SpaceX closed out 2025 with a blistering launch tempo that pushed orbital rocketry into territory that once sounded like science fiction. The company’s manifest ultimately climbed past 165 orbital flights, cementing a new global benchmark for how often a single operator can reach space in a year. That cadence is no longer a one-off stunt but the backbone of a business model that is reshaping everything from broadband access to national security launches.

From 165 to 167: a moving target in a record year

By late December, internal tallies and industry trackers converged on a milestone that would have been unthinkable a decade ago: SpaceX had notched at least 165 orbital missions for the year, with more launches still queued up on the range. As the final week unfolded, that figure was overtaken by fresh liftoffs, and reporting now pegs the company’s total at 167 orbital launches, a number that folds the earlier 165 benchmark into an even more aggressive finish. I see that progression less as a correction than as a snapshot of how quickly the launch count was evolving in real time.

That final tally of 167 m is not just a bragging right, it is a structural shift in what the industry considers normal. Each additional flight represents hardware that had to be turned around, payloads that had to be integrated, and regulatory approvals that had to be secured on a drumbeat that used to span months, not days. When I look at that curve, the story is not only that SpaceX shattered its own record again, but that the company has normalized a launch rate that forces every competitor and customer to recalibrate their expectations for 2026 and beyond.

Starlink as the engine behind the numbers

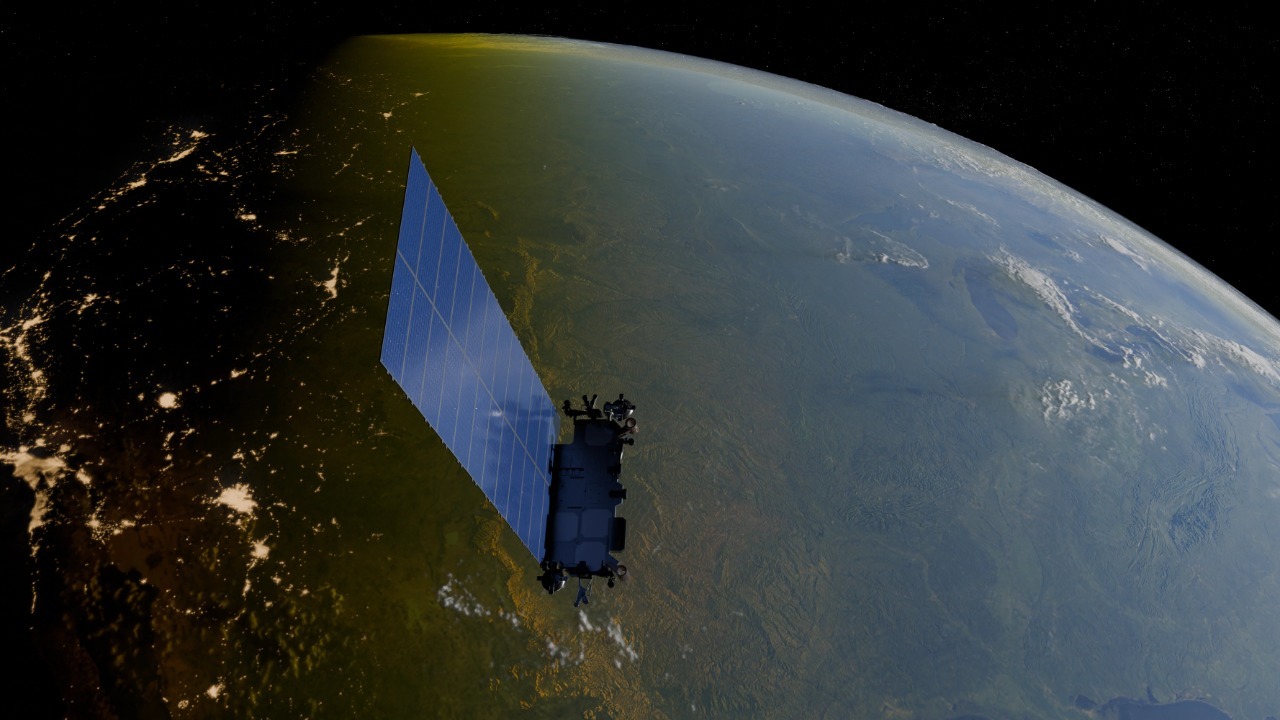

The raw launch count only makes sense when you follow the payloads, and here the pattern is unmistakable: Starlink is the engine driving most of this activity. Reporting shows that Speaking of Starlink missions, They dominated the manifest, accounting for 123 of the 167 Falcon 9 launches. That means a clear majority of the company’s orbital flights were effectively in-house work, lofting its own broadband satellites rather than third party payloads.

Together, those missions lofted more than 3,000 satellites for the Starlink megaconstellation, which currently consists of thousands of spacecraft in low Earth orbit. A parallel account notes that Together those Starlink flights have turned the network into a central pillar of the company’s revenue and strategy. When I weigh those figures, it is clear that the record launch cadence is less about chasing trophies and more about feeding a vertically integrated communications business that depends on constant replenishment and expansion of the constellation.

Reliability, reusability and a maturing Falcon fleet

High cadence only matters if the rockets keep working, and here the numbers are almost as striking as the launch count itself. Across the year’s orbital flights, Falcon boosters delivered payloads successfully on all but a tiny handful of occasions, with one detailed tally noting that missions succeeded on all but three attempts. That performance is reflected in coverage that describes how the company managed Share of global orbital traffic while maintaining a remarkably low failure rate.

