Nvidia’s graphics processors sit at the center of the AI boom, but the company that designs them is only one player in a sprawling global supply chain. To understand who really makes Nvidia GPUs and where they are built, it helps to follow the chips from design labs to overseas fabs, then on to board partners and final assembly lines. The result is a map of modern geopolitics as much as a bill of materials.

What looks like a single “Nvidia card” in a gaming PC or data center rack is in fact the product of specialized manufacturers in Asia, new investments in the United States, and a web of partners that handle memory, cooling, and packaging. I will walk through each stage of that journey, from the foundries in East Asia to emerging AI factories and American-made supercomputers, to show how Nvidia’s hardware actually comes to life.

Nvidia designs the brains, others build the silicon

The starting point is simple: Nvidia is a chip designer, not a traditional manufacturer. The company creates the GPU architectures and detailed layouts, but it does not operate its own semiconductor fabrication plants. Instead, it relies on contract chipmakers to turn those designs into physical wafers, a model that lets Nvidia move quickly while tapping the most advanced production lines in the world. Reporting on Nvidia’s recent growth in AI underscores that the company’s soaring valuation is tied directly to how efficiently outside fabs can turn its designs into the chips that power today’s AI boom, a relationship highlighted in coverage of how Nvidia GPUs are made and where they are manufactured in practice, including the way partners handle cooling, factory overclock features, and packaging once the silicon is ready for boards, as detailed in an analysis of how Nvidia GPUs are primarily made.

That division of labor is central to Nvidia’s strategy in the AI era. One detailed breakdown notes that while Nvidia designs its chips, it sends production to outside foundries that specialize in leading-edge process nodes, a setup that has enabled the rapid rollout of successive GPU generations that power data centers and generative AI services. The same reporting explains that the chips driving today’s AI boom are fabricated by these partners, not by Nvidia itself, and that the company’s role is to define the architecture and then coordinate with manufacturing giants to bring it to life, a point underscored in an examination of who makes and where manufactured Nvidia GPUs.

Taiwan’s fabs sit at the heart of Nvidia’s GPU supply

When I trace where most Nvidia GPUs begin their physical life, the trail leads first to Taiwan. The island’s semiconductor ecosystem, anchored by Taiwan Semiconductor Manufacturing Company (TSMC), has become indispensable to Nvidia’s rise. Detailed financial analysis of Nvidia’s valuation points out that its rapid ascent would not have been possible without the fabrication prowess of Taiwan Semiconductor Manufacturing Company, which produces the advanced GPU dies that underpin Nvidia’s data center and AI products. That same reporting stresses that TSMC’s leadership in cutting-edge nodes is a core reason Nvidia can ship such powerful chips at scale, making the Taiwanese foundry a quiet co-author of Nvidia’s success story.

Another breakdown of Nvidia’s manufacturing footprint is even more direct, stating that Nvidia GPUs are mostly made in Taiwan and South Korea, with Taiwanese facilities handling a large share of the graphics card manufacturing journey from wafer to finished board. This includes not only the initial chip fabrication but also key steps in packaging and assembly that prepare GPUs for integration into consumer and enterprise products. By the time a card reaches a PC builder or cloud provider, it has already passed through multiple plants in Taiwan’s industrial hubs, a path laid out in reporting that emphasizes how Nvidia GPUs are mostly made in Taiwan and South Korea and how those locations shape the journey to the end user, as described in an overview of how Nvidia GPUs are mostly made in Taiwan and South Korea.

South Korea’s memory and fabs complete the high-end stack

If Taiwan provides the core GPU dies, South Korea supplies much of the high-bandwidth memory and additional fabrication muscle that turn those dies into full AI accelerators. Analysis of Nvidia’s valuation highlights that its rise has been fueled not only by TSMC but also by South Korea’s SK Hynix, which provides critical memory components. The report notes that this valuation milestone would not have been possible without the fabrication prowess of Taiwan Semiconductor Manufacturing Company and South Korea’s SK Hynix, underscoring how Korean memory technology is tightly coupled with Nvidia’s GPU roadmap and the performance of its data center products.

