Quantum computing has moved from physics labs into boardroom slide decks, promising to crack problems that leave even the largest AI models and supercomputers gasping. Yet for all the talk of a coming revolution, the technology still sits in a fragile, experimental phase that looks nothing like the mass-market boom that turned AI into a household term. The real question now is whether quantum becomes the next transformative platform after AI, or whether the current excitement races far ahead of what the hardware and economics can deliver.

From national strategies to speculative stocks, money and attention are pouring into Quantum, even as the field remains fragmented and technically daunting. I see a landscape where genuine breakthroughs coexist with overconfident timelines, where some investors expect “the next Nvidia” while researchers quietly stress how far there is to go. Sorting signal from noise is the only way to tell whether quantum is poised to reshape computing or simply replay another hype cycle.

Quantum’s moment: big promises, messy reality

Quantum computing is having a moment, but not quite the one early evangelists imagined. Instead of a single dominant platform, the ecosystem is split across competing hardware approaches, from superconducting circuits to trapped ions, each with its own complexity and ambition. One detailed assessment describes how Quantum is simultaneously fragmented, heavily funded, and still forming as a commercial market, with governments like the United Kingdom building national plans around the idea that quantum computing is having a surge of interest even as practical deployments remain limited, a tension that captures the gap between vision and reality in the field so far.

That same analysis underlines how the technology’s immaturity shapes everything from workforce needs to business models. Rather than shipping boxes of quantum machines, most providers expect users to access early devices remotely, wrapped in layers of classical control software and error mitigation. The result is a sector that looks more like a long-term infrastructure bet than a near-term product boom, even as policymakers and corporate strategists talk up Quantum as a strategic asset on par with AI and advanced semiconductors, a framing that helps explain why so much capital is flowing into a technology that still struggles to run stable circuits for more than a few hundred operations on today’s hardware, as outlined in the same Quantum overview.

From lab curiosity to strategic race

Despite the technical caveats, quantum computing has clearly graduated from a niche research topic into a strategic technology race. A recent survey of emerging tools describes Q for Quantum Computing Quantum as a field that has moved from promising research to delivering actual breakthroughs, with companies like IBM and others pouring billions into hardware and software stacks to lead the race. That shift in tone, from “maybe one day” to “we cannot afford to fall behind,” mirrors the way AI moved from academic conferences into cloud platforms and consumer apps, even if quantum’s timelines are longer and its user base far narrower for now.

What stands out in that assessment is how Quantum Computing Quantum is framed alongside other headline technologies such as agentic AI and advanced chips, not as a distant curiosity but as part of the same competitive landscape. IBM is singled out as a key player in this push, building larger devices and more sophisticated control systems while courting developers who might one day build quantum-native applications. The narrative is not that quantum has already matched AI’s impact, but that it has crossed a threshold where governments and corporations see it as a strategic pillar worth sustained investment, a point underscored in the Quantum Computing Quantum entry that places it firmly in the 2025 tech alphabet.

Investors want “the next Nvidia,” but the analogy is shaky

On trading forums and in stock newsletters, a familiar storyline has taken hold: quantum computing will mint the next Nvidia, and early buyers will ride a similar wave of exponential returns. I find that comparison misleading. One widely shared comment from Aug in a stocks discussion bluntly argues that the “quantum will be the next Nvidia” take is a stretch, pointing out that Nvidia’s rise was powered by GPUs that already had immediate commercial uses in gaming, graphics, and then AI, while quantum hardware today has no comparable mass-market demand and no single company running away with it. That reality matters for anyone expecting a quick repeat of the GPU boom.

The same thread notes that even if quantum eventually becomes transformative, the path is likely to be slower and more diffuse, with value spread across hardware makers, cloud providers, and specialized software firms rather than concentrated in one dominant chip vendor. For retail investors, that means the risk profile looks very different from buying into Nvidia when GPUs were already shipping in millions of gaming PCs. The Aug commenter’s skepticism about a single quantum champion reflects a broader caution I see in more sober market analysis, where the consensus is that the sector is still in an experimental phase and that talk of a runaway winner is premature, a point captured in the Aug discussion about Nvidia comparisons.

