Yttrium has quietly moved from obscure chemistry charts into the center of a strategic scramble, as a once-plentiful rare earth suddenly looks like a bottleneck for modern technology. The element sits inside everything from precision missiles to OLED TVs, and its tightening supply is now colliding with surging demand in ways that could reshape prices, supply chains, and even national security planning.

I see a new phase of the rare earth story taking shape, one where yttrium, not just neodymium or dysprosium, becomes a flashpoint between industrial policy and technological ambition. The stakes run from the cost of consumer gadgets to the resilience of clean energy and defense systems that quietly depend on this little-known metal.

Why yttrium suddenly matters so much

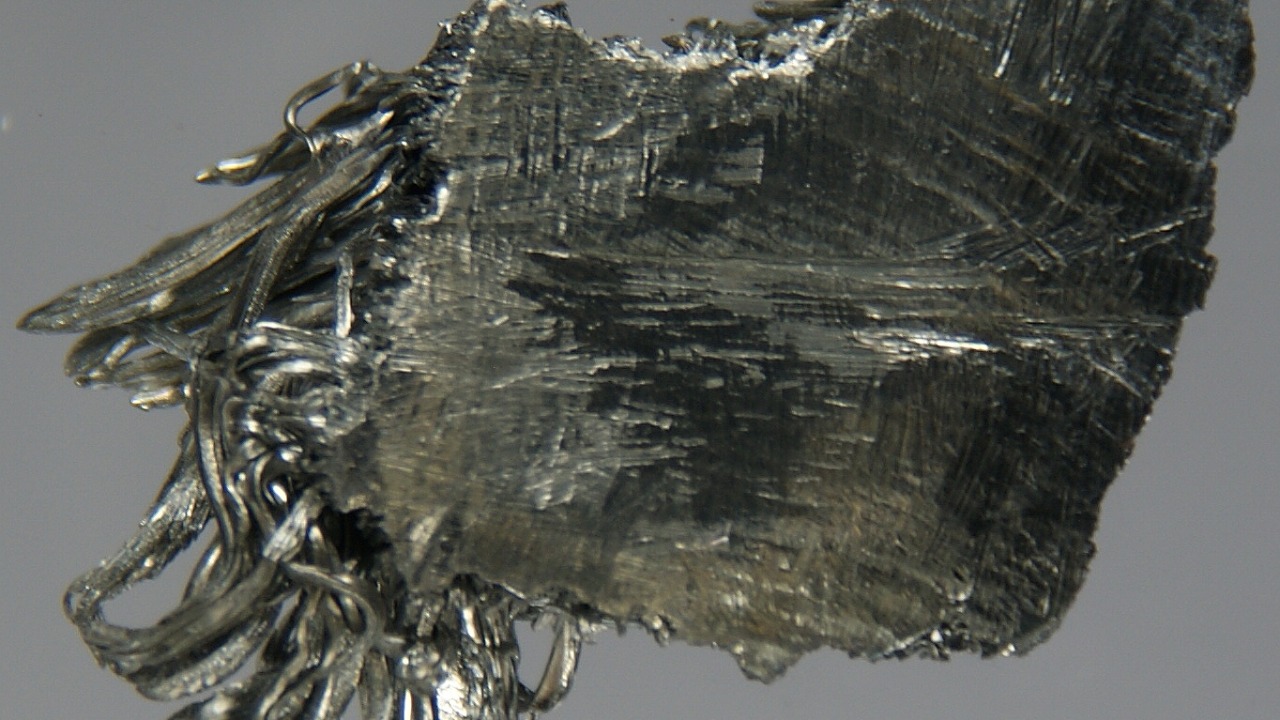

For years, yttrium sat in the background of the rare earth conversation, overshadowed by the magnets that power electric vehicles and wind turbines. That complacency is now colliding with reality, as manufacturers discover how deeply embedded yttrium is in high-value components such as phosphors for LED and laser systems, ceramic capacitors, and specialized alloys used in aerospace and defense. The growing alarm is not about a niche material, but about a foundational ingredient in the hardware of the digital and low-carbon economy.

Industry analysts now describe a brewing supply crunch that is spreading across sectors that rely on yttrium-heavy components, from advanced radar and guidance systems to medical imaging and high-end display panels, with warnings that a new rare earth crisis is emerging around this single element. Technical commentators have gone further, arguing that the world is effectively running out of yttrium as existing mines struggle to keep pace with demand from electronics, clean energy hardware, and defense platforms that were designed on the assumption of abundant supply.

