I see a story about China’s tech ambitions colliding head‑on with U.S. export controls, and at the center of it is an alleged $1 billion pipeline of Nvidia’s most coveted AI chips slipping into the country despite a formal ban. The emerging picture is of a sprawling smuggling network that moved advanced processors at industrial scale, and of Chinese authorities now scrambling to reassert control over a gray market they had quietly tolerated. As investigators dig into how so many restricted chips crossed the border so quickly, the case is becoming a test of how enforceable high‑end semiconductor sanctions really are.

How a $1 billion shadow pipeline of Nvidia chips came to light

When I trace the arc of this story, the first striking detail is the sheer volume: reporting indicates that Nvidia AI chips worth about $1 billion entered China over a short window even as tighter U.S. export rules were in force. Those controls were designed to keep advanced accelerators like the A100 and H100 out of Chinese hands, yet customs and trade data now suggest that thousands of units still reached buyers inside the country through indirect routes and opaque intermediaries, prompting Chinese regulators to open a sweeping investigation into how such a large consignment slipped through. The scale alone signals that this was not a handful of gray‑market resales, but a coordinated logistics operation that treated export controls as just another cost of doing business.

According to accounts that reconstruct the flow of hardware, the chips were routed through neighboring jurisdictions and free‑trade hubs before being re‑exported into mainland China, allowing traders to mask the true destination until the last possible moment. One detailed breakdown describes how Nvidia AI chips worth $1 billion allegedly entered China despite U.S. curbs, with shipments fragmented across multiple small consignments and layered through shell companies to avoid triggering automated compliance checks, a pattern that aligns with what investigators are now probing in the wake of the crackdown on the suspected smuggling ring despite US curbs.

Inside the alleged smuggling network Chinese authorities are targeting

As Chinese officials move from quiet monitoring to active enforcement, they are zeroing in on a cluster of domestic firms accused of orchestrating the parallel supply chain. Investigators are examining how these companies allegedly bought restricted Nvidia accelerators through overseas fronts, then moved them into China using falsified paperwork and misdeclared cargo, effectively turning legitimate logistics channels into conduits for sanctioned technology. The focus on corporate actors rather than individual couriers underscores that authorities see this as a white‑collar operation embedded in the formal economy, not a back‑alley contraband trade.

Reports on the probe describe Chinese companies allegedly smuggling about $1 billion worth of Nvidia AI chips into the country by exploiting gaps between U.S. export rules and local enforcement, with some entities accused of disguising the hardware as less sensitive components or routing it through third‑party distributors that specialize in high‑risk markets. Those allegations, now at the center of the Chinese investigation, highlight how corporate buyers and intermediaries built a business model around moving restricted chips into domestic data centers and AI labs even as the legal environment tightened around them allegedly smuggled $1bn.

The routes, tactics, and “shadow supply chains” that kept chips flowing

What stands out to me in the emerging evidence is how methodical the smuggling logistics appear to have been. Rather than relying on a single corridor, the network seems to have used multiple transit points—often in jurisdictions with looser re‑export oversight—to break up and relabel shipments before they crossed into mainland China. By the time the chips reached their final buyers, the paper trail had been laundered through so many intermediaries that tracing the original export from a U.S.‑aligned supplier became a forensic exercise, not a routine compliance check.

Analyses of the trade flows describe Nvidia AI chips worth one billion dollars being smuggled into China through what amount to “shadow supply chains,” with consignments moving via regional hubs, bonded warehouses, and small freight forwarders that specialize in high‑value electronics. These accounts detail how traders mixed restricted accelerators with legitimate components, used vague product descriptions, and leaned on lightly regulated resellers to keep the hardware flowing into Chinese AI clusters even as official channels dried up, a pattern that now forms a key line of inquiry for Chinese regulators trying to map the full network smuggled into China.

Why U.S. export controls struggled to stop the flow

From a policy perspective, the alleged smuggling operation exposes how difficult it is to enforce unilateral export controls on components that are small, high‑value, and globally coveted. The U.S. rules target specific performance thresholds and model numbers, but once a chip leaves a compliant distributor and enters a secondary market, the ability of Washington or its allies to track every subsequent resale drops sharply. That enforcement gap is exactly what traders appear to have exploited, turning the chips into fungible assets that could be moved across borders with little more than a mislabeled invoice and a cooperative freight forwarder.

One detailed account of the trade describes how Nvidia AI chips worth $1 billion were allegedly smuggled to China despite U.S. export controls, emphasizing that the controls themselves remained on the books while enforcement faltered at the level of re‑exports and end‑user verification. The reporting points to a combination of limited customs capacity, fragmented data sharing between jurisdictions, and the sheer speed of AI hardware demand as factors that allowed the network to operate at scale before regulators caught up, a dynamic that Chinese authorities are now confronting as they target the domestic end of the pipeline despite export controls.

