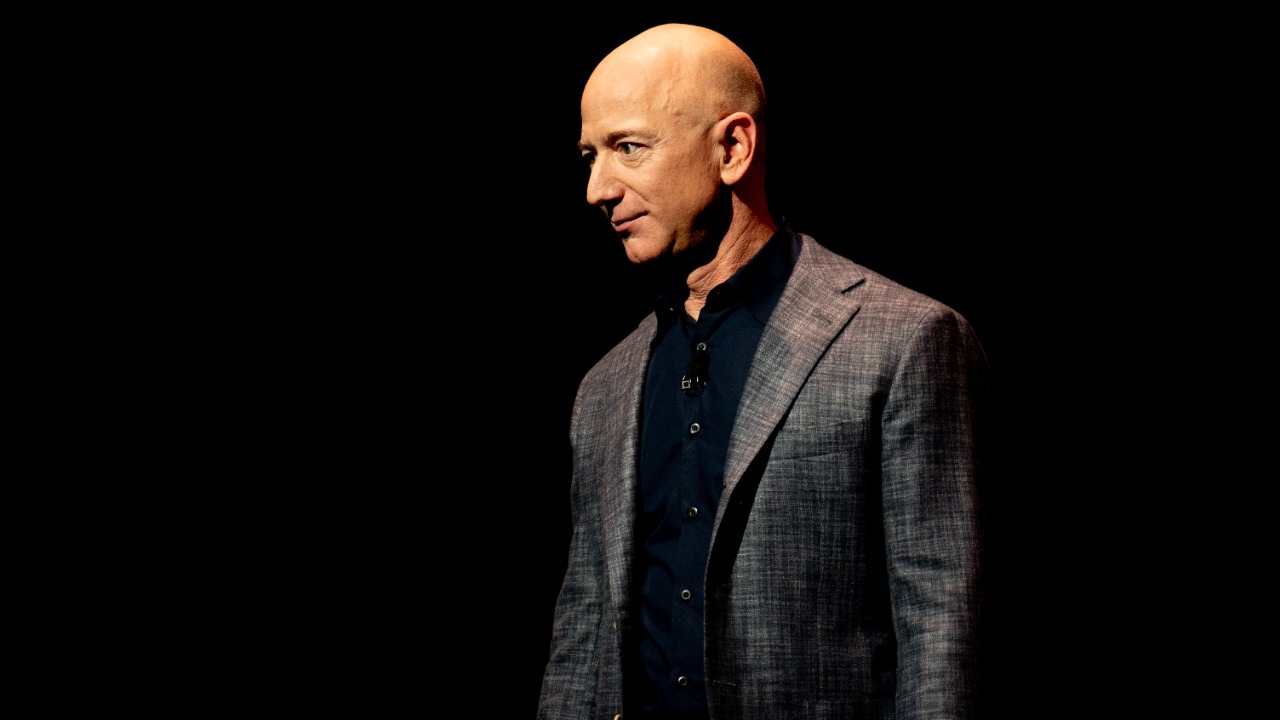

Jeff Bezos is stepping back into the operational spotlight, launching a new artificial intelligence company and reclaiming the chief executive title he relinquished at Amazon. After several years as executive chairman and high-profile investor, he is now positioning himself at the center of the AI race, not as a distant backer but as the person running the business day to day. His return to a CEO role signals that the next phase of his career will be defined less by space tourism or philanthropy and more by a direct bid to shape the infrastructure of the AI economy.

The move also resets expectations for how aggressively he intends to compete with both Big Tech incumbents and the new generation of AI startups. Rather than simply funding others, Bezos is building a company that aims to set the pace in advanced computing and manufacturing for AI systems, with multibillion‑dollar capital behind it and a leadership structure that puts his name back on the org chart. For the tech industry, this is not just a familiar founder returning to form, it is a signal that the AI boom has reached a stage where even the most accomplished executives feel compelled to get personally involved.

Bezos’ first hands-on role since Amazon

I see Bezos’ decision to become a chief executive again as a clear break from the more hands-off posture he adopted after leaving Amazon’s top job. Reporting across several outlets describes him taking on a formal CEO or co‑CEO title at a newly created AI-focused company, marking his first operational role since he handed Amazon’s reins to Andy Jassy. One detailed account notes that with the launch of this new venture, Bezos will “become a CEO again,” underscoring that he is not content to remain a passive boardroom presence while others define the next wave of computing, a shift that is captured in coverage of his new company.

Other reports frame the move as a deliberate return to the kind of day‑to‑day leadership he once exercised in Amazon’s early years, but now applied to a sector where AI models, data centers, and specialized hardware are the core products. Several stories emphasize that this is his “first operational role since Amazon,” describing him as a co‑leader of an AI startup rather than a distant investor, and noting that he is expected to share the top job with another seasoned executive. That framing appears in coverage of his decision to co‑lead an AI startup, which highlights how unusual it is for a founder of his stature to step back into the trenches after building one of the world’s largest companies.

A multibillion-dollar AI bet

The scale of Bezos’ new venture immediately sets it apart from the typical startup narrative. Instead of bootstrapping or raising a modest seed round, he is anchoring a multibillion‑dollar capital commitment that effectively treats the company as a fully funded infrastructure project from day one. One report describes the initiative as a “6.7 billion” venture, indicating that the funding envelope rivals what many public tech companies would deploy over several years, and positioning the firm as a heavyweight competitor in AI infrastructure rather than a speculative experiment, a point underscored in coverage of his 6.7 billion venture.

