Washington tried to slow the global spread of cutting-edge artificial intelligence hardware, but Nvidia chief executive Jensen Huang turned those constraints into a design brief. Instead of retreating from one of its biggest markets, Nvidia retooled its chips, rewired its lobbying strategy, and emerged with a playbook that keeps its AI engines inside China while staying inside U.S. rules. In the process, Huang has shown that the real power in the AI chip fight lies with the company that controls the technology roadmap, not the governments writing the export regulations.

What looks on paper like a regime of tough restrictions has, in practice, entrenched Nvidia’s dominance and given Huang leverage in both Washington and Beijing. By treating export controls as a geopolitical design parameter rather than a brick wall, he has preserved access to Chinese demand, reassured U.S. officials that guardrails remain in place, and kept Nvidia’s global AI lead intact.

The export control squeeze that was supposed to clip Nvidia

When the United States tightened rules on advanced semiconductors, the target was clear: limit the flow of the most powerful GPUs into strategic rivals and slow their progress in military and surveillance AI. Since 2022, the U.S. has imposed strict export controls on high-end semiconductors, particularly GPUs critical for artificial intelligence, in order to block sales to entities in China and other jurisdictions that might enhance military or surveillance capabilities, a policy that has reshaped the global chip supply chain and forced companies to rethink how they design and ship products across borders, as detailed in one analysis of how Since 2022, the U.S. has imposed strict export controls. The intent was to curb the most advanced AI training capabilities, especially those that could be repurposed for defense or state surveillance.

On Capitol Hill, China hawks pushed for even tighter limits, arguing that any access to top-tier AI accelerators would help China close the gap with U.S. capabilities. Despite their pressure, Nvidia Corp and other chipmakers worked to shape the rules, and the resulting framework left room for tailored products that sit just below the red lines. Reporting on how Despite their ( Nvidia Corp ) failed effort to avoid any new restrictions at all, the final outcome still allowed Nvidia to keep selling modified AI chips into China, signaling that the company had successfully defended its core commercial interests even as the political rhetoric hardened.

