The race for dominance in the U.S. robotaxi market is heating up, with Tesla and Waymo, a subsidiary of Alphabet, as the main contenders. Tesla’s Cybercab, unveiled in 2024, promises unsupervised Full Self-Driving (FSD) deployment in Texas and California starting in 2025, with production slated for before 2027. On the other hand, Waymo has already logged over 20 million autonomous miles and provided more than 4 million paid rides across Phoenix, San Francisco, and Los Angeles, operating a fleet of over 700 vehicles. The stakes are high as both companies aim to leverage their unique strengths in a market projected to reach trillions in value.

Tesla’s Vision-Only Technology Edge

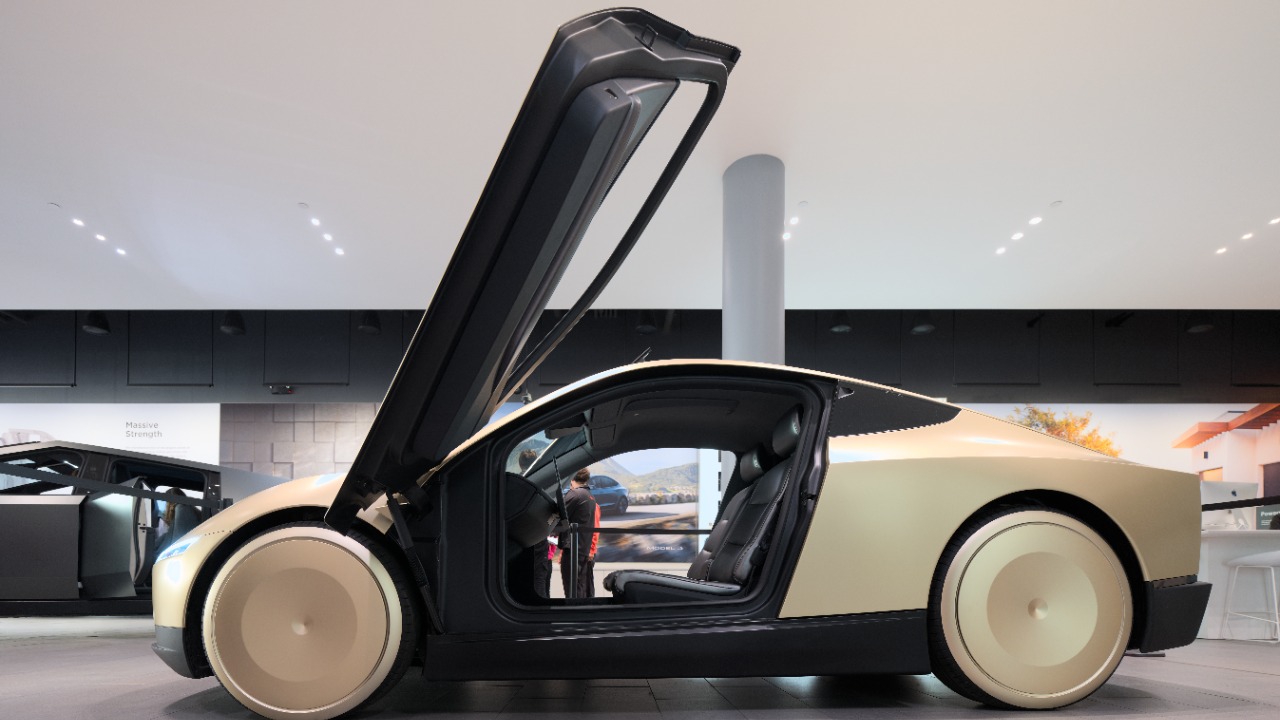

Tesla’s approach to autonomous driving is unique, relying on camera-based Full Self-Driving (FSD) software. This technology has been trained on data from over 6 billion miles driven by Tesla’s customer fleet, enabling scalable deployment without the need for expensive sensors like lidar1. Elon Musk, Tesla’s CEO, has positioned the Cybercab as a cost-effective, two-seat vehicle designed for high-volume production, claiming that Tesla’s approach avoids the “crutches” of radar and lidar2.

