The Tesla Model 3, once heralded as the future of electric vehicles, is experiencing a surprising decline in its resale value. This trend raises questions about the factors contributing to this depreciation and the implications it holds for current and future Tesla owners. As the electric vehicle landscape evolves, understanding these dynamics becomes essential for those invested in Tesla’s flagship model.

Market Saturation and Increased Competition

The electric vehicle market is witnessing an influx of new models from various automakers, providing consumers with a plethora of choices beyond the Tesla Model 3. Companies such as Ford, Chevrolet, and Hyundai have stepped up their game, producing electric cars that are not only competitive in terms of price but also in features and performance. The Ford Mustang Mach-E, Chevrolet Bolt EV, and Hyundai Ioniq 5 are just a few examples of vehicles that directly contest the Model 3’s dominance. These alternatives offer unique features and price points that appeal to a broad spectrum of consumers, potentially eroding Tesla’s market share.

Tesla’s own strategy of rapid expansion and model diversification further complicates the scenario. By introducing new models like the Cybertruck and Model Y, Tesla aims to capture a broader market. However, this approach may inadvertently cannibalize the demand for older models such as the Model 3. Additionally, the company’s commitment to frequent updates and announcements of new features can make existing cars feel outdated quickly. As consumers anticipate newer models with advanced features, the appeal of purchasing a used Model 3 may diminish, impacting its resale value.

Depreciation Trends in Electric Vehicles

Electric vehicles, in general, tend to depreciate faster than their gasoline counterparts, primarily due to the rapid pace of technological advancements. The Tesla Model 3 is no exception to this trend. With technology in the electric vehicle sector evolving swiftly, newer models often feature enhancements that make previous versions seem obsolete. Consequently, the resale value of the Model 3 has been dropping more quickly than anticipated, as potential buyers may prefer the latest technological offerings.

Battery technology plays a significant role in this depreciation pattern. Concerns about battery degradation over time can deter potential buyers from considering used electric vehicles, including the Model 3. Although Tesla has made strides in improving battery longevity, the perception of battery life remains a critical factor. Furthermore, new advancements in battery technology, such as solid-state batteries, promise longer life and higher efficiency, potentially rendering older models less desirable. As these newer technologies become mainstream, the appeal of older models with conventional battery technology might diminish.

Economic and Environmental Factors

Government incentives have traditionally played a crucial role in promoting electric vehicle adoption. However, fluctuations in these incentives can significantly impact the resale value of electric vehicles. In some regions, subsidies for electric vehicle purchases have been reduced or entirely removed, affecting consumer demand and consequently, resale prices. The uncertainty surrounding these incentives can influence potential buyers’ decisions, as the financial benefits of owning an electric vehicle become less predictable.

The perception of the environmental impact of electric vehicles also affects their market appeal. While electric vehicles are marketed as environmentally friendly, the production process and battery disposal have raised environmental concerns. These issues can shape consumer perception and dampen resale interest. As awareness of these environmental challenges grows, consumers may become more cautious about investing in used electric vehicles, including the Model 3, which may contribute to its declining resale value.

Consumer Feedback and Market Sentiment

Consumer experiences and reviews have a profound impact on market sentiment, influencing the decisions of prospective buyers. Feedback from existing Model 3 owners regarding performance, maintenance costs, and customer service can sway opinions. Online platforms like Reddit and Tesla forums provide real-time insights into owner experiences, which can rapidly influence market sentiment. Negative feedback or dissatisfaction with aspects of the Model 3 can deter potential buyers, contributing to a decline in resale value.