From obscure oxide to record-breaking commodity

What was once a relatively sleepy corner of the metals market has turned into one of its most volatile arenas, as buyers scramble to secure yttrium oxide and related products at almost any cost. Prices that used to move in quiet, incremental steps have instead vaulted to unprecedented levels, reflecting both genuine scarcity and a rush of speculative interest. For producers and traders, yttrium has shifted from a byproduct to a headline commodity in a matter of months.

Specialist mining coverage has tracked how yttrium has rapidly ascended to record highs as supply concerns escalated, with buyers in Asia, Europe, and North America all bidding up limited spot volumes. Broader commodities reporting now notes that the rare earth has surged toward the 1,500 level in its latest rally, a price point that would have seemed implausible when yttrium was treated as a secondary product in mixed rare earth concentrates rather than a strategic asset in its own right.

China’s grip and the geopolitics of scarcity

The emerging crunch is not just about geology or market cycles, it is about geography and power. Yttrium production, like much of the rare earth sector, is heavily concentrated in China, which dominates processing capacity and export flows. That concentration has turned a technical supply issue into a geopolitical risk, as governments and companies weigh how exposed they are to policy shifts in Beijing.

Regional business reporting has highlighted how yttrium has become the latest rare earth concern as global supplies fall and importers confront the reality that alternative sources are limited and slow to develop. Mining industry analysis has gone further, tying the current price spike directly to curbs in China that have tightened export availability and amplified fears that yttrium could be used as a lever in broader trade and technology disputes.

Tech, defense, and the industries on the front line

The impact of a constrained yttrium market is already rippling through the sectors that depend on it most, particularly advanced electronics and defense. Engineers designing everything from 5G base stations to infrared targeting systems have long relied on yttrium-based materials for their stability and performance, often without a clear backup plan if those inputs became scarce. Now procurement teams are being forced to confront that vulnerability in real time.

Video briefings aimed at investors and policy watchers describe how a rare earth crisis is brewing as shortages spread into aerospace and defense supply chains that cannot easily substitute away from yttrium without redesigning critical components. Broadcast segments shared on mainstream platforms echo that warning, framing the situation as a new rare earth crisis that could affect production timelines for precision-guided munitions, satellite systems, and high-end sensors that underpin both national security and commercial space ventures.

Market alarm, social media buzz, and public awareness

What began as a technical concern inside mining circles has spilled into broader public view, helped along by social media and online video. Retail investors, tech enthusiasts, and policy commentators are now trading charts and supply maps that would once have been confined to specialist conferences. That shift in awareness is feeding back into the market, as more participants try to position around a material they had barely heard of a year ago.

On social platforms, posts warning about yttrium shortages have circulated widely among retail traders and technology forums, often pairing price spikes with concerns about the availability of next generation electronics. Long-form explainers on video platforms, including detailed breakdowns of yttrium’s role in lasers, phosphors, and defense systems such as one widely shared yttrium-focused analysis, have helped translate obscure materials science into a more accessible narrative of strategic risk and opportunity.

Scramble for alternatives and new supply

As prices climb and supply tightens, the race is on to find both new sources of yttrium and ways to use less of it. Mining companies are revisiting deposits that were previously uneconomic, while recyclers and materials scientists look for ways to recover yttrium from industrial waste streams and end-of-life electronics. None of these options will come online overnight, which is why the near-term market remains so tense.

Regional coverage of the sector notes that global buyers are already shifting contracts and exploration budgets in response to falling supplies, with particular attention on projects outside China that could eventually diversify the market. At the same time, specialist mining reports describe how producers are trying to navigate record yttrium prices without overcommitting capital to projects that might become uneconomic if policy or technology shifts reduce demand, a balancing act that will shape how quickly any new supply actually reaches end users.

What comes next for a suddenly strategic element

The trajectory of yttrium over the next few years will hinge on three intertwined forces: policy, technology, and market psychology. Governments are already weighing whether to treat yttrium as a strategic material, with stockpiling, export controls, and subsidies for alternative supply all on the table. Technology companies, for their part, are quietly reassessing how much yttrium they can design out of future products without sacrificing performance, a process that could take years given the complexity of modern components.

Market commentators who first flagged that the world was running short of yttrium now frame the situation as a test of how quickly industrial systems can adapt to the limits of a once-overlooked resource. Detailed reporting on the spreading shortages suggests that the adjustment will not be painless, particularly for defense and high-end electronics, but it may also accelerate overdue investments in recycling, substitution, and diversified mining that could leave the yttrium market more resilient than the fragile status quo that preceded this crisis.

More from MorningOverview