Apple is entering one of the most turbulent periods in its modern history, with a cluster of senior departures reshaping the company’s upper ranks at the very moment it is trying to define its next era. The exits are not isolated retirements but a pattern that is forcing Apple to rethink who leads its hardware, design, and artificial intelligence efforts, and how those leaders work together. As vice presidents and other senior figures walk out the door, the question is no longer whether Apple is changing, but whether it can control the direction of that change.

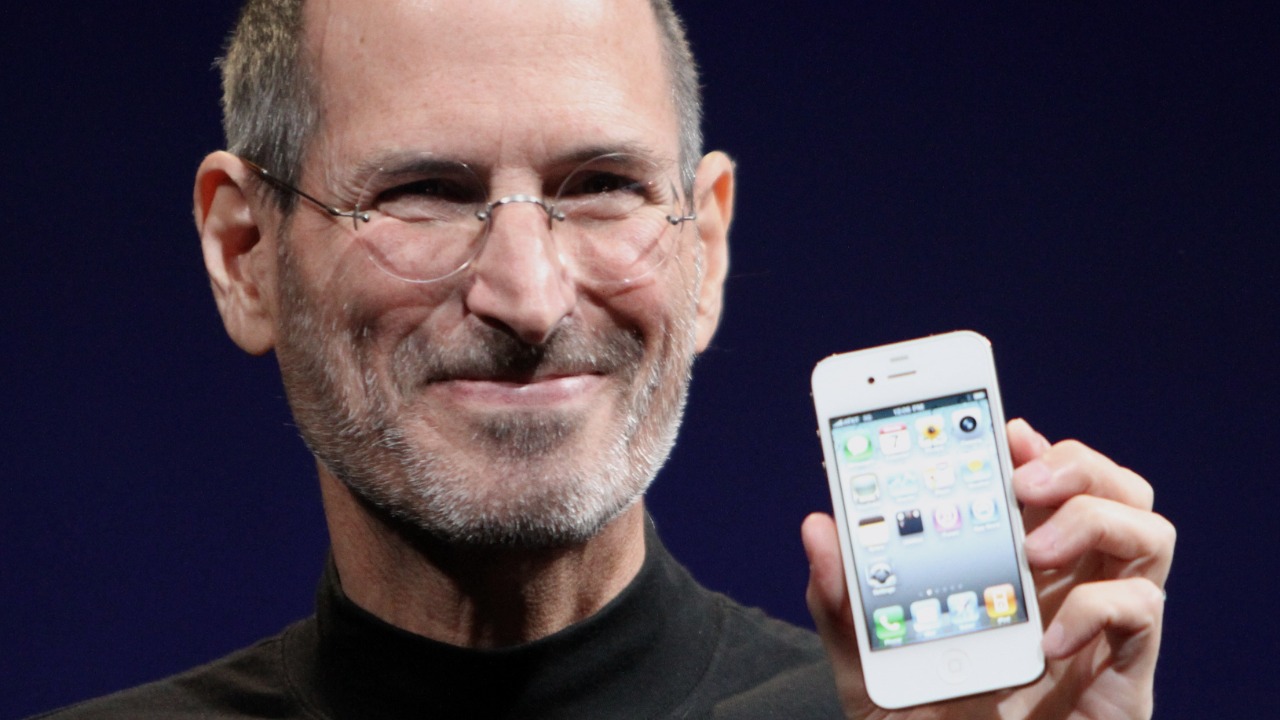

The leadership churn is colliding with strategic pressure on multiple fronts, from slowing iPhone momentum to intensifying competition in AI and mixed reality. I see a company that is still immensely powerful, yet suddenly vulnerable in ways it has not been since the transition after Steve Jobs, with internal succession bets like John Ternus and a sweeping AI reset now carrying far more weight than any single product launch.

The biggest shake-up since the Steve Jobs era

By any reasonable measure, Apple is living through its most significant leadership overhaul since the aftermath of Steve Jobs’s death. Multiple reports describe a wave of senior departures that is touching core product groups and long-tenured lieutenants, not just peripheral teams. Apple is currently undergoing what has been described as the most extensive executive overhaul in recent history, a shift that is being framed as the biggest leadership shake-up in the Tim Cook era, which underscores how unusual this level of churn is for a company that has prized continuity at the top for more than a decade. That scale of change is why investors and employees alike are treating this as a structural moment rather than a routine reshuffle, with the company’s long-standing operating model now in play as much as any individual role.