Manufacturing overviews also stress that Nvidia GPUs are mostly made in Taiwan and South Korea, with Korean facilities contributing both chip fabrication and advanced packaging for certain product lines. That includes work by Samsung and other local players that support the broader ecosystem of AI hardware, from memory stacks to system-level integration. The importance of South Korea’s role is reinforced by reporting that pairs it with Taiwan as the primary locations where Nvidia GPUs are mostly made, and by financial analysis that explicitly credits South Korea’s SK Hynix alongside TSMC in enabling Nvidia’s rapid rise, as detailed in a review of Nvidia’s rapid rise fueled by chip giants TSMC and South Korea’s SK Hynix.

China’s role in assembly, packaging, and the broader PC ecosystem

Beyond the leading-edge fabs, a large share of the physical work that turns Nvidia chips into finished graphics cards happens in China. Contract manufacturers there handle printed circuit boards, cooling systems, and final assembly for many PC components, including GPUs. Community discussions among PC builders point out that companies like Foxconn often assemble already manufactured PCBs, screens, and housings for notebooks and phones, and that these assemblers have limited influence over pricing compared with the brands that control design and distribution. One widely cited thread explains that the former control the pricing while the latter, such as Foxconn, Asus, and others, focus on manufacturing and assembly, a distinction that helps clarify how Nvidia’s board partners rely on Chinese factories without ceding strategic control, as discussed in a breakdown of who actually makes GPUs that highlights Foxconn.

Official and commercial data on China’s manufacturing base reinforce that it remains a central hub for electronics assembly, even as geopolitical tensions and export controls reshape where the most advanced chips are fabricated. While the cutting-edge GPU dies for Nvidia’s latest AI accelerators are produced in Taiwan and South Korea, many supporting components, cooling systems, and even some older-generation products still move through Chinese plants before reaching global markets. That layered role, from PCBs to full systems, means China remains deeply embedded in Nvidia’s supply chain, even as the company and its partners diversify fabrication and high-end packaging to other regions.

From reference boards to partner cards: who actually sells “Nvidia GPUs”