China’s domestic AI boom and the demand that fueled the scheme

To understand why anyone would take the risk of moving restricted chips at this scale, I have to look at the intensity of China’s AI build‑out. Local cloud providers, internet platforms, and research labs are racing to train large language models and computer‑vision systems that can compete globally, and Nvidia’s high‑end accelerators remain the gold standard for that work. With official channels constrained by U.S. rules, the price of a single A100 or H100 on the gray market can soar, turning each shipment into a high‑margin opportunity for traders willing to navigate the legal and logistical hazards.

Coverage of the case notes that Nvidia chips were smuggled into China despite a formal ban, with domestic buyers ranging from major tech firms to smaller AI startups that lacked access to alternative hardware at comparable performance levels. That pent‑up demand created a powerful incentive for intermediaries to keep sourcing the chips through indirect routes, even as both U.S. and Chinese regulators tightened their scrutiny of cross‑border tech flows, and it is that demand‑side pressure that now complicates Beijing’s effort to crack down without slowing its own AI ambitions smuggled despite ban.

How Chinese regulators are responding to the alleged smuggling ring

What makes this case particularly sensitive inside China is that the government is now targeting a network that, until recently, helped domestic firms work around foreign restrictions. By moving against the alleged smugglers, regulators are signaling that they want to bring the AI hardware market back under formal oversight, even if that means short‑term pain for local developers. The investigation also serves a diplomatic purpose: by showing that Beijing is willing to police illicit imports of restricted U.S. technology, officials can argue that they are not simply turning a blind eye to sanctions‑busting activity.

Reports on the crackdown describe how Nvidia AI chips worth $1 billion were sold into China despite U.S. export controls, and how Chinese authorities have now launched probes into the companies suspected of orchestrating those sales. The enforcement push includes audits of import records, on‑site inspections at data centers, and tighter monitoring of distributors that handle high‑end accelerators, all aimed at dismantling the networks that moved the chips and deterring others from stepping into the gap left behind sold despite controls.

Shadow supply chains and the business of sanctioned technology

Looking more broadly, the alleged Nvidia operation fits a familiar pattern in global trade: when a product is both highly profitable and tightly controlled, specialized intermediaries emerge to move it through what analysts often call “shadow supply chains.” These networks are not purely criminal in the traditional sense; they blend legitimate logistics firms, gray‑market resellers, and front companies that exist mainly on paper, all stitched together by brokers who understand both the technical specifications of the hardware and the regulatory thresholds they need to dodge. In the Nvidia case, that meant knowing exactly which chip models were restricted and how to describe them in ways that would not automatically trigger export red flags.

One in‑depth analysis of these dynamics describes shadow supply chains inside the $1 billion Nvidia AI chip flow to China, detailing how traders leveraged gaps between customs regimes, exploited the opacity of complex corporate structures, and used just‑in‑time shipping to minimize the window in which any single consignment could be intercepted. That portrait of a professionalized, globally distributed smuggling business helps explain why Chinese authorities are now treating the case as a systemic risk to their tech governance, not just a one‑off scandal involving a few rogue actors shadow supply chains.