Cloud access and the NISQ bottleneck

Even as hype builds, the way most people will touch quantum in the near term is quietly pragmatic. Rather than buying a refrigerator-sized machine, users are expected to connect to early devices over the internet, much as they already do with AI accelerators in the cloud. A detailed ethics and governance paper notes that Access to these devices is likely to be through cloud-based services, mirroring the current model for some NISQ computers, where NISQ stands for noisy intermediate-scale quantum systems that are powerful enough to run interesting experiments but far too error prone for fault-tolerant algorithms. That framing is crucial, because it underlines how quantum will initially feel like a specialized cloud feature, not a standalone product on every office floor.

The same work stresses that NISQ hardware comes with significant constraints, from limited qubit counts to high error rates that force researchers to spend much of their time on calibration and error mitigation rather than on solving business problems. For policymakers and companies, that means planning for a long period where quantum is accessed as a scarce, shared resource, with ethical questions about who gets priority and how results are validated. The emphasis on Access and NISQ in the analysis is a reminder that the first wave of quantum services will be as much about governance and fair use as about raw performance, a point made explicit in the discussion of Access to NISQ devices.

Will quantum really outgrow AI?

As AI systems spread into everything from search to medical imaging, some technologists have started asking whether quantum could eventually be even bigger. A recent analysis frames the debate by noting that, Broadly speaking, we tend to think about quantum more in terms of hardware like computers and sensor platforms, while AI is usually understood as software that runs on many different kinds of chips. That distinction matters, because it suggests the two technologies will create value in different ways, with quantum potentially reshaping physical measurement and secure communications even if it never matches AI’s ubiquity in consumer apps.

The same piece argues that the potential is there for quantum to rival AI in economic impact, but only if the hardware matures and if industries find compelling use cases beyond niche scientific problems. It highlights how quantum sensor systems could transform fields like navigation and medical diagnostics, while quantum computers might one day crack optimization and chemistry tasks that stump classical machines. Yet the author also stresses that both technologies are likely to be lucrative, and that the more realistic scenario is one where AI and quantum complement each other rather than one simply eclipsing the other, a nuanced view captured in the Broadly framed comparison of AI and quantum sensor hardware.

Q-Day fears: crypto and cybersecurity on the clock

If there is one narrative that has broken out of specialist circles, it is the fear of a future “Q-Day” when quantum computers can break today’s encryption. In the crypto world, that anxiety is particularly sharp. A widely shared Oct commentary on digital assets lays out 3 Key Takeaways from a Forbes analysis, warning that Q-Day is closer than many in the industry think and that Experts already see a significant impact on the cryptocurrency ecosystem if current public key schemes are not replaced in time. The message is blunt: the time to prepare is now, not after a powerful machine comes online.

The same piece urges blockchain projects and financial institutions to start architecting their legacy systems for post-quantum security, from strategic hiring of cryptography talent to audits of where vulnerable algorithms are embedded. It frames the transition as both a technical and organizational challenge, arguing that those who move early will protect their users and reputations, while laggards risk catastrophic breaches. By tying Q-Day directly to practical steps like strategic hiring and protocol upgrades, the Oct analysis moves the conversation beyond abstract fear and into concrete planning, a shift reflected in its emphasis on Key Takeaways and the role of Experts in shaping crypto’s response.

Quantum plus AI: hype, or a genuine “next frontier”?

Where quantum and AI intersect, the rhetoric can sound almost breathless, but there are hints of real substance beneath the slogans. One detailed analysis of this convergence argues that Generative AI is The Next Frontier Generative AI for quantum, suggesting that models like Quantum Generative Adve architectures could become a “killer app” by using quantum circuits to explore vast chemical and materials spaces that classical models struggle to search. The idea is that quantum-enhanced generative models might design new molecules or materials from scratch, compressing years of lab work into far shorter cycles.

In that framing, Models that blend quantum sampling with classical neural networks could give researchers a new way to navigate complex energy landscapes in drug discovery or battery design. The author is careful to note that this vision depends on more capable hardware and better error correction, but the direction of travel is clear: rather than competing with AI, quantum may supercharge it in specific domains where the underlying physics is inherently quantum mechanical. That is why the piece positions Generative AI as both a beneficiary and a driver of quantum progress, with Quantum Generative Adve style approaches held up as early examples of how the two fields might collide productively, a perspective laid out in the discussion of Generative AI as The Next Frontier Generative AI.