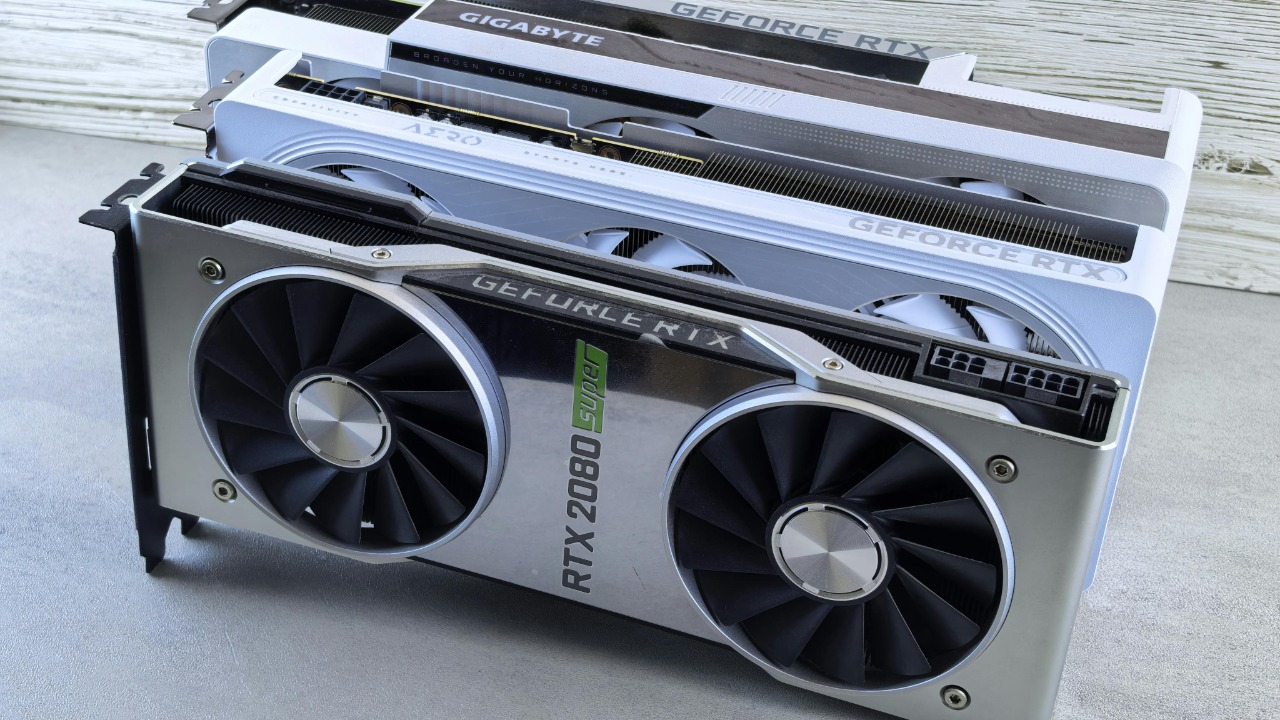

Once the GPU dies and memory stacks are ready, the next question is who turns them into the graphics cards that gamers and data centers actually buy. Nvidia produces its own reference boards for some flagship products, but a large portion of the market is handled by add-in board partners such as Asus, MSI, Gigabyte, and others. These companies design custom PCBs, cooling solutions, and power delivery systems, then integrate Nvidia’s chips into finished cards. Detailed manufacturing explainers note that graphics cards are manufactured in multiple stages, with the GPU die mounted on a board, paired with memory, and then enclosed in a cooler and shroud before being boxed for retail, a process that often takes place in the same Asian hubs that fabricate the chips.

Community discussions among enthusiasts help clarify the division of responsibilities. One widely referenced explanation notes that the companies that own the GPU designs control pricing and product positioning, while assemblers and board partners such as Foxconn, Asus, and others focus on manufacturing, cooling, and cosmetic differentiation. That means when a buyer picks up a factory overclocked card with a triple-fan cooler, they are purchasing a product whose core silicon comes from Nvidia’s foundry partners, but whose physical form and thermal performance are defined by the board maker. Reporting on how Nvidia GPUs are primarily made in specific regions and then customized with factory overclock features and packaging by partners reinforces that the “Nvidia GPU” brand on the box is the tip of a much larger industrial iceberg, a point illustrated in coverage of how Nvidia GPUs are primarily made in certain regions before partners add factory overclock features.

American-made AI supercomputers and the Arizona shift

For years, Nvidia’s most advanced chips were designed in the United States but fabricated and assembled abroad. That pattern is starting to change as Nvidia moves some manufacturing for AI systems onto American soil. Earlier this year, Nvidia announced that it would manufacture American-made AI supercomputers in the US for the first time, with production centered on its Blackwell generation of chips. The company described how NVIDIA Blackwell chip production would start in the US, with assembly and testing operations in Arizona, marking a significant shift toward domestic manufacturing for high-end AI hardware and signaling a new phase in how Nvidia balances efficiency with supply chain resilience, as laid out in its own announcement that NVIDIA to Manufacture American-Made AI Supercomputers in US for First Time.

The shift is not limited to corporate blog posts. Nvidia CEO Jensen Huang has publicly emphasized that Nvidia’s AI chips are now being manufactured in Arizona, highlighting the role of new US-based fabs and assembly lines in the company’s roadmap. In remarks at a major company event in Washington, DC, Nvidia CEO Jensen Huang said that Nvidia’s AI chips are being manufactured in Arizona and that systems built around them would be assembled in the US as well, underscoring how domestic production is becoming part of Nvidia’s pitch to governments and enterprise customers. That message aligns with broader US industrial policy aimed at boosting semiconductor manufacturing within the United States, and it signals that future Nvidia supercomputers may increasingly be built closer to the customers and regulators who depend on them, as reflected in coverage of how Nvidia CEO Jensen Huang described Arizona manufacturing and US assembly.