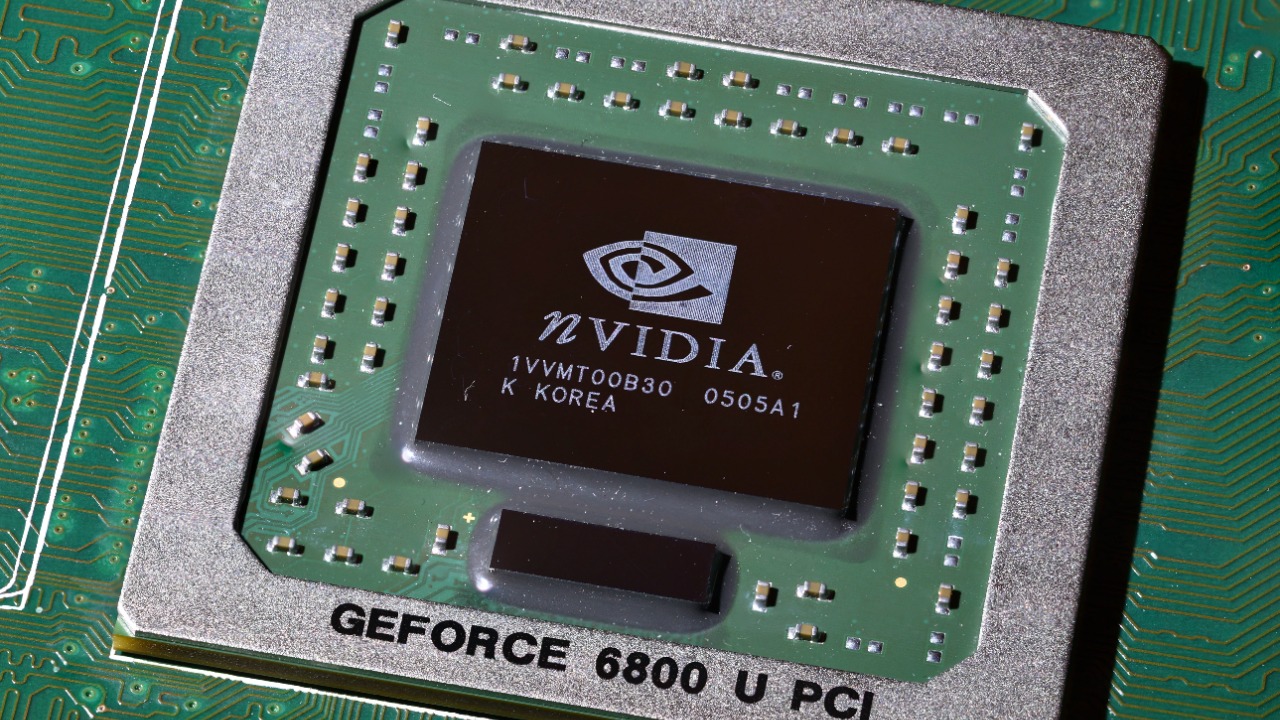

What the case reveals about Nvidia, gamers, and the wider chip ecosystem

Although the investigation is centered on China and export controls, the alleged smuggling ring also sheds light on Nvidia’s unique position in the global chip ecosystem. The same architectures that power hyperscale AI training also underpin high‑end gaming GPUs, and the company’s supply chain has to balance demand from data centers, consumer PC builders, and now a thriving gray market in restricted accelerators. When a significant volume of chips is siphoned off into illicit channels, it can ripple through pricing and availability for everyone from cloud providers to gamers building RTX‑powered rigs.

Some coverage of the affair has highlighted how Nvidia chips bound for AI workloads ended up in China through back‑door channels, with commentators noting that the company’s brand and technology are now so central to machine‑learning infrastructure that even strict export rules have not stopped determined buyers. One account frames the episode as a “whoops” moment for regulators and suppliers alike, pointing out that the same logistics networks that move consumer GPUs can be repurposed to ship restricted accelerators if oversight is lax, a convergence that complicates efforts to ring‑fence AI hardware from the broader PC hardware market chips China whoops.

The three‑month surge and what it says about enforcement speed

Another detail that jumps out at me is the compressed timeframe in which the alleged smuggling took place. Rather than a slow drip over years, reports suggest that roughly $1 billion worth of Nvidia AI chips were shifted into China over the course of about three months while stricter U.S. export controls were already in effect. That surge hints at a network that moved quickly to exploit a perceived window of opportunity, stockpiling hardware in Chinese data centers before regulators on either side could fully adapt their enforcement playbooks.

One reconstruction of the trade flows suggests that chip smugglers shifted an alleged USD 1 billion worth of Nvidia’s AI chips to China in that three‑month span, underscoring how fast a well‑organized network can act once it identifies a profitable arbitrage between restricted supply and surging demand. For Chinese authorities now trying to unwind the operation, that speed presents a challenge: by the time the investigation began, much of the hardware was already installed in racks and clusters, blurring the line between contraband and critical infrastructure that domestic AI firms now depend on over the course of 3 months.

What comes next for China’s AI ambitions and global chip controls

As I look ahead, the crackdown on the alleged smuggling ring forces Beijing into a delicate balancing act. On one hand, Chinese authorities need to show they can police illicit imports of restricted U.S. technology, both to maintain control over their own tech sector and to manage diplomatic friction with Washington. On the other, they cannot ignore the reality that domestic AI developers still see Nvidia’s accelerators as essential, and that cutting off gray‑market supply without a ready substitute risks slowing projects that are politically and economically important at home.

Further reporting on the case describes a secret Nvidia chip smuggling ring that operated in the shadows of official trade channels, and suggests that Chinese regulators are now weighing tougher oversight of distributors, stricter end‑user checks, and potential incentives for local alternatives to Nvidia’s hardware. Whatever mix of measures they choose, the investigation into the $1 billion flow of AI chips has already become a reference point in the global debate over how to control advanced semiconductors without choking off innovation, and it is likely to shape how both China and the U.S. design their next round of tech policies secret chip smuggling ring.

More from MorningOverview