Stellantis, the multinational automaker, has announced a $13 billion investment plan aimed at expanding its U.S. manufacturing capabilities. Interestingly, the plan seems to deprioritize electric vehicles (EVs), focusing instead on the production of internal combustion engine (ICE) and hybrid models. This strategic shift appears to be a response to current market trends and a slowdown in EV adoption.

Stellantis’ Overall Investment Strategy

The $13 billion investment plan is set to bolster Stellantis’ U.S. operations, with funds allocated for modernizing plants and creating thousands of jobs across multiple states. Immediate infrastructure upgrades at facilities in Michigan and Indiana are part of the multi-year timeline for these investments, aimed at enhancing overall production efficiency. source

Stellantis CEO Carlos Tavares has stated that the company’s investments are aligned with a “realistic market evolution” rather than aggressive EV targets. This approach reflects a pragmatic understanding of the current automotive market and its future trajectory. source

De-emphasis on Electric Vehicles

Within the $13 billion plan, EV-specific funding accounts for less than 20% of the total investment. This indicates a significant shift in resources away from battery production expansions. Furthermore, Stellantis has decided to pause the launch of new EV models in the U.S. for the next two years, citing insufficient consumer demand and infrastructure challenges. source

Industry analysts have described this as a “pragmatic pivot” from Stellantis’ previous Dare Forward 2030 EV goals. This shift in strategy suggests a more cautious approach to EV adoption, aligning with current market realities rather than ambitious forecasts. source

Expansion of ICE and Hybrid Production

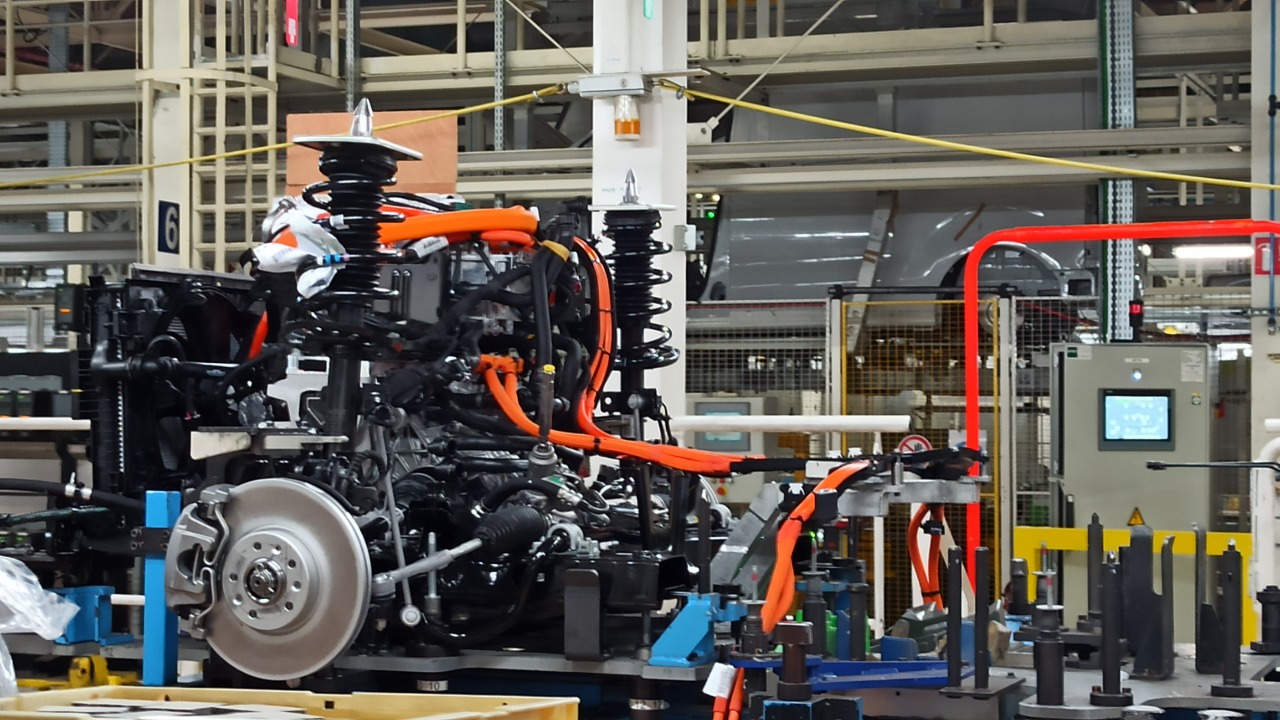

Stellantis’ investment plan includes a significant focus on ICE engine manufacturing. For instance, $5 billion has been earmarked for upgrading assembly lines at the Belvidere, Illinois plant to produce hybrid variants of Jeep and Ram models. source

The company is also investing in hybrid technology development, with specific funding allocated for powertrain integrations at the Auburn Hills, Michigan headquarters. This investment will support the production of targeted models, such as the next-generation Dodge Hornet hybrid, which is expected to roll out from U.S. facilities by 2026. source

U.S. Manufacturing Footprint Enhancements

The investment plan includes site-specific investments, such as $3.2 billion for the Toledo, Ohio assembly plant to increase output of profitable truck lines. This expansion will not only enhance Stellantis’ manufacturing capabilities but also contribute to local economies. source

Stellantis has also committed to retaining 20,000 existing U.S. jobs and creating 1,500 new ones through automation and training programs. Additionally, the company plans to partner with local suppliers in the Midwest to support the expanded operations, ensuring supply chain resilience. source

Market and Competitive Context

Stellantis’ investment strategy reflects the slowing growth of U.S. EV sales. The company cites a 15% drop in EV market share for automakers in 2024 as a key factor in the plan’s direction. This trend is not unique to Stellantis, as rivals like Ford and GM have also scaled back their EV ambitions. source

Regulatory influences, such as potential changes to federal EV incentives under new administrations, are also impacting investment priorities. With its $13 billion plan, Stellantis is positioning itself to capture more ICE/hybrid demand in the evolving automotive market. source

Long-Term Implications for Stellantis

The $13 billion plan supports Stellantis’ goal of achieving a 30% U.S. market share in profitable segments by 2028, with a focus on hybrid transitions over full electrification. However, this strategy is not without risks. Environmental groups have criticized the company’s reduced focus on EVs, to which Stellantis has responded by pledging gradual adoption of green technologies. source

Financially, the company expects significant gains from the expanded capacity. Projections indicate $10 billion in annual U.S. revenue gains starting in 2027, suggesting a promising return on the company’s substantial investment. source