Samsung, AI factories, and the next phase of intelligent manufacturing

Even as Nvidia deepens its US footprint, it is also expanding partnerships in Asia that go beyond traditional chip fabrication. One of the most notable moves is a collaboration with Samsung to build an AI factory aimed at transforming global intelligent manufacturing. In a joint announcement, the companies described how NVIDIA and Samsung build AI factory infrastructure that supports simulation, verification, and manufacturing analysis, effectively turning AI hardware and software into a platform for optimizing industrial production itself. The news summary framed this AI factory as a way to bring advanced computing directly into the heart of manufacturing lines, using Nvidia’s GPUs and Samsung’s production expertise to accelerate everything from design validation to real-time quality control, as detailed in the description of how NVIDIA and Samsung Build AI Factory to Transform Global Intelligent Manufacturing.

This partnership illustrates how Nvidia’s role in manufacturing is evolving from being a customer of fabs to being a co-architect of AI-driven production systems. By embedding GPUs into the tools that design and monitor factories, Nvidia is effectively helping to build the next generation of the very plants that will produce its own hardware. The AI factory concept also underscores the tight integration between hardware and software in modern manufacturing, where simulation and verification run on the same class of accelerators that train large language models. In that sense, Nvidia’s collaboration with Samsung is both a new revenue stream and a strategic bet that intelligent manufacturing will be a defining feature of the next decade of industrial growth.

Texas, regional hubs, and the geography of AI infrastructure

As Nvidia’s AI hardware becomes a core part of national infrastructure, the geography of where systems are built and deployed is gaining political and economic weight. Within the US, states like Texas are emerging as key hubs for data centers and AI deployments that rely heavily on Nvidia GPUs. While the most advanced chip fabrication remains concentrated in Taiwan, South Korea, and new facilities in Arizona, the build-out of AI infrastructure in places like Texas reflects how Nvidia’s hardware is reshaping regional economies. Large cloud providers and enterprises are installing racks of Nvidia accelerators in Texan data centers, tying local energy grids, real estate markets, and workforce development directly to the availability of high-end GPUs.

This regionalization of AI infrastructure mirrors the broader pattern of Nvidia’s supply chain, where design, fabrication, assembly, and deployment are spread across multiple continents. The presence of major data center clusters in Texas, combined with manufacturing moves in Arizona and ongoing reliance on Asian fabs, shows how Nvidia’s hardware lifecycle now spans from US design labs to East Asian foundries and back to American server farms. That loop is likely to tighten as more domestic manufacturing comes online and as states compete to attract AI investments that depend on reliable access to Nvidia’s latest chips.

Why the global map of Nvidia GPU manufacturing matters

Understanding who makes Nvidia GPUs and where they are built is not just a matter of trivia for hardware enthusiasts. It has direct implications for supply chain resilience, national security, and the pace of AI innovation. The fact that Nvidia GPUs are mostly made in Taiwan and South Korea, with critical roles played by Taiwan Semiconductor Manufacturing Company and South Korea’s SK Hynix, means that geopolitical risks in East Asia can ripple quickly through global AI projects. At the same time, the growing importance of assembly and packaging in China, the rise of American-made AI supercomputers in Arizona, and the build-out of AI factories with Samsung show that Nvidia is actively diversifying how and where its hardware is produced.

For buyers, developers, and policymakers, the key takeaway is that a single Nvidia GPU embodies a network of relationships that stretch from Taiwan’s fabs and South Korea’s memory plants to China’s assembly lines and new facilities in the United States. Each link in that chain carries its own risks and opportunities, from export controls to local job creation. As AI systems become more deeply embedded in everything from healthcare to transportation, the question of who makes Nvidia GPUs and where they are built will only grow more central to debates over technology, economics, and power.

More from MorningOverview