The Oshkosh Defense JLTV, a next-generation Army truck, is outpacing Pentagon innovation timelines by integrating commercial tech at speeds unmatched by traditional acquisition processes. Since 2018, it has delivered over 10,000 units with modular upgrades that adapt to emerging threats like electronic warfare. This success echoes the U.S. Army’s post-Vietnam reforms under leaders like General Creighton Abrams, which rebuilt force structure from 1973 onward to emphasize combined arms and readiness. As Silicon Valley targets the Pentagon’s $850 billion budget in 2025, firms like Anduril and Palantir seek contracts for AI-driven logistics that could further accelerate programs like the JLTV.123

The Origins of the JLTV Innovation Edge

The JLTV program was conceived in 2007 as a replacement for the Humvee, with a focus on survivability. The vehicle boasts a 14,000-pound gross weight and a blast-resistant V-hull design that survived over 200 IED tests in prototypes. Oshkosh Defense’s role in winning the 2015 contract for 17,000 vehicles was a testament to private-sector agility, allowing for rapid iterations beyond Pentagon red tape.1

Early field tests in 2016 at Yuma Proving Ground, Arizona, demonstrated the JLTV’s superior off-road mobility, outperforming legacy vehicles by 30%. This set the stage for full-rate production and the subsequent successful deployment of the vehicle.1

Pentagon Bureaucracy as an Innovation Bottleneck

The Federal Acquisition Regulation (FAR) process often delays approvals by 18-24 months per milestone, creating a significant bottleneck for innovation. In contrast, the JLTV’s use of Other Transaction Authority (OTA) for faster prototyping has proven to be a more efficient approach.1

Historical examples like the F-35 program’s $1.7 trillion lifecycle cost overruns due to layered contractor oversight show how such systems stifle the kind of nimble upgrades seen in the JLTV. Furthermore, congressional budget controls that cap R&D at 2.8% of the defense outlay limit experimental projects compared to the JLTV’s $6.7 billion investment yielding deployable tech.13

Post-Vietnam Lessons Revitalizing Army Procurement

General Creighton Abrams’ 1973 reorganization of the Army into brigade-centric structures post-Vietnam reduced division sizes from 16,000 to 12,000 troops for better agility. This influenced modern vehicle programs and has been a key factor in the development of the JLTV.2

The 1974 creation of the Training and Doctrine Command (TRADOC) under Abrams standardized innovation pipelines and parallels the JLTV’s doctrine-driven design for multi-domain operations. The post-Vietnam shift to a volunteer force in 1973, which increased retention to 85% by 1980 through equipment modernization, is a tactic echoed in the JLTV’s focus on soldier-centric tech.2

Post-GWOT Reforms and the JLTV’s Tactical Fit

The Army’s 2014 pivot from counterinsurgency to peer competition after the Global War on Terrorism (GWOT) led to the 2018 adoption of Multi-Domain Operations doctrine. The JLTV supports this doctrine with its integration of Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance (C4ISR).2

The 2020 establishment of the Army Futures Command in Austin, Texas, streamlined acquisition and enabled JLTV variants like the 6×6 model for heavy lift in contested environments. Lessons from GWOT-era deployments, such as the use of Mine-Resistant Ambush Protected (MRAP) vehicles exceeding 20,000 units, informed the JLTV’s mine-resistant features without the weight penalties.21

Silicon Valley’s Push into Defense Innovation

Anduril Industries’ 2024 bid for JLTV sensor upgrades using AI for threat detection is targeting $10 billion in Pentagon contracts amid 2025 budget reallocations. This is part of a broader push by Silicon Valley into defense innovation.3

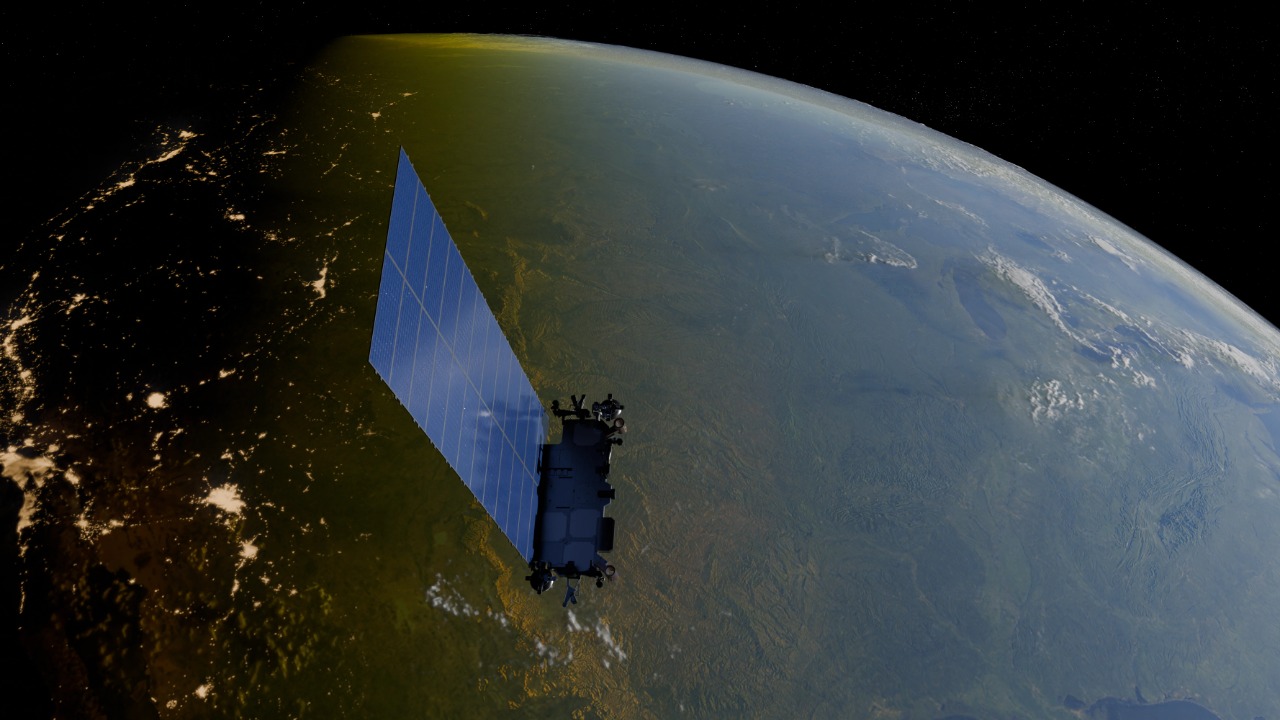

Palantir Technologies’ software integrations for JLTV logistics, which process 1 petabyte of data daily to predict maintenance, are part of Silicon Valley’s shift from aversion to engagement post-2018. Additionally, SpaceX’s Starlink trials on JLTVs in 2023 exercises at Fort Irwin, California, provided resilient communications in jammed scenarios, eyeing the $886 billion FY2025 defense topline.3

Future Pathways for Army Truck-Led Innovation

The JLTV’s evolution is projected to include electric variants by 2030, with a 50% battery range extension through commercial partnerships, bypassing the Pentagon’s slow EV mandates. This represents a significant step forward in military vehicle technology.1

Hybrid models blending post-Vietnam decentralization with GWOT adaptability could potentially scale to 50,000 units across services by 2028. In the 2025 budget fights, $150 billion in tech R&D could fund JLTV-like programs, reducing acquisition timelines to under 5 years. This would represent a significant shift in defense procurement and a major opportunity for tech firms.23