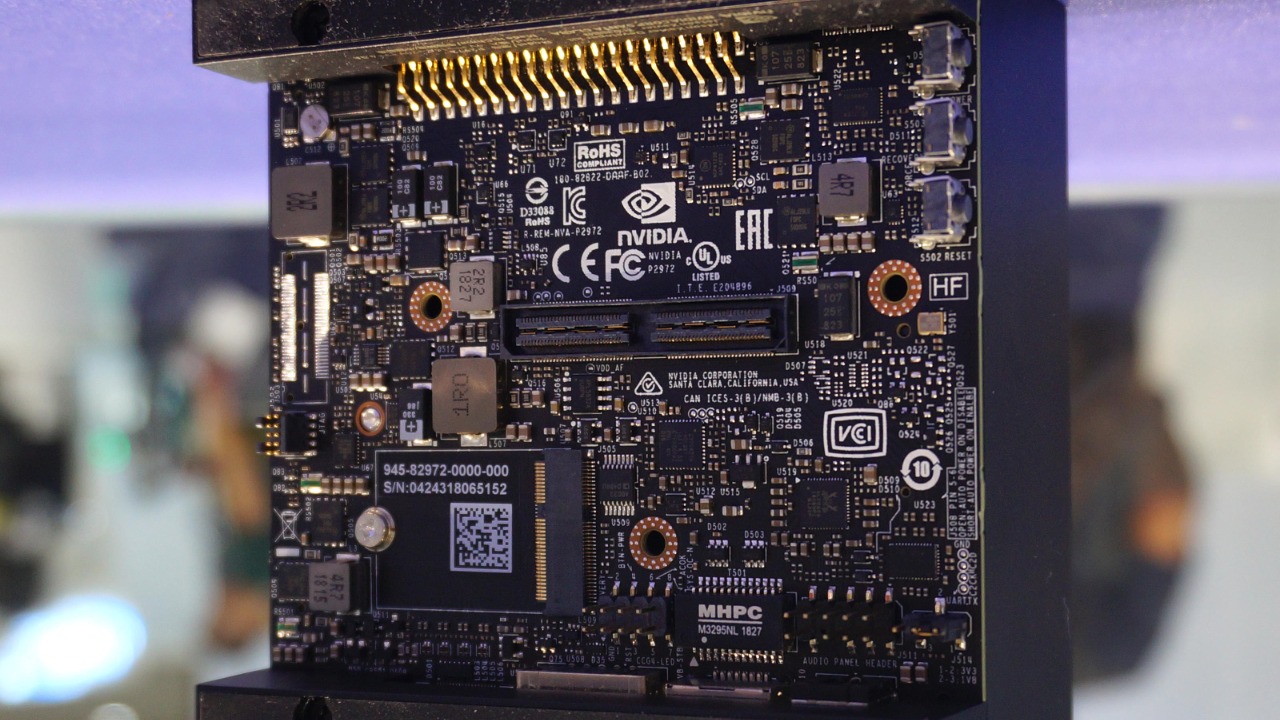

The surge in venture capital flowing into AI startups has been nothing short of explosive. Since 2023, funding rounds and valuations have ballooned, positioning AI as the dominant economic driver. This influx of capital has seen major corporations like NVIDIA and OpenAI experience skyrocketing stock prices and market caps. AI-related equities now comprise over 20% of total market value, reflecting the sector’s significant influence on broader market indices. [source]

Government incentives have further fueled this growth. The U.S. CHIPS Act, for instance, has funneled billions into AI infrastructure, creating jobs in tech hubs like Silicon Valley and Austin. These subsidies have not only bolstered AI development but have also cemented its role as a cornerstone of the modern economy. [source]

AI’s Deep Integration into Core Economic Sectors

AI’s integration into manufacturing has revolutionized supply chains, with companies like Tesla relying heavily on AI for production efficiency. This dependency means that any disruption in AI technology poses a direct threat to GDP. In financial services, firms such as JPMorgan have invested over $10 billion in AI for algorithmic trading and fraud detection, exposing banks to AI-specific risks like model failures. [source]

