California’s fusion sector is moving from lab curiosity to industrial ambition, and one startup now claims its reactors could eventually generate enough electricity for more than two megacities on a fuel diet measured in soda cans. That kind of boast sits at the intersection of physics, finance, and policy, where the promise of virtually limitless clean energy collides with the hard realities of engineering and grid economics. I set out to trace how this new claim fits into a broader California fusion ecosystem that is suddenly flush with capital, political attention, and technical milestones.

The result is a picture of a state betting that fusion will not just light up a few experimental facilities but could underpin a new industrial base, from Bay Area laser labs to Southern California startups. The numbers now attached to fusion, from billion‑dollar funding rounds to projections of tens of thousands of jobs, suggest that the race to power multiple megacities is no longer a distant thought experiment but an emerging economic strategy.

California’s bold fusion pitch: megacities on a soda‑can fuel supply

The most eye‑catching claim in California fusion right now comes from a company arguing that its technology could power a major United States city using the energy content of roughly “three soda cans” of fuel. That image, tiny aluminum cylinders standing in for sprawling metropolitan skylines, is designed to make the energy density of fusion tangible to non‑scientists and to signal that the startup is thinking at the scale of entire urban regions rather than niche demonstration plants. The company’s approach centers on laser‑driven fusion, positioning itself as part of a new wave of private ventures that want to compress decades of government‑led research into commercially relevant timelines.

In reporting on this claim, I found that the description of powering a large city with “three soda cans” of fuel is tied to a Nov 30, 2024 account of an Energy company working on laser fusion technology. That piece describes how Nov is associated with a vision of compact fuel requirements and highlights how the firm, referred to simply as Energy, is trying to translate laboratory physics into a power‑plant concept. The soda‑can metaphor does not prove that a reactor can run a grid today, but it does capture the core physics advantage that fusion advocates are selling to investors and policymakers who are used to thinking in terms of coal trains, gas pipelines, and sprawling solar farms.

From 192 lasers to private reactors: the scientific foundation

Any California startup promising to power multiple megacities with fusion is building on a scientific base that only recently crossed a crucial threshold. The modern inflection point came when Scientists at a federal facility managed to trigger a fusion reaction that produced more energy than the lasers used to ignite it, a result that moved fusion from theoretical aspiration to experimental proof of concept. That achievement did not instantly solve the engineering challenges of continuous operation, component durability, or cost, but it gave private companies a concrete benchmark to point to when arguing that fusion is no longer science fiction.

The experiment that changed the tone of the conversation involved a precisely choreographed blast of 192 Lasers focused on a tiny fuel pellet, a feat described in a Dec 13, 2022 report on how Scientists at Lawrenc pushed inertial confinement fusion into net‑energy‑gain territory. That work, which unfolded at a national laboratory, showed that the same basic process that powers the sun could be coaxed into a controlled reaction on Earth, at least for a fraction of a second. When I talk to people in the startup world, they routinely cite that Dec milestone as the moment when investors stopped asking whether fusion was possible at all and started asking how quickly it could be engineered into a power plant.

California’s fusion ecosystem: from Bay Area labs to startup campuses

California’s claim to be the place where fusion might first scale to megacity levels rests on a dense network of public laboratories and private companies that share talent, suppliers, and political support. At the center of that network is The Lawrence Livermore National Laboratory, which has become a global reference point for inertial confinement fusion and a magnet for physicists who later spin out into startups. The lab’s work has turned the Bay Area into a proving ground for fusion diagnostics, laser systems, and target fabrication, all of which are essential ingredients for any company trying to commercialize the technology.

Earlier in 2024, investigators highlighted how The Lawrence Livermore National Laboratory had successfully hosted five nuclear fusion reactions inside its Bay Area lab since Dec. 2022, underscoring that the Dec breakthrough was not a one‑off event but part of a series of repeatable experiments. That consistency matters for startups that want to convince utilities and regulators that fusion is not just a spectacular single shot but a process that can be industrialized. When I look at the California map, I see a corridor that runs from Bay Area research hubs down to Southern California industrial parks, where private ventures are trying to turn Livermore’s physics into hardware that can be manufactured, maintained, and eventually plugged into the grid.

Money meets megawatts: the $900 Million bet on a California startup

Bold claims about powering multiple megacities would ring hollow without serious capital behind them, and in California that capital is now arriving in nine‑figure chunks. One of the clearest signals came when a US / California Nuclear Fusion Startup secured a Series A round that instantly vaulted it into the top tier of privately funded fusion ventures. The size of that check suggests that investors are no longer content with small seed experiments and instead are backing companies that promise to move quickly toward pilot plants and, eventually, commercial reactors.