Underneath that reliability is a reusability regime that has turned Falcon 9 and Falcon Heavy into something closer to a commercial air fleet than a traditional expendable rocket line. Boosters are landing, being inspected, and flying again on a rhythm that would have sounded reckless in the early 2010s but now feels routine. I read the record year as proof that the refurbishment pipeline, from droneship recoveries to hangar operations, has matured into a stable industrial process rather than a series of experimental stunts. That maturity is what allows the company to stack up more than 165 orbital missions without a corresponding spike in cost or risk.

Launch pad choreography and the NROL-77 benchmark

Behind every launch statistic is a physical pad that has to be cleared, reset, and readied for the next rocket, and in 2025 SpaceX quietly broke records here too. One Falcon 9 liftoff carrying a batch of Starlink satellites from Cape Canaveral set a new pad turnaround mark for the company, lifting off just two days after the classified NROL-77 m mission. That kind of tempo means ground crews are treating launch sites less like bespoke facilities and more like high throughput infrastructure, with standardized procedures that can be executed in hours instead of weeks.

The NROL-77 flight itself underscored how tightly SpaceX has woven its operations into the fabric of United States national security space. A live broadcast of the mission highlighted how the company and its government partners thanked the Range and FAA for their support, a reminder that such rapid turnarounds depend on regulators and range operators as much as on engineers and technicians. When I look at that cooperation, I see a quiet but important shift: the public infrastructure that once supported a handful of government launches per year is now flexing to accommodate a quasi-commercial airline schedule to orbit.

Starship’s parallel story and the road to 172

While Falcon 9 and Falcon Heavy carried the bulk of the 2025 workload, Starship was writing its own chapter in the background. A year that saw multiple Starship test flights, including unalloyed successes between June and October, signaled that the super heavy lift system is edging closer to operational status. In a broader look at the year’s milestones, analysts noted that if Starship flights are counted alongside Falcon missions, that number should reach 172, a figure that hints at how quickly total launch activity could grow once the new vehicle is fully online.

Starship’s progress is not just a technical subplot, it is a strategic hedge against the limits of Falcon’s architecture. As the Starlink constellation grows and payload ambitions expand to include deep space missions and potential crewed flights beyond low Earth orbit, the economics of stacking thousands more satellites or massive spacecraft on Falcon 9 start to look strained. I read the 165-plus orbital launches of 2025 as both a triumph and a warning: Falcon can carry the load for now, but the company is clearly preparing Starship to take over the heaviest and most demanding missions so that the overall cadence can keep climbing without hitting a wall on payload capacity.

Commercial, civil and military customers in a crowded manifest

Even with Starlink dominating the manifest, the record year was not a purely internal affair. The same pads and boosters that lofted thousands of broadband satellites also carried weather spacecraft, scientific payloads, and classified cargo for agencies that once relied exclusively on bespoke government launchers. The NROL-77 mission for the U.S. National Reconnaissance Office is one example, but it sits alongside a broader pattern of civil and commercial customers booking rides on a schedule that is increasingly constrained by Starlink’s needs rather than the other way around.

That tension is visible in how the manifest is structured. High priority government missions are slotted into windows that must coexist with a relentless stream of internal flights, while commercial operators weigh the benefits of lower prices and frequent opportunities against the reality that they are sharing capacity with the company’s own constellation. From my vantage point, the fact that SpaceX still managed more than 165 orbital launches while accommodating this mix of customers suggests that its scheduling and integration teams have become as critical to the business as its propulsion engineers. The challenge for 2026 will be to keep that balance as demand from all three sectors continues to grow.

Public visibility and the normalization of rocket launches

One of the more subtle shifts in 2025 was cultural rather than technical: orbital launches are starting to feel ordinary to people who live near the coasts and even to those watching from hundreds of kilometers away. Residents along North Carolina’s barrier islands, for example, were treated to a Sunday Falcon 9 ascent that was visible throughout the Outer Banks, with local outlets pointing readers to More information on upcoming and past launches. When a rocket trail becomes a regular part of the weekend sky, it changes how communities think about spaceflight.

That normalization is reinforced by how easy it has become to track the company’s activity. Anyone with a browser can pull up a running list of missions, payloads, and launch windows on the official launches page, turning what used to be insider knowledge into a public calendar. I see this transparency as a quiet but powerful force: it demystifies orbital access, invites local tourism around launch events, and builds a constituency that notices when the cadence speeds up or slows down. In a year when SpaceX crossed the 165 launch threshold, that kind of public engagement helps anchor the abstract numbers in lived experience.

What a 165-plus launch year means for 2026 and beyond

Crossing the 165 launch mark in 2025 sets a high bar for what comes next, and the company’s own rhetoric suggests it has no intention of easing off the throttle. Coverage of the year’s performance frames the 167 total as a new global high and notes that internal planning is already eyeing even more orbital flights in 2026. When I connect that ambition with the projection that combined Falcon and Starship activity could reach that number of 172, the trajectory is clear: the company is treating 2025 not as a peak but as a baseline.

The implications ripple far beyond one firm’s balance sheet. A world in which a single operator can reliably conduct more than 165 orbital launches in a year is a world where satellite constellations can be refreshed rapidly, responsive launch for defense becomes practical, and new entrants can hitch rides to orbit on a schedule that looks more like commercial aviation than bespoke space missions. At the same time, the environmental, regulatory, and orbital debris challenges of such a cadence are only beginning to be understood. As I look ahead, the record shattering year of 2025 feels less like the culmination of a trend and more like the opening chapter of a new era in which access to space is abundant, contested, and central to everyday life on Earth.

More from MorningOverview