Hard numbers: when quantum really beats supercomputers

For all the speculation, the most convincing evidence that quantum is more than marketing comes from concrete performance results. Earlier this year, Google Quantum AI reported that its 65-qubit processor had performed a complex physics simulation 13,000 times faster than the Frontier supercomputer, a milestone that points to real progress toward practical quantum advantage rather than just toy benchmarks. The task in question was not a generic math puzzle but a targeted simulation of a physical system, the kind of workload where quantum mechanics is baked into the problem itself.

That result does not mean quantum machines are ready to replace classical supercomputers across the board, but it does show that for certain structured problems, the combination of a 65-qubit device and carefully designed algorithms can already outpace the world’s fastest classical hardware by orders of magnitude. It also underscores why companies like Google Quantum AI and operators of systems like Frontier are racing to define where each architecture shines, with quantum taking on specialized simulation tasks while classical machines handle broader workloads. The reported 13,000 speedup is a reminder that beneath the hype, there are specific niches where quantum is starting to deliver, as detailed in the account of Google Quantum AI and Frontier in that simulation.

Quantum AI as “the next big thing” – with caveats

Beyond physics labs, some AI specialists argue that quantum-enhanced machine learning could reshape industries from healthcare to finance. One detailed overview claims that by delivering unmatched computational power, accelerated machine learning capabilities, and enhanced predictive and optimization skills, quantum AI could unlock new applications ranging from drug discovery to portfolio management. In that vision, quantum processors act as accelerators for specific subroutines inside larger AI workflows, helping models explore more possibilities in less time.

The same analysis stresses that the payoff will depend on integrating quantum hardware into existing data pipelines and software stacks, rather than treating it as a standalone curiosity. It highlights scenarios where quantum optimization might improve logistics routing or risk analysis, while quantum-enhanced pattern recognition could refine diagnostics in medical imaging. Yet even as it brands quantum AI as the next big thing for the future of AI, the piece implicitly acknowledges that these gains will arrive incrementally, as hardware matures and developers learn where quantum really adds value, a balance captured in its description of the future of AI across sectors ranging from healthcare to finance and beyond.

