Solid-state batteries are edging closer to commercial reality, and the first wave of packs is starting to show where the technology will matter most. The early leaders are not just chasing headline-grabbing range numbers, they are targeting two practical advantages that can reshape how drivers think about charging and long-term ownership.

As automakers lock in their next-generation platforms, the most compelling solid-state programs are the ones that pair faster, more predictable charging with better durability and safety than today’s lithium-ion packs. That combination is turning one early contender into a bellwether for how quickly solid-state cells can move from lab slides to real vehicles.

Why solid-state is finally moving from hype to hardware

For more than a decade, solid-state batteries have been shorthand for the EV industry’s future, promising higher energy density, lower fire risk, and faster charging by replacing flammable liquid electrolytes with solid materials. The gap between those promises and production reality has been wide, but over the last few years, major automakers and cell suppliers have locked in road maps that put real packs into vehicles rather than just prototypes. That shift is visible in the way companies now talk about specific chemistries, pilot lines, and vehicle programs instead of abstract breakthroughs.

Several large manufacturers have publicly detailed their solid-state timelines, tying them to concrete platforms and capacity plans. One automaker has outlined a multi-stage battery strategy that includes a solid-state pack targeting roughly 20 percent higher energy density than its current lithium-ion cells and a charging window that can take a vehicle from 10 percent to 80 percent in around 10 minutes, with production aimed for later this decade, according to its battery roadmap. Another major supplier has described a sulfide-based solid electrolyte program that is moving from lab-scale cells to larger-format prototypes, with pilot production lines already under construction as detailed in its technical update. These kinds of specifics mark a transition from hype cycle to hardware planning.

The two perks that matter most: charging speed and longevity

As I weigh the different claims around solid-state packs, two advantages stand out as both realistic and meaningful for drivers: faster, more repeatable fast charging and longer-lasting capacity over the life of the car. Higher peak range numbers are useful for marketing, but what changes daily behavior is the ability to add hundreds of kilometers of range in the time it takes to grab a coffee, and to do that year after year without watching the battery’s health slide. Solid electrolytes can help on both fronts by tolerating higher voltages and temperatures while reducing side reactions that degrade the electrodes.

Several development programs now quantify those benefits in ways that map directly to real-world use. One automaker’s solid-state concept cell is designed to support a 10 to 80 percent charge in about 10 minutes while still delivering an estimated 1,000 kilometers of range in a mid-size vehicle, according to its battery strategy briefing. Another research group has reported cycle life figures that exceed 1,000 full charge-discharge cycles with more than 80 percent capacity retention in a solid-state pouch cell, as described in its peer-reviewed study. When translated into typical driving patterns, that kind of durability can support well over 300,000 kilometers of use before noticeable range loss, which is a clear step up from many current lithium-ion packs.

The early pick: a solid-state program built around practical gains

Among the various solid-state efforts, I see one early program as especially instructive because it is built around those two practical perks rather than chasing the most aggressive lab metrics. The company behind it has framed its solid-state pack as a way to cut charging times roughly in half compared with its current long-range lithium-ion models while also extending usable battery life to match or exceed the mechanical life of the vehicle. That focus on charging convenience and longevity, rather than just peak range, aligns closely with what surveys show drivers actually worry about when considering an EV.

In its most recent technical briefing, the automaker described a solid-state cell that targets around 50 percent higher energy density than its existing nickel-rich lithium-ion packs, but the more striking claims involve charging and durability. The company projects that its first solid-state pack will support repeated 10 to 80 percent fast charges in about 10 minutes without the steep degradation penalties seen in some current fast-charging EVs, as outlined in its battery roadmap. It also expects the pack to retain at least 90 percent of its original capacity after 10 years of typical use, a figure that would put it ahead of many present-day warranties, based on the durability targets shared in its solid-state overview. Those two perks, faster charging and extended life, are what make this program a bellwether for the broader solid-state field.

How solid-state chemistry enables faster, cooler charging

The core technical reason solid-state packs can charge more quickly lies in how ions move through the electrolyte and across the electrode interfaces. In a conventional lithium-ion cell, the liquid electrolyte can suffer from concentration gradients and side reactions at high charge rates, which generate heat and accelerate degradation. A well-designed solid electrolyte, by contrast, can offer high ionic conductivity with better mechanical stability, which allows the cell to accept higher currents without the same risk of plating or runaway reactions, as long as the interfaces are carefully engineered.