Tesla plans to roll out its unsupervised FSD in Austin, Texas, and California cities in 2025, using existing Model 3 and Model Y vehicles initially before the Cybercab launch3. This ambitious plan, if successful, could give Tesla a significant edge in the robotaxi market.

Waymo’s Lidar-Driven Deployment Success

Waymo, on the other hand, uses a multi-sensor suite including lidar, radar, and cameras for its autonomous vehicles. This approach has enabled commercial operations since 2020 in Phoenix, Arizona, with expansions to San Francisco and Los Angeles4. By mid-2024, Waymo had achieved over 20 million autonomous miles and 4 million paid rides, operating a fleet of 700+ Jaguar I-Pace vehicles under strict geofenced conditions5.

Waymo’s safety record is impressive, with incidents per million miles lower than human drivers, as reported in NHTSA data. This has supported its lead in regulatory approvals from the California DMV6. The company’s focus on safety and regulatory compliance has been a key factor in its early success in the robotaxi market.

Regulatory Hurdles and Safety Comparisons

While Tesla’s vision-based approach is innovative, it has faced challenges with regulatory bodies. NHTSA investigations into FSD crashes, including a 2023 incident in Arizona involving a pedestrian, have delayed full unsupervised approval7. In contrast, Waymo has proactively engaged with regulators, securing permits for driverless operations in multiple states since 2018, although these are limited to specific urban zones8.

The broader U.S. regulatory landscape also poses challenges for both companies. For instance, California’s AB 2286 bill requires remote operators for robotaxis, which could impact both companies’ expansion timelines9. Navigating these regulatory hurdles will be crucial for both Tesla and Waymo as they seek to expand their robotaxi operations.

Market Expansion Strategies

Tesla has an aggressive scaling plan, aiming for 2-4 million Cybercabs by 2027 through over-the-air updates on its 5 million+ vehicle fleet. The company is also targeting global markets beyond the U.S10. In contrast, Waymo’s growth has been more measured. The company has partnered with Uber for rides in Atlanta starting in 2024 and is planning to enter Austin, Texas, in 2025, while focusing on U.S. urban corridors11.

When it comes to fleet economics, Tesla’s projected operating cost is $0.20 per mile, significantly lower than Waymo’s current $0.60-1.00 per mile. This difference is influenced by the companies’ respective vehicle ownership models12. These contrasting strategies reflect the companies’ different approaches to capturing market share in the robotaxi industry.

Financial Stakes and Investor Perspectives

Alphabet’s investment in Waymo has exceeded $5 billion since 2009, yielding a current valuation of $30-45 billion amid profitable ride-hailing in select markets13. On the other hand, analysts estimate Tesla’s robotaxi market could reach $1 trillion by 2030. However, Tesla’s stock has seen volatility post-Cybercab reveal due to execution risks14.

Investor sentiment towards Tesla has been mixed, with Seeking Alpha issuing a “downgrade to sell” rating on Tesla, citing overvaluation at 100x earnings and delays in robotaxi timelines compared to Waymo’s operational lead15. These financial stakes and investor perspectives underscore the high-risk, high-reward nature of the robotaxi market.

Expert Views on the Long-Term Race

Brad Templeton, writing for Forbes, emphasizes Waymo’s “deep story” of incremental scaling since 2009 versus Tesla’s bold but unproven vision-only bet16. Impakter.com projects a “trillion-dollar battle,” where Waymo’s first-mover advantage in data and partnerships could outpace Tesla unless FSD achieves Level 4 autonomy swiftly17.

WION predicts near-term wins for Waymo in regulated cities, while Tesla could disrupt the market with affordability in 2026-202718. These expert views highlight the complexity of the robotaxi race, with both companies having distinct strengths and challenges. The ultimate winner will likely be the one that can best navigate the regulatory landscape, deliver on safety, and scale effectively.