According to a report dated Oct 1, 2024, a deal described as California Nuclear Fusion Startup Gets $900 M in backing, with By David Dalton noting that the company had raised $900 Million in Series A Funding to pursue its roadmap. The same account references Pacific as part of the context for the investment, signaling that the Pacific region is emerging as a focal point for fusion finance. When I connect that funding to the soda‑can fuel narrative, I see a pattern: investors are not just buying into physics, they are buying into a story that fusion can leapfrog incremental grid upgrades and deliver city‑scale power in a single technological jump.

Fusion as industrial strategy: $125 Billion and 43,000 jobs on the line

California’s fusion push is not only about electrons on the grid, it is also about building an industrial base that can manufacture reactors, components, and control systems at scale. A recent economic analysis framed fusion as a potential engine for tens of thousands of jobs, suggesting that the technology could anchor a new manufacturing and services ecosystem if the right policies and investments line up. That framing matters because it turns fusion from a niche research topic into a pillar of regional economic planning, with implications for workforce training, land use, and export strategy.

An Oct 15, 2025 report on the state’s prospects argued that Fusion, the same process that powers the sun, could generate $125 Billion in economic activity and 43,000 jobs if California maintains the right mix of policy, investment, and industrial coordination. The report, which explicitly labels the technology as Fusion and situates it in an Oct timeframe, treats fusion as a strategic sector rather than a speculative bet. When I weigh that projection against the megacity‑scale power claims, I see a dual narrative: fusion is being sold both as a way to decarbonize the grid and as a way to anchor high‑skill employment that can keep California at the forefront of advanced energy manufacturing.

Political backing: Fusion as clean, safe, and reliable power

No startup can credibly promise to power multiple megacities without a political environment that is willing to permit, regulate, and in some cases subsidize the necessary infrastructure. In California, that environment is increasingly shaped by lawmakers who see fusion as a complement to solar, wind, and storage rather than a distraction from them. Their argument is that fusion can provide firm, dispatchable power that fills in the gaps when weather‑dependent resources fall short, all while avoiding the carbon emissions and long‑lived waste associated with traditional nuclear fission.

One of the clearest articulations of that view came on Sep 3, 2025, when a state legislator published a statement titled Fusion will transform the energy sector, arguing that Fusion energy offers a pathway to clean, safe, and reliable energy capable of meeting humanity’s needs for generations. The same statement suggested that with the right support, a commercial fusion plant could be operating in the next decade, a timeline that aligns with the ambitions of California startups pitching megacity‑scale power. When I read that, I see political leaders effectively endorsing the idea that fusion is not just a research project but a near‑term infrastructure option, which in turn gives companies more confidence to raise capital and plan large facilities.

Tech money surges in: $7.1 billion and a 2030s horizon

California’s fusion startups are not raising money in a vacuum; they are part of a broader wave of tech‑driven investment that is pouring into fusion companies around the world. That wave is reshaping who gets to define the roadmap, with venture capitalists and tech executives increasingly sitting alongside physicists and utility planners. The sums involved are now large enough to influence regional economies and to attract talent that might otherwise have gone into software or conventional clean‑energy firms.

A Jul 17, 2024 report on the sector noted that Tech companies had raked in $7.1 billion as they aim to harness nuclear fusion in ways that have never been done before, with Long hailed as an impossibility now giving way to talk of a major energy source sometime in the 2030s. That 2030s horizon is crucial for understanding the megacity claims: it suggests that investors are willing to wait a decade or more for returns, but they still expect a commercial payoff within a human planning cycle, not in some indefinite future. When I connect that global $7.1 billion figure to the $900 Million Series A in California, it becomes clear that the state’s startups are not outliers but central players in a worldwide race to turn fusion into a bankable asset class.