What makes this period especially striking is that it is unfolding while Apple is still delivering strong financial results, which removes the usual excuse of crisis-driven housecleaning. Instead, the exits are landing as Apple tries to pivot from an iPhone-centric playbook to a broader platform built around services, wearables, and AI, and that timing raises the stakes of every departure. One detailed account notes that Apple is currently undergoing the most extensive executive overhaul in its recent history, and that framing has quickly become the lens through which the rest of the industry is reading the company’s moves.

A cluster of VP exits, not a trickle

The most worrying signal for any large company is not a single high-profile exit but a cluster of them, and that is exactly what is happening inside Apple. Over just a few days, Apple has announced the departures of four senior executives, a burst of turnover that would be notable in any context and is especially jarring for a company that usually manages transitions quietly and over longer arcs. These are not mid-level managers but leaders with broad remits and deep institutional memory, the kind of people who translate a CEO’s strategy into the thousands of small decisions that shape products like the iPhone, Mac, and Apple Watch.

That concentration of exits is why some observers are now openly asking whether Apple’s dominance is at risk, rather than assuming the company can simply slot in the next person on the bench. The pattern suggests more than coincidence, pointing instead to a deliberate effort to refresh the leadership layer or to internal tensions about the company’s direction, or both. One analysis notes that Apple has announced the departures of four senior executives in quick succession as it reorganizes key leadership roles, a cadence that makes it harder to argue this is just normal attrition.

Why the exits are accelerating now

Leadership turnover rarely happens in a vacuum, and the acceleration at Apple appears tied to a mix of strategic, cultural, and market forces converging at once. After years of incremental updates to the iPhone and other flagship products, Apple is under pressure to prove it can lead in new categories like mixed reality and generative AI, and that pressure often exposes fault lines over priorities and risk tolerance. At the same time, the company’s internal culture has been shifting from the tightly controlled, design-led ethos of the Jobs era to a more operations-heavy model under Tim Cook, which can leave some long-serving executives feeling that the job they signed up for is not the one they are doing now.

There is also the simple reality that Apple’s senior bench is aging into a natural transition window, with many leaders having spent decades inside the company and now facing a choice between another long cycle or a clean break. When a few of those people decide to leave, it can create a domino effect, both by opening up opportunities for others and by signaling that the era of lifetime Apple careers is fading. Reports that Apple Faces Its Biggest Leadership Shake-Up in Decades as AI Talent Flees capture how this moment is being read inside the broader tech labor market, where Apple is no longer seen as the only pinnacle destination for ambitious executives.

John Ternus and the succession question

Amid the churn, one name keeps surfacing as a potential anchor for Apple’s future: John Ternus. He has emerged as the likely CEO successor, a development that signals how Apple is thinking about its next generation of leadership and what skills it values most. Choosing Ternus would be a major departure from what has worked for Apple during the past decade, when Tim Cook’s operational discipline and supply chain mastery defined the company’s leadership style, and it would instead elevate a hardware and product-focused executive to the top job. That shift would echo the earlier era when design and product vision sat closer to the center of power, but it would do so in a very different competitive landscape.

The fact that Apple is clearly setting up its next era while still grappling with a wave of exits shows how succession planning and crisis management are now intertwined. Ternus’s rise is being read as a bet that Apple can recapture some of the energy of its iPhone-era playbook while still adapting to a world where AI and services drive much of the value. One widely shared analysis notes that Apple choosing Ternus would be a pretty major departure from what has worked for Apple during the past decade, especially for its design team in particular, and that framing captures both the promise and the risk of centering the company’s future on a single internal candidate.

AI talent flees as rivals circle

If the VP departures are the most visible sign of Apple’s leadership strain, the quiet exodus of AI specialists may be even more consequential. Apple is contending with accelerating departures across its AI ranks, with reports that companies like Meta and OpenAI have been particularly successful at recruiting away some of its most sought-after researchers and engineers. Those moves matter because AI is no longer a side project or a behind-the-scenes optimization for Apple, it is central to how the company plans to differentiate everything from Siri to on-device photo editing and health features on the Apple Watch.

The loss of that talent is especially painful given Apple’s reputation for secrecy and its historically cautious approach to publishing research, which can make it harder to attract and retain AI experts who want to build a public profile. When those people leave, they take not just code but also institutional knowledge about how to ship AI features within Apple’s privacy constraints and hardware stack. One detailed report notes that Apple is also contending with accelerating departures across its AI ranks, with Meta, OpenAI and several star researchers cited as key destinations for those who have departed or scaled back their roles.