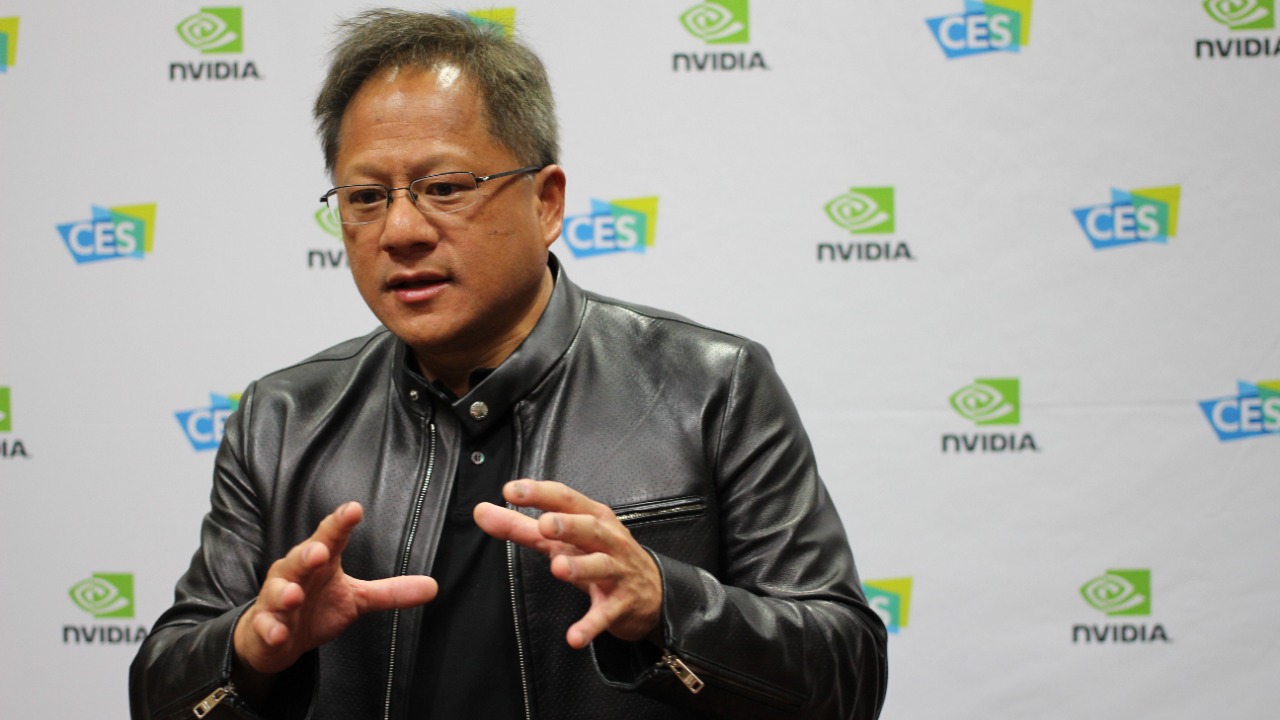

Jensen Huang’s geopolitical bet on AI leadership

Jensen Huang has been unusually blunt for a chief executive about the geopolitical stakes of AI hardware. He has framed AI leadership as a matter of national power, not just corporate competition, arguing that the countries that control advanced GPUs will shape the future of industry, security, and scientific research. That framing helps explain why he has invested so heavily in navigating Washington’s rules while still serving customers in China, rather than choosing one side of the Pacific and walking away from the other.

Huang has also been clear that the race is not a one-country contest. He has said that China is going to win the AI race, a remark he made to the Financial Times that underscored his belief that Chinese companies and researchers will remain central to the global AI landscape even under tighter controls. In that interview, China is going to win the AI race, Jensen Huang told the Financial Times, and Huang’s assessment reflects both the scale of China’s market and its aggressive investment in AI infrastructure, which in turn makes continued access to Nvidia’s hardware strategically important for Beijing and commercially vital for Nvidia.

Designing around the rules instead of fighting them

Rather than treating export controls as a purely political problem, Nvidia turned them into an engineering challenge. The company began designing chips that would comply with U.S. thresholds on performance and interconnect speed while still offering enough capability to satisfy cloud providers and AI developers in restricted markets. That approach allowed Nvidia to keep shipping hardware into China without crossing the lines that regulators had drawn, effectively transforming legal constraints into product specifications.

The clearest example is the H20, a modified version of Nvidia’s AI chip that is designed specifically for China and in compliance with U.S. export controls. Nvidia started offering the H20, a modified version of its AI chip that is designed specifically for China and in compliance with U.S. export controls, to Chinese customers this year, a move that showed how quickly the company could retool its lineup to match new rules while still serving demand in China and across Asia. Reporting on this shift notes that Nvidia started offering the H20 to Chinese customers this year, illustrating how the company has used design tweaks to stay inside the law while keeping its hardware central to China’s AI buildout.

Lobbying that blunted the harshest proposals

Engineering alone did not secure Nvidia’s position. The company also invested heavily in lobbying to shape how export controls were written and implemented, arguing that overly broad restrictions would hurt U.S. innovation and push customers toward rival suppliers. By engaging directly with policymakers, Nvidia sought to preserve a path for continued sales of downgraded chips while accepting that its most advanced GPUs would be off limits in some markets.

That strategy paid off in the details of the rules. While China hawks on Capitol Hill pressed for sweeping bans, the final framework allowed Nvidia Corp to keep selling tailored products that fell just under the performance caps, preserving a lucrative revenue stream and maintaining U.S. influence over China’s AI infrastructure. Coverage of this process notes that, despite their ( Nvidia Corp ) failed attempt to avoid any new limits at all, China hawks on Capitol Hill are poised to continue their push for stricter controls on AI technology, signaling ongoing challenges for the industry even as Nvidia has secured room to maneuver.