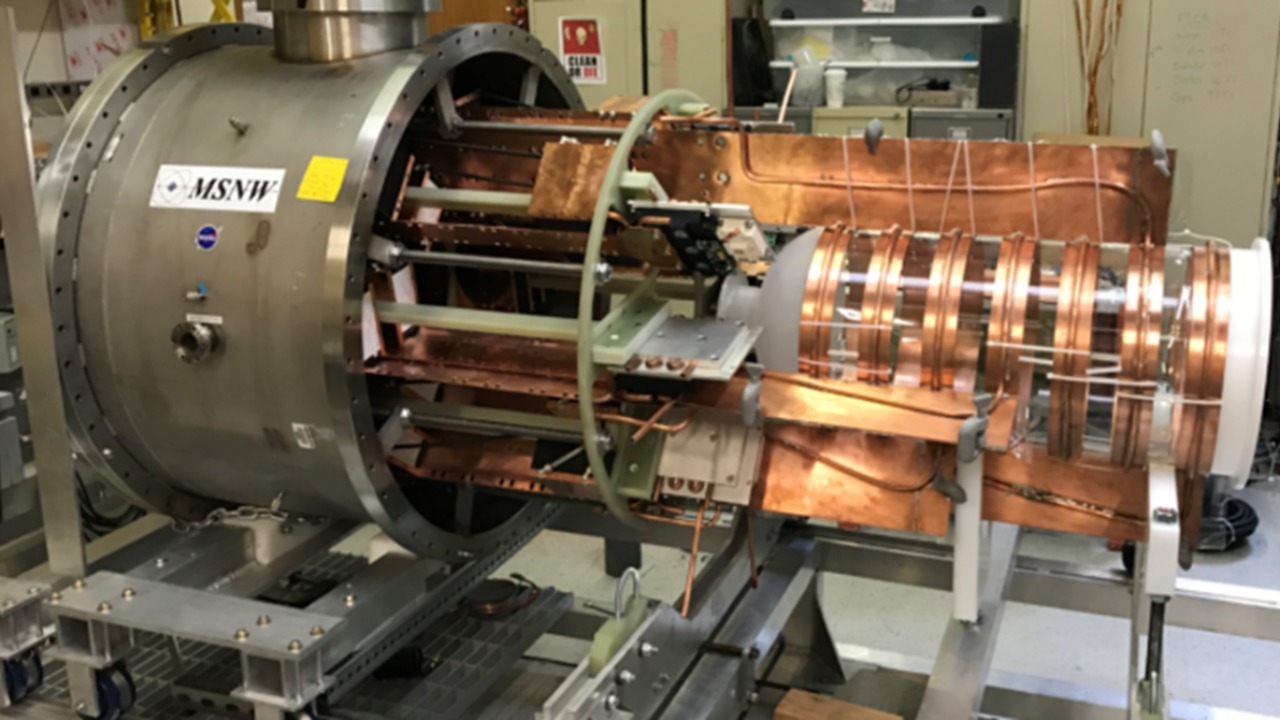

Laser fusion’s unique pitch: compact fuel, massive output

Within the broader fusion landscape, laser‑driven approaches occupy a distinctive niche that aligns neatly with the idea of powering multiple megacities from a relatively small fuel stockpile. Unlike magnetic confinement designs that rely on giant donut‑shaped reactors, laser systems promise more modular architectures, where arrays of high‑power lasers fire at tiny fuel targets in rapid succession. Proponents argue that this geometry could eventually lead to plants that are easier to site near existing load centers, reducing the need for long transmission lines and making it more plausible to serve dense urban regions directly.

The Nov 30, 2024 account of an Energy company working on laser fusion technology, which ties Nov to a vision of powering a major US city with “three soda cans” of fuel, captures that pitch in vivid terms. The company, identified simply as Energy, is effectively arguing that the combination of high energy density and compact plant design could allow a single facility to serve what today would require multiple large fossil‑fuel stations. When I weigh that claim against the experimental record at national labs, I see both continuity and ambition: the same basic physics that enabled 192 Lasers to ignite a pellet in a government facility is now being repackaged as the foundation for privately financed power plants that could, in theory, light up more than two megacities.

Reality check: timelines, risks, and what “beyond two megacities” really means

For all the excitement around California’s fusion startups, it is important to parse what it actually means to say that a technology could power more than two megacities. In practice, that kind of statement usually refers to the theoretical energy output of a fully optimized plant fleet rather than a single reactor that can instantly replace every gas turbine on the grid. It also assumes that the engineering challenges of continuous operation, component fatigue, tritium handling, and regulatory approval can be solved on timelines that match investor expectations and political promises.

When I look across the available reporting, I see a convergence around the idea that fusion could become a major energy source sometime in the 2030s, as highlighted in the Jul account of Tech companies raising $7.1 billion, and in the Sep statement that Fusion energy could support a commercial plant in the next decade. Those timelines are ambitious but not immediate, which means that any claim about powering multiple megacities should be read as a long‑term projection rather than a near‑term guarantee. Unverified based on available sources are the exact engineering details that would allow a single California startup to scale from a prototype to a fleet capable of serving more than two megacities, but the combination of public‑sector breakthroughs, private capital, and explicit political backing suggests that the state is serious about trying to make that projection real.

More from MorningOverview