A ‘major reset’ in AI strategy

In response to both competitive pressure and internal turnover, Apple is now engaged in what has been described as a major reset of its AI strategy. Rather than treating AI as a series of incremental upgrades, the company is reorganizing teams and leadership to put machine learning and generative models at the center of its product roadmap. That reset is not just about catching up to rivals that have moved faster in public, it is also about reconciling Apple’s long-standing commitments to privacy and on-device processing with the demands of modern AI systems that often rely on large cloud-based models.

From my perspective, this reset is both overdue and inherently disruptive, because it forces Apple to revisit assumptions that have guided its software and hardware integration for years. It also raises the bar for whoever steps into the leadership gaps left by departing AI executives, since they will be expected to deliver visible progress quickly while rebuilding teams that have been thinned out by departures. Reporting that Apple’s leadership shift marks a ‘major reset’ in AI strategy captures how tightly linked the personnel changes and strategic overhaul have become, with each amplifying the impact of the other.

Product misfires and the iPhone Air warning sign

Leadership instability would be easier to dismiss if Apple’s recent product record looked flawless, but some high-profile stumbles are feeding the sense that the company’s execution machine is not as smooth as it once was. The iPhone Air, pitched as Apple’s ultra-thin future, has become a cautionary tale after struggling with demand despite heavy marketing and the company’s usual retail muscle. For a brand that built its reputation on turning design experiments into mass-market hits, the gap between the hype and the actual sales trajectory of the iPhone Air is a warning sign that the product intuition inside Apple may not be as sharp as it was in earlier cycles.

That misalignment between expectation and reality is part of a broader pattern that critics say is hard to ignore, especially when viewed alongside the leadership exodus. When a flagship device like the iPhone Air underperforms, it invites scrutiny of the decision-making process that greenlit its design, pricing, and positioning, and by extension of the leaders responsible for those calls. One analysis points out that the iPhone Air was hyped as Apple’s ultra-thin future; instead it struggled with demand, and that observation has quickly become shorthand for a broader concern that Apple’s product instincts may be drifting.

Can Apple’s dominance withstand the exodus?

The central strategic question is whether Apple’s market dominance can absorb this level of leadership turnover without a meaningful hit to its competitive position. On one hand, Apple’s scale, cash reserves, and integrated ecosystem give it a cushion that few companies enjoy, and its ability to promote from within has historically allowed it to weather departures that would cripple smaller rivals. On the other hand, the current wave of exits is touching exactly the areas where Apple needs to be strongest, from AI to hardware design, at a time when rivals are more aggressive and better funded than ever in those same domains.

Investors and partners are watching closely for signs that the company’s vaunted execution discipline is slipping, whether in delayed product roadmaps, more frequent bugs in software releases, or weaker-than-expected launches in new categories like mixed reality headsets. The concern is not that Apple will suddenly collapse, but that a slow erosion of leadership quality could translate into a gradual loss of pricing power and brand prestige, which are central to its business model. One widely circulated discussion frames it bluntly, asking whether the Apple exodus jeopardizes its dominance, and that question now hangs over every new executive appointment and product announcement.

Rebuilding the bench while resetting the playbook

For Apple, the path forward hinges on whether it can turn this period of disruption into an opportunity to refresh its leadership bench and modernize its internal playbook. That means not only elevating figures like John Ternus but also empowering a new generation of VPs who are comfortable operating in a world where AI, services, and cross-platform experiences matter as much as hardware polish. It also requires Apple to rethink how it competes for talent with companies like Meta and OpenAI, which are often more willing to let researchers publish and build public profiles, a key draw for top AI minds.

At the same time, Apple has to reassure employees and investors that the core strengths that made it successful, from tight hardware-software integration to a relentless focus on user experience, are not being sacrificed in the rush to reset. That balancing act is delicate, because it asks new leaders to challenge old assumptions without discarding the cultural DNA that differentiates Apple from its rivals. One influential commentary captures this tension by noting that At the same time Apple is clearly setting up its next era, with John Ternus emerging as the likely CEO successor, it is also moving away from the old iPhone-era playbook, a dual shift that will define whether this leadership exodus becomes a footnote or a turning point.

More from MorningOverview