The healthcare and retail sectors have also embraced AI, using it for diagnostics and personalization to boost productivity. However, this reliance creates single points of failure, making these industries vulnerable if AI development stalls. The potential for widespread disruption underscores the critical need for robust and reliable AI systems. [source]

In the automotive industry, AI is not only enhancing production lines but also driving innovation in autonomous vehicles. Companies like Waymo and Uber are investing heavily in AI to develop self-driving technologies, which promise to revolutionize transportation and logistics. This shift is expected to reduce costs and increase efficiency, but it also raises concerns about job displacement and regulatory hurdles. The reliance on AI for such critical functions underscores the need for robust systems that can withstand technological and market fluctuations. [source]

Moreover, AI’s role in agriculture is transforming how food is produced and distributed. Precision agriculture, powered by AI, allows for more efficient use of resources, optimizing yields and reducing waste. This technological integration is crucial for meeting the demands of a growing global population. However, it also highlights the sector’s vulnerability to AI-related disruptions, which could have far-reaching impacts on food security and supply chains. [source]

Risks of an AI Bubble Bursting

Historical parallels to the dot-com bubble highlight the risks of AI’s current overvaluation. Projections of $1 trillion in annual spending by 2030 mirror the unsustainable growth patterns seen in 2000. Regulatory challenges, such as the EU AI Act enforcement starting in 2025, could impose compliance costs that strain smaller AI firms, potentially leading to market consolidation. [source]

Additionally, talent shortages and ethical concerns, like bias in AI systems, have been cited by experts at conferences such as NeurIPS 2024. These issues could erode investor confidence, further exacerbating the risks of an AI bubble bursting. The industry must address these challenges to maintain its trajectory and avoid catastrophic consequences. [source]

The potential for an AI bubble burst is further compounded by the rapid pace of technological advancement, which can outstrip regulatory frameworks and ethical guidelines. As AI systems become more complex, the risk of unforeseen consequences increases, potentially leading to significant financial and operational disruptions. The lack of standardized protocols for AI deployment and monitoring exacerbates these risks, making it difficult for companies to ensure compliance and maintain investor confidence. [source]

Furthermore, the concentration of AI expertise and resources in a few major tech hubs creates an uneven playing field, where smaller firms struggle to compete. This disparity can lead to monopolistic practices and stifle innovation, as larger companies dominate the market. The resulting lack of diversity in AI development could hinder the industry’s ability to adapt to changing market conditions and consumer needs, increasing the likelihood of a bubble burst. [source]

Strategies for the AI Industry to Avoid Catastrophe

To mitigate over-reliance on unproven technologies, companies like Google are exploring diversification efforts, such as hybrid AI-human workflows. International collaborations are also crucial, especially amid U.S.-China tensions over AI chips that could fragment global supply chains. Frameworks like the G7 AI pact offer potential solutions to these geopolitical challenges. [source]

Sustainable scaling models are essential for the AI industry’s long-term viability. With AI data centers consuming power equivalent to small countries, green AI initiatives are being proposed to address energy demands. These strategies aim to ensure that AI continues to drive economic growth without succumbing to the pitfalls of overvaluation and systemic risk. [source]

One approach to mitigating the risks of an AI bubble is the implementation of robust regulatory frameworks that promote transparency and accountability. By establishing clear guidelines for AI development and deployment, governments can help ensure that companies adhere to ethical standards and minimize the potential for misuse. This regulatory oversight can also foster consumer trust, which is essential for the sustained growth of the AI industry. [source]

Additionally, fostering a culture of continuous learning and adaptation within the AI workforce is crucial. As AI technologies evolve, so too must the skills and knowledge of those who develop and manage them. By investing in education and training programs, companies can equip their employees with the tools needed to navigate the complexities of AI, ensuring that the industry remains resilient in the face of technological and economic challenges. [source]