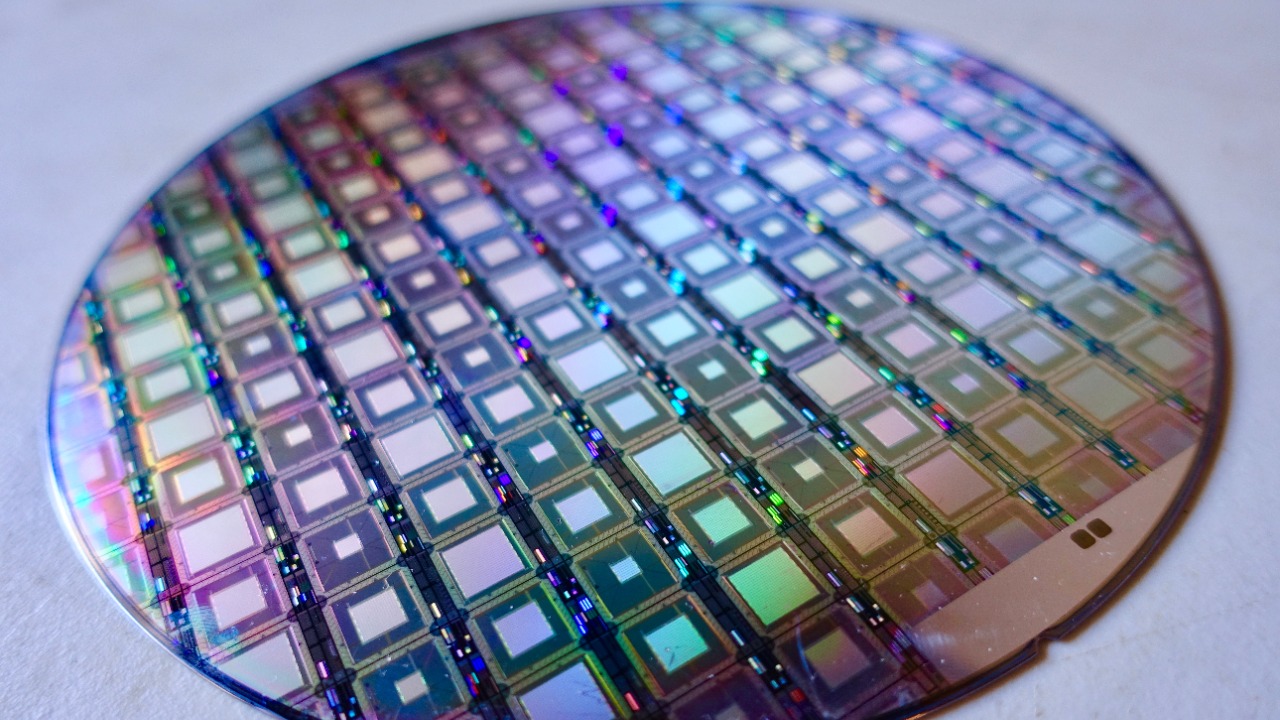

Physics, superconductors, and the long road to scale

Underneath the software narratives, quantum computing is still a story about hard physics. A detailed explainer on the field notes that Tech giants, including Google and IBM, are adapting superconductors, materials that have zero electrical resistance at very low temperatures, to build qubits that can maintain fragile quantum states long enough to perform useful calculations. These superconducting circuits sit inside dilution refrigerators that cool them close to absolute zero, a level of engineering complexity that makes AI data centers look almost straightforward by comparison.

The same piece argues that this hardware race could be the next revolution in computing, but only if engineers can dramatically improve qubit coherence times and error rates while scaling from dozens to thousands or millions of qubits. It highlights how Google and IBM are experimenting with different layouts and control schemes to pack more qubits into a single chip without overwhelming the system with noise. That focus on superconductors and cryogenics is a reminder that quantum’s trajectory is constrained by the laws of physics in a way AI’s software-driven progress is not, a reality laid out in the discussion of how Tech players like Google and IBM are betting on superconducting approaches.

Hype cycles, prototypes, and stock market plays

In the broader tech conversation, quantum has already earned a reputation for recurring waves of excitement. A recent A–Z rundown of 2025 trends labels Q as Quantum hype (Again), noting that the field has returned to headlines with a mix of bold promises, prototype devices, and suspicious timelines that feel familiar to anyone who watched earlier AI booms. The author places quantum squarely in the “we have seen this movie before” category, where impressive demos coexist with roadmaps that gloss over the messy engineering still required to reach mainstream impact.

At the same time, financial analysts are starting to treat quantum as the stock market’s next big tech play, pointing to companies that build hardware, software, or enabling components as potential beneficiaries. One market-focused report argues that Quantum computing is the stock market’s next big tech play and that some related stocks are still cheap, while also warning that Quantum computers can read encrypted data and do much more than just win a science prize, a nod to both the upside and the security risks. That duality, captured in the mix of Quantum hype (Again) and sober assessments of what quantum machines might do to encryption, is reflected in coverage that spans both the Quantum hype (Again) narrative and the view of Quantum as a market opportunity in Quantum stocks.

Reality check: fragile qubits and risky stocks

Strip away the marketing, and the technical obstacles remain formidable. A detailed breakdown of Quantum Computing: Hype vs Reality lists Current Challenges and Limitations, with One of the main challenges being qubit stability and high error rates that make it difficult to run long, complex algorithms. The piece explains how environmental noise, imperfect control pulses, and cross talk between qubits all conspire to corrupt calculations, forcing researchers to repeat experiments many times and rely on error mitigation techniques that eat into any theoretical speedup.

Those engineering hurdles feed directly into the financial risk profile of quantum-focused companies. A candid Oct investment note on Quantum argues that the short answer to whether the technology is worth investing in today is “not for most people,” warning that while the science is exciting, many quantum stocks do not yet meet the quality grade the analysts recommend, which they set at 60+. Another market analysis from Dec echoes that caution, stating that While the potential for quantum computing is significant, many pure-play quantum stocks, such as Rigetti, remain high risk and have very little revenue, a reminder that the path from lab prototype to profitable business is far from guaranteed. Together, these assessments of Current Challenges and Limitations, the Oct view of Quantum as a speculative bet, and the Dec warning that While the prospects are big but Rigetti and peers have very little revenue, underline why I see quantum today as a field where scientific momentum is real but commercial dominance is still a distant, uncertain prize.

More from MorningOverview