Elon Musk, the visionary behind Tesla, has recently announced plans to build a gigantic chip fabrication plant to meet the burgeoning demand for AI and robotics hardware. Musk also hinted at a possible collaboration with Intel to expedite this endeavor, while acknowledging the competition from established semiconductor giants like TSMC and Samsung. This strategic move is aimed at securing Tesla’s supply chain amid the escalating computational needs of autonomous vehicles and humanoid robots.

Musk’s Vision for Tesla’s Semiconductor Independence

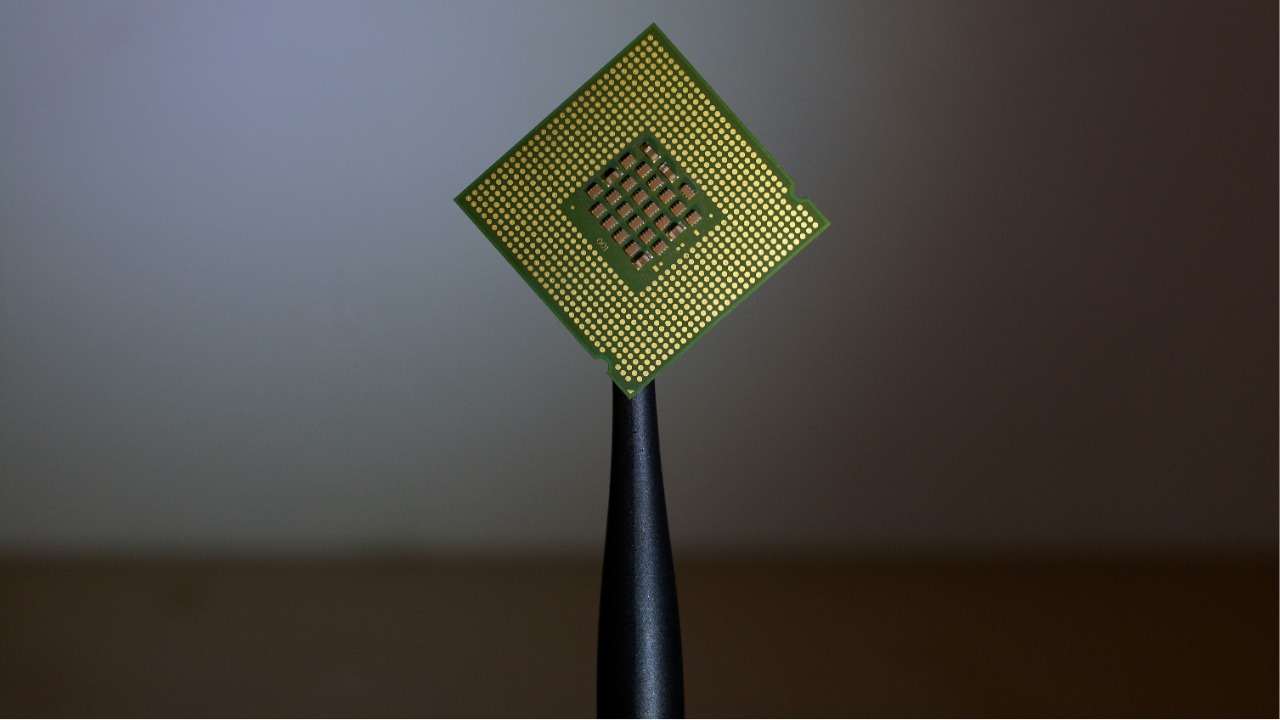

Elon Musk’s recent announcement underscores the importance of a gigantic chip fab for Tesla’s goal of self-sufficiency in chip production. Musk was quoted saying that Tesla “needs to build ‘gigantic chip fab’” to fuel long-term innovation. This statement marks a significant shift towards vertical integration in hardware for Tesla, with the proposed fab targeting the production of high-performance chips crucial for AI training and inference workloads [source].

Musk envisions the facility to be potentially the largest of its kind, drawing comparisons to Tesla’s existing Gigafactories for batteries and vehicles to illustrate the scale of the project.

The Role of AI and Robotics in Driving Demand

Musk explicitly linked the proposed gigantic chip fab to Tesla’s AI ambitions. He stated that the facility would cater to the “AI and robotics needs” for projects like Full Self-Driving software and Optimus humanoid robots [source]. The emphasis on AI demand underscores Tesla’s requirement for custom silicon optimized for neural networks, which would address current supply bottlenecks for edge computing in vehicles.

Robotics applications, including advanced sensors and processors for Tesla’s Optimus project, would also benefit from the increased production volume that Musk envisions.

Teased Partnership with Intel

Elon Musk indicated that Tesla is “looking into Intel collab” to co-develop or leverage expertise for the gigantic chip fab. This collaboration could potentially expedite the construction and technology transfer process [source]. The partnership could involve Intel providing fabrication tools or process nodes, building on Tesla’s prior experience with custom Dojo chips designed in-house.

The potential collaboration with Intel aims to combine Tesla’s AI-specific designs with Intel’s manufacturing prowess, thereby reducing reliance on external foundries.

Competition from TSMC and Samsung

In his discussion, Musk acknowledged TSMC as a key competitor, noting Tesla’s current dependence on such foundries for AI chips and the need for a gigantic in-house fab to compete [source]. Samsung was also highlighted alongside TSMC as another major player in advanced semiconductor production, with Musk implying that Tesla’s fab would rival their scale for robotics and AI applications [source].

This strategy positions Tesla to bypass supply constraints from these Asian giants, ensuring dedicated capacity for U.S.-based innovation.

Details on the Proposed Gigantic Chip Fab

Musk described the proposed facility as a “gigantic chip fab plant,” potentially named or scaled under the “Terra” concept to handle massive wafer output for Tesla’s ecosystem [source]. The fab would focus on producing chips at leading-edge nodes, similar to those used in Tesla’s HW4 hardware for autonomous driving.

While construction timelines and locations remain exploratory, Musk’s comments suggest alignment with Tesla’s U.S. manufacturing footprint for strategic and regulatory advantages.

Broader Implications for Tesla’s Supply Chain

By building its own gigantic chip fab, Tesla aims to mitigate the impact of global semiconductor shortages. Musk noted this in the context of meeting the explosive demand for AI [source]. This initiative extends Tesla’s control over critical components, from raw materials to final assembly, enhancing resilience against geopolitical disruptions.

Potential involvement from Intel could introduce hybrid models, blending Tesla’s designs with established fabrication processes for faster market entry.

More from MorningOverview