Other accounts reference a “6.2b AI manufacturing startup,” suggesting that the capital is not just earmarked for software research but for large‑scale facilities, specialized equipment, and the kind of supply chain commitments that usually belong to semiconductor or advanced manufacturing giants. That figure appears in reporting on his role as co‑chief executive of a 6.2b AI manufacturing startup, which portrays the company as a serious industrial player from the outset. Taken together, the numbers point to a strategy that treats AI not as a narrow software play but as a capital‑intensive platform that spans chips, data centers, and production lines.

Why AI manufacturing is the focus

Bezos’ choice to focus on AI manufacturing rather than a consumer app or a pure software model reflects a strategic reading of where the bottlenecks in the AI economy actually lie. Training and deploying large models requires enormous compute capacity, specialized chips, and highly optimized hardware, and the most acute constraints today are in fabrication, packaging, and the physical infrastructure that keeps data centers running. By building a company that explicitly targets AI manufacturing, he is aiming at the layer of the stack where demand is exploding and supply is hardest to scale, a direction that is consistent with reports describing the startup as an AI manufacturing specialist with billions in committed capital.

Several stories highlight that the new company is designed to produce or support the hardware and industrial processes that underpin advanced AI systems, rather than competing directly with existing model labs on chatbots or consumer‑facing tools. Coverage of his return as CEO for a new AI startup emphasizes that the venture is oriented around the infrastructure side of AI, while other reporting on his co‑CEO role at a manufacturing‑focused firm reinforces that the business model is built on large‑scale production and supply chain execution. That focus plays to his strengths from Amazon, where logistics, fulfillment centers, and custom hardware became core competitive advantages.

How this reshapes Bezos’ post-Amazon identity

For several years after stepping down as Amazon’s chief executive, Bezos’ public identity was defined by a mix of space exploration, philanthropy, and high‑profile investments. He was the founder who had moved on to the next chapter, leaving the day‑to‑day grind to his successor while he focused on Blue Origin, climate initiatives, and personal projects. The decision to take on a CEO title again, particularly in a sector as demanding as AI infrastructure, effectively rewrites that narrative and signals that he still sees himself as an operator, not just a benefactor or elder statesman of tech, a shift that is echoed in profiles that revisit his trajectory as Amazon founder Jeff Bezos.

This new role also complicates how other tech leaders will relate to him. Instead of being a neutral investor or board member, he is now a direct competitor in the scramble for AI talent, chip supply, and cloud contracts. That dynamic is particularly striking given that Amazon Web Services is itself a major AI infrastructure provider, which means his new company will inevitably be compared with, and potentially compete against, the cloud business he helped build. The reporting that frames his return to a CEO role with an AI startup, including coverage in the tech and AI press, underscores how this move blurs the line between his legacy as Amazon’s founder and his ambitions in the next wave of computing.

A new kind of rivalry in the AI boom

Bezos’ reentry into the CEO ranks lands in the middle of an intense AI arms race, where Big Tech companies and well‑funded startups are competing for the same scarce resources. His new venture is not just another participant, it is a signal to other billionaires and corporate leaders that the AI infrastructure layer is now a strategic battleground worthy of direct personal involvement. One analysis notes that he has become the latest high‑profile figure to jump into AI leadership, describing him as part of a broader wave of “copycat” moves in which established moguls launch their own AI platforms rather than relying solely on partnerships, a trend captured in coverage of how Jeff Bezos becomes the latest to take this path.

That competitive context matters because it shapes how regulators, suppliers, and customers will view the new company. When a founder with Bezos’ track record commits more than 6 billion dollars to AI manufacturing, chipmakers, equipment vendors, and cloud buyers are likely to treat the venture as a long‑term player rather than a speculative bet. At the same time, his presence raises the stakes for other AI infrastructure startups that lack his capital base or brand recognition, potentially accelerating consolidation as smaller firms seek alliances to keep up. The reporting that situates his move within a broader pattern of AI investments by tech titans underscores that this is not an isolated story but part of a structural shift in how power is aligning around AI infrastructure.

Global implications and where the company fits

The international reaction to Bezos’ new role highlights how central AI infrastructure has become to national industrial strategies. Coverage from Asia, for example, places his venture in the context of global competition over advanced manufacturing and semiconductor capacity, noting that governments and corporations across the region are watching how Western tech leaders allocate capital in AI‑related factories and supply chains. One report from a major Korean outlet frames his move as part of a broader race to secure leadership in AI hardware and data center build‑outs, reflecting how closely foreign observers track the decisions of figures like Bezos, as seen in analysis of his impact on industry and AI competition.

At the same time, coverage from India and other emerging markets emphasizes that Bezos’ new CEO role is not tied to Amazon itself, but to a separate AI company that could still intersect with global cloud and e‑commerce ecosystems. One widely cited report stresses that his new chief executive job “is not with Amazon,” underscoring that this is a distinct corporate entity even if it draws on his experience and relationships from the e‑commerce giant, a point made explicit in stories explaining that he is taking up a new CEO job outside Amazon. That separation gives him flexibility to partner across cloud providers and hardware vendors, while still leveraging his reputation as one of the most effective operators in modern business.

More from MorningOverview