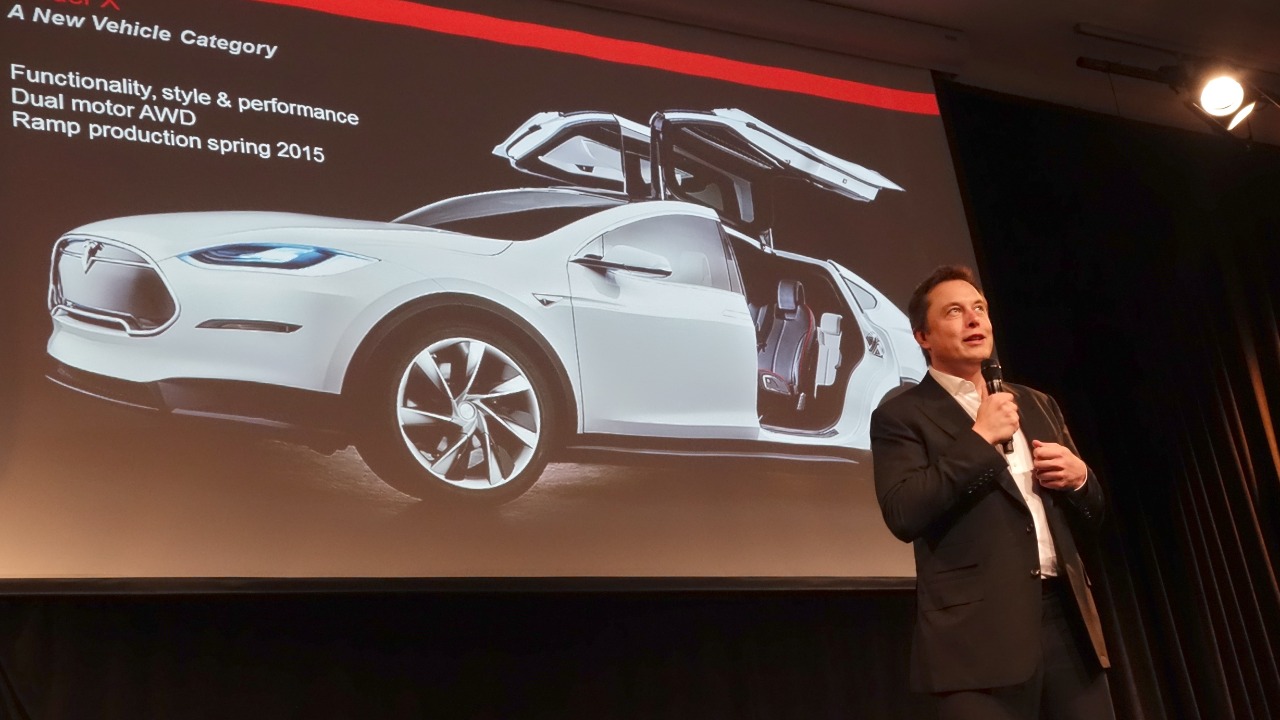

Tesla’s brand reputation and the public persona of its CEO, Elon Musk, further influence consumer confidence and loyalty. While Tesla has a devoted fan base, any negative press or controversies surrounding the company can lead to decreased demand for used models. The intricate relationship between brand image and resale value underscores the importance of maintaining a positive reputation in the market. As a high-profile company, Tesla’s actions and public perception can significantly impact the desirability of its vehicles on the resale market.

Technological Advancements and Updates

Tesla’s commitment to technological innovation is evident through its frequent over-the-air software updates. These updates enhance the appeal of new models, offering features and improvements that are often not available on older models. As newer models receive these updates, older vehicles like the Model 3 may seem less attractive to potential buyers. The pace of technological advancement, particularly in autonomous driving capabilities, can quickly outdate previous models, affecting their resale value.

The development of Tesla’s Autopilot and Full Self-Driving features represents a significant technological leap. As Tesla continues to refine these technologies, newer models equipped with the latest advancements may be more appealing to buyers seeking cutting-edge technology. The promise of fully autonomous driving capabilities can be a strong selling point, making older models without these features less desirable. As a result, the resale value of the Model 3 may decline as consumers prioritize the latest technological offerings in their purchasing decisions.