Keeping China close with custom chips and personal diplomacy

Huang has not left the China relationship to product managers and lawyers. He has personally re-engaged with the market, signaling to Chinese partners that Nvidia intends to remain a central supplier within the boundaries set by Washington. His presence underscores how critical China remains to Nvidia’s growth story and to the broader AI ecosystem, even as political tensions rise.

On his first post-pandemic visit to China, the Nvidia CEO highlighted how the company has been working closely with the U.S. government to create products for the Chinese market like the H20, L20 and L2 chips that can be exported to China. That trip underscored Nvidia’s dual-track strategy of compliance and commitment: it reassured U.S. officials that the company was respecting export rules while signaling to Chinese customers that Nvidia would keep delivering tailored solutions. Reporting on the visit notes that The company has been working closely with U.S. authorities to define chips that can be exported to China, a level of coordination that has effectively turned regulatory compliance into a competitive advantage.

Resuming AI chip sales into a contested market

For all the political friction, Nvidia has managed to keep the flow of AI hardware into China going, albeit in modified form. The company’s ability to resume and sustain sales of highly desired AI computer chips into a market that Washington has tried to constrain shows how adaptable its strategy has been. Instead of a clean break, the result has been a more complex, but still robust, commercial relationship.

Reporting on this dynamic notes that the trade rivalry between the U.S. and China has been weighing heavily on the industry, yet Nvidia is preparing to resume or expand sales of AI chips that comply with the latest rules. One account of the situation explains that, however intense the political rhetoric becomes, However, the trade rivalry between the U.S. and China has not stopped Nvidia from planning to resume sales of highly desired AI computer chips to China, highlighting how regulatory friction has led to product redesigns rather than a full decoupling of AI hardware supply.

Staying ahead on performance while others play catch-up

Export controls have not slowed Nvidia’s push at the cutting edge of AI performance. The company continues to roll out new flagship chips that set the pace for data centers and model training, reinforcing its dominance in markets that are not subject to the same restrictions. That performance lead gives Nvidia leverage in negotiations with both customers and regulators, because no rival can yet match the combination of hardware, software, and ecosystem support it offers.

Nvidia has unveiled its latest artificial intelligence chip which it says can do some tasks 30 times faster than its predecessor, a leap that keeps it far ahead of competitors in the most demanding AI workloads. By continuing to push that frontier, Nvidia ensures that even its downgraded export-compliant chips benefit from the same architectural advances and software stack, making them more attractive than alternative offerings. Coverage of the launch notes that Nvidia has unveiled its latest artificial intelligence chip with performance up to 30 times faster than its predecessor on some tasks, a reminder that the company’s core advantage remains technological, not political.

Why Huang’s strategy amounts to a win in the restrictions fight

Put together, these moves amount to a quiet victory for Jensen Huang in the AI chip restrictions fight. Washington has its export controls on the books, China hawks can point to formal limits on the most advanced GPUs, and yet Nvidia still sells large volumes of AI hardware into China, maintains its global performance lead, and deepens its relationships on both sides of the Pacific. The company has accepted constraints at the very top end of its product line in exchange for preserving the bulk of its business and its influence over how AI infrastructure is built worldwide.

At the same time, Huang has positioned Nvidia as an indispensable intermediary in a geopolitical contest that neither side can afford to lose. By designing chips like the H20 that comply with U.S. rules while serving Chinese demand, by personally engaging with Chinese partners, and by lobbying to keep regulatory space open for tailored products, he has turned a potentially existential threat into a manageable design and policy problem. The result is that export controls have constrained the margins of Nvidia’s business but not its core, leaving Huang in the rare position of satisfying Washington’s security concerns, keeping China supplied with AI hardware, and reinforcing Nvidia’s status as the central player in the global AI chip race.

More from MorningOverview