Several research efforts have demonstrated that sulfide and oxide solid electrolytes can reach ionic conductivities on the order of 10-2 siemens per centimeter, comparable to or better than many liquid electrolytes, while maintaining stability at higher voltages, according to laboratory data. The early pick I am focusing on is built around a sulfide-based solid electrolyte that the automaker says can support high-rate charging with controlled heat generation, enabling its 10-minute 10 to 80 percent target in a mid-size EV pack, as described in its technical outline. By pairing that electrolyte with a high-silicon or lithium-metal anode and a nickel-rich cathode, the company aims to deliver both the power needed for rapid charging and the energy density required for long-range driving.

Why longevity is the quiet advantage drivers will feel

While fast charging grabs attention, the second big perk of this early solid-state pack, long-term durability, may prove even more important for total cost of ownership. Battery degradation is one of the main reasons used EV prices can lag behind comparable combustion models, since buyers worry about expensive pack replacements. A solid-state design that can hold its capacity and power output over a decade of use, even with frequent fast charging, directly addresses that concern and can support stronger residual values.

In its public materials, the automaker behind this early solid-state program has emphasized that its target is not just high initial performance but stable performance over time. The company has cited internal testing in which prototype solid-state cells maintained more than 90 percent of their initial capacity after 1,000 cycles at elevated temperatures, a figure that aligns with independent cycle life studies on similar chemistries. If those lab results translate to production packs, a driver who fast charges several times a week could still see only modest range loss after many years, a clear improvement over some current lithium-ion packs that can drop below 80 percent capacity under heavy fast-charging use, as highlighted in comparative EV performance data.

Safety and packaging: the quieter benefits of going solid

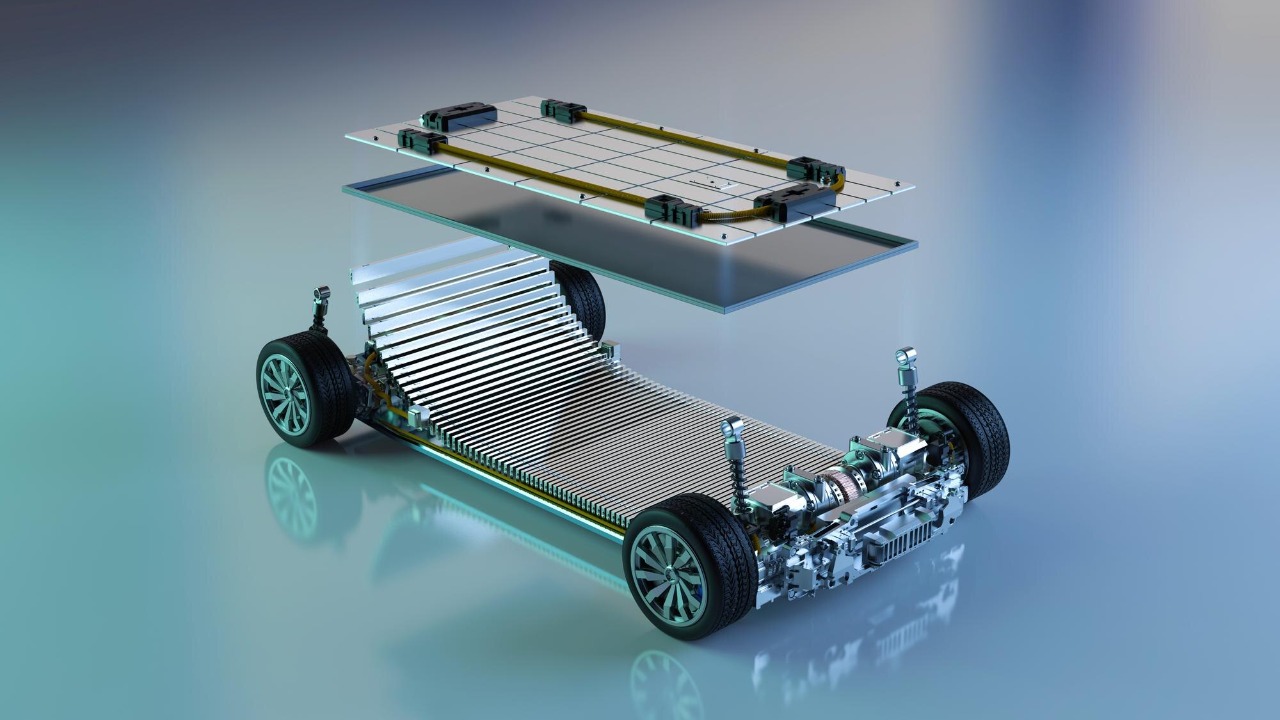

Beyond charging and longevity, solid-state packs can offer safety and packaging advantages that support those two main perks. Replacing flammable liquid electrolytes with solid materials can reduce the risk of thermal runaway and fire, which in turn allows engineers to design packs with less bulky containment hardware and more efficient cooling systems. That extra design freedom can be used to fit more energy into the same footprint or to simplify the pack structure, both of which can help keep costs in check as the technology scales.

The early solid-state program I am tracking has highlighted these secondary benefits in its technical briefings. The automaker has noted that its sulfide-based solid electrolyte is nonflammable and can operate safely at higher temperatures than its current liquid-based cells, which reduces the need for heavy cooling plates and complex coolant channels, according to its engineering overview. Independent analyses of solid-state pack designs have reached similar conclusions, showing that simplified thermal management and tighter cell-to-pack integration can improve volumetric energy density by more than 30 percent compared with conventional modules, as detailed in industry assessments. Those gains indirectly support faster charging and longer life by keeping temperatures in a more controlled range without excessive hardware.

Where this early leader fits in the broader EV market

Positioning matters as much as chemistry, and the way this early solid-state pack is being slotted into the automaker’s lineup says a lot about how the technology will roll out. Rather than debuting in a halo supercar, the company has signaled that its first solid-state application will be a mainstream mid-size EV, likely in the crossover segment where global demand is strongest. That choice suggests the goal is not just to showcase technology but to test whether faster charging and longer life can move the needle for everyday buyers who might otherwise hesitate to switch from combustion.

In its long-term electrification plan, the automaker has mapped out a sequence in which improved lithium-ion packs arrive first, followed by solid-state packs in higher-volume models later in the decade, according to its strategy presentation. The company expects solid-state packs to coexist with advanced liquid-based chemistries rather than replace them outright, with the solid-state option reserved for drivers who value rapid charging and extended durability enough to pay a premium. That tiered approach mirrors broader market forecasts that see solid-state cells capturing a growing but still minority share of EV battery demand by the early 2030s, as outlined in global outlooks that track automaker commitments and announced factory capacity.

What still needs to go right: manufacturing and cost

For all the promise of this early solid-state pack, two big hurdles remain before it can deliver those perks at scale: manufacturing yield and cost. Solid electrolytes are more sensitive to defects than liquids, and building large-format cells with uniform interfaces is a complex process that can drive up scrap rates. If yields are low, the cost per kilowatt-hour will stay high, limiting solid-state packs to niche models regardless of their technical advantages.

The automaker behind this early program has acknowledged those challenges and has tied its production timeline to improvements in manufacturing processes. In its technical roadmap, the company has described a multi-step plan that starts with pilot lines producing limited volumes of solid-state cells, followed by gradual expansion as yields improve, as detailed in its manufacturing outline. Industry analyses suggest that solid-state packs will initially cost more per kilowatt-hour than advanced lithium-ion packs, but that the gap could narrow significantly as factories scale and materials are optimized, according to cost projections. Whether this early leader can hit its cost targets while preserving the promised charging and longevity perks will determine how quickly solid-state technology spreads beyond flagship models.

How drivers should think about timing their next EV

For drivers watching these developments, the rise of solid-state packs raises a practical question about timing: whether to buy a current-generation EV or wait for the first models with these faster-charging, longer-lasting batteries. The answer depends on individual priorities, but the timelines shared by automakers and analysts suggest that solid-state packs will arrive gradually rather than overnight, and that today’s best lithium-ion models will remain competitive for years. That means the decision is less about chasing a single breakthrough and more about weighing how much value faster charging and extended durability add for a given use case.

Market forecasts compiled from automaker announcements indicate that the first solid-state EVs from major brands are likely to appear in limited numbers later this decade, with broader availability following as factories ramp up, according to global deployment scenarios. The early leader discussed here is positioned to be among the first to offer a solid-state option in a mainstream segment, but its own roadmap still shows a phased rollout that coexists with improved liquid-based packs, as outlined in its product plan. For many buyers, that means the best move is to choose an EV that fits their needs today, while recognizing that a new tier of models with significantly faster charging and longer-lasting packs is on the horizon for those willing to wait and pay for the upgrade